Hailey Bieber’s sale of Rhode to e.l.f. Cosmetics for $1 billion this week adds to a growing list of creator-founded brands leveraging attention as their primary asset.

The beauty brand, which launched just three years ago, achieved a ten-figure valuation not through marketplace optimization or supply chain innovation but by maximizing pre-existing audience capture to shortcut the traditional path to scale.

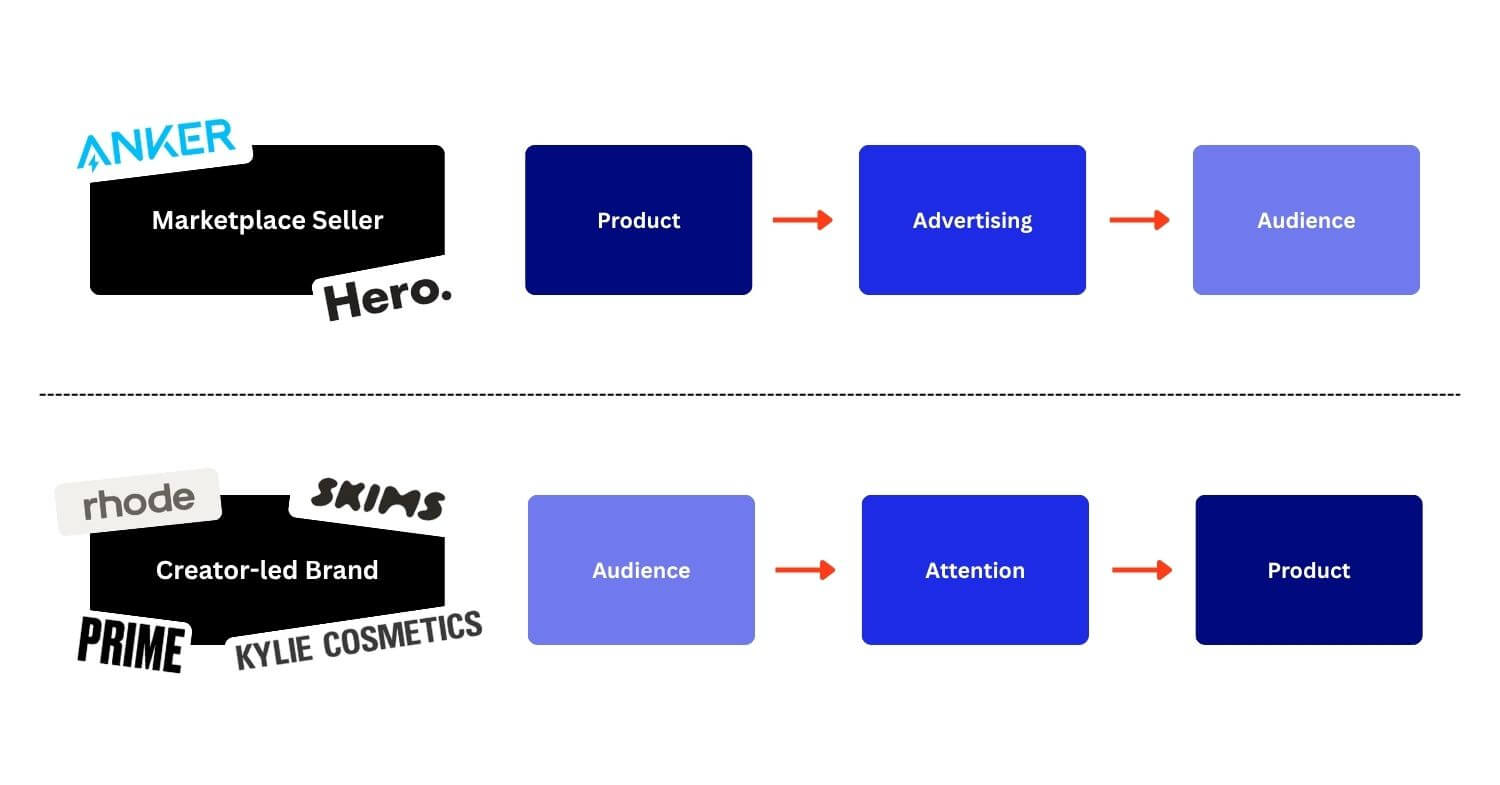

Traditional e-commerce follows a predictable playbook: identify market gaps, develop products, optimize for search algorithms, scale through marketplace efficiency. Hero Cosmetics exemplified this approach when it sold for $630 million in 2022, building from a single Amazon SKU through algorithmic optimization. Anker similarly hit $1 billion in Amazon sales by mastering marketplace mechanics and scaling through fulfillment infrastructure.

Creator-led brands like Rhode, SKIMS (Kim Kardashian), Kylie Cosmetics (Kylie Jenner), and Prime Hydration (Logan Paul & KSI) flip the script and operate from an entirely different premise where marketplaces are for distribution rather than discovery.

Rather than fighting for attention within increasingly expensive advertising ecosystems like Amazon, where sellers now pay over 50% of revenue in fees, they begin with captured attention and work backward to products. Hailey Bieber’s 55 million Instagram followers didn’t discover Rhode through Amazon search results; they were pre-sold before the first product launched.

In fact, Rhode – like SKIMS and Kylie Cosmetics – has barely any presence on Amazon at all. A small range of product offerings from third-party sellers currently captures the 100,000+ monthly brand-related searches.

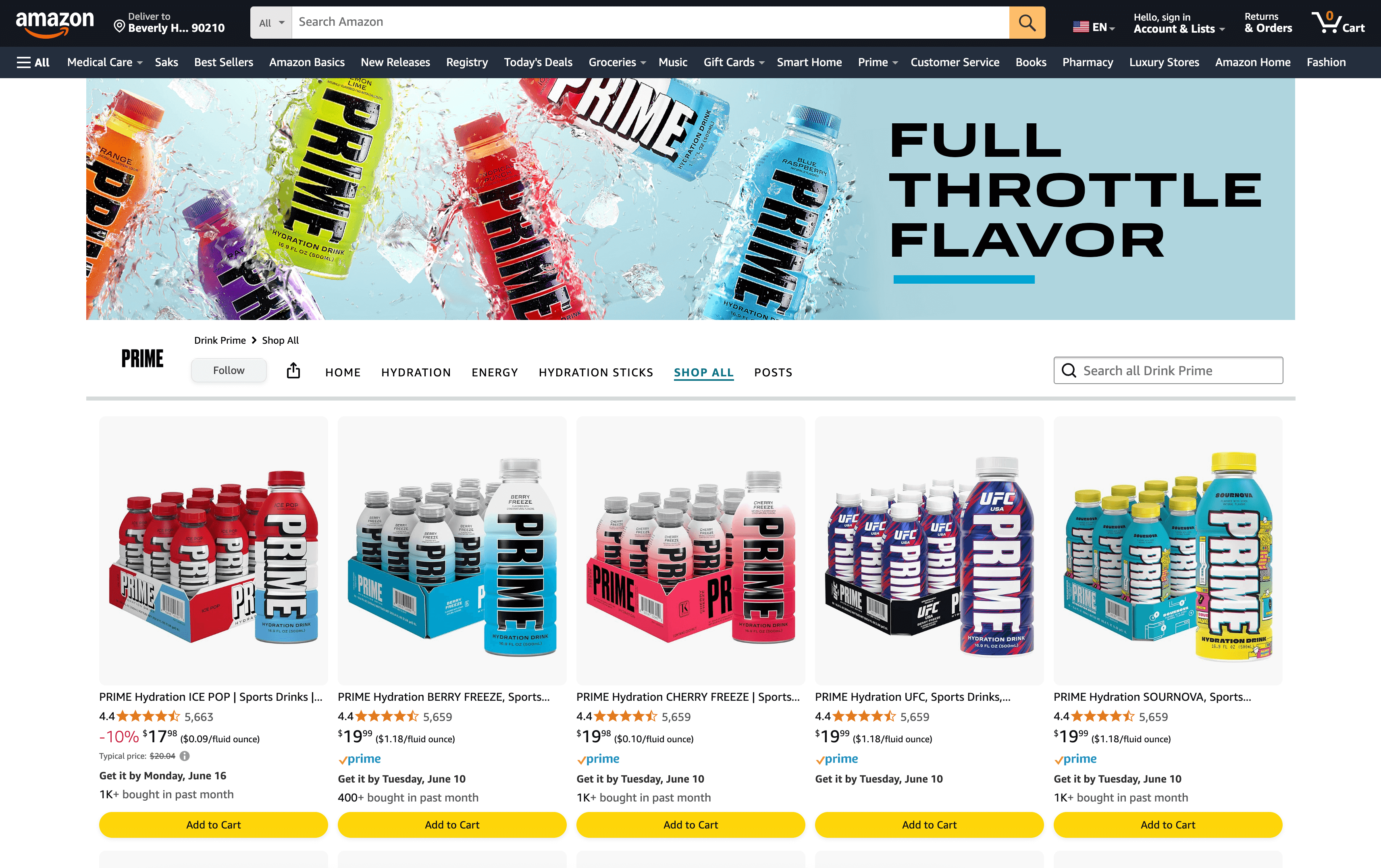

Conversely, Prime Hydration, reportedly valued at over $3 billion, has a strong presence on Amazon, capturing significant branded searches with its most popular SKUs, generating six figures per month each, according to Helium 10 estimates.

Using marketplaces to reach an audience has become more difficult – and more expensive – for e-commerce brands in recent years. Traditional sellers must continuously pay platforms like Amazon or Meta for discovery, creating an escalating arms race of advertising spend. Amazon has buried organic search results to the point where only four of the first twenty products shoppers see are unpaid placements.

Creator brands bypass this entirely and gain discovery through owned media – Instagram posts, TikTok videos, YouTube content – before leveraging traditional retail channels’ distribution. Building the audience to make this possible isn’t easy and is rarely entirely free. However, the attention that comes with an engaged audience proves time and again to be a valuable asset.

This content-first approach extends beyond individual creator brands to entire platforms. The shift is most visible on TikTok Shop, where content drives sales rather than search. GuruNanda’s pulling oil became TikTok’s best-selling product through viral content, then translated to becoming Amazon’s #1 bestseller, demonstrating how attention-first brands can dominate traditional marketplaces without playing by their rules.

What unites these brands isn’t superior product innovation or supply chain efficiency – the traditional competitive advantages in e-commerce. Instead, they share pre-built audience relationships that translate directly into purchasing power, avoiding the customer acquisition costs that burden traditional marketplace sellers.

This trend poses existential questions for traditional e-commerce infrastructure. If discovery increasingly happens off-platform, what role do marketplaces play beyond fulfillment? Amazon’s introduction of Inspire – its now defunct TikTok-like social commerce feature – acknowledges that search-based commerce faces fundamental challenges from content-first discovery.

For e-commerce businesses evaluating their options, the Rhode exit crystallizes a choice between two fundamentally different approaches: competing within existing marketplace infrastructure or building audience-first brands that transcend platform limitations.

As marketplaces become more efficient at extracting fees from sellers, they create more substantial incentives for brands to build direct relationships with customers.

While domestic Amazon sellers continue to lose market share to Chinese competitors who can operate on thinner margins, creator brands are achieving billion-dollar valuations by circumventing the marketplace fee structure entirely. Rhode’s success demonstrates that in an attention economy, owning audience relationships makes marketplace dependency optional.