Amazon offers dozens of services that sellers and brands can use to grow their businesses. It insists these are optional, and strictly speaking, that is correct. But while Amazon itself doesn’t require them, it has created an ecosystem that does.

When Amazon introduced advertising, it offered sellers a way to get to the top of the search results without ranking first organically. Search results used to be an imperfect but somewhat meritocratic sorting of the best products for sale. As more sellers saw the opportunity, Amazon allocated more space for ads, and hence, few of the first 20 search results today are organic. What used to be an optional service was rendered unavoidable and, thus, required.

Long before advertising, Amazon introduced fulfillment services known as Fulfillment by Amazon (FBA). Products using FBA ranked higher, and sellers using FBA would get the buy box even if they were not the cheapest because FBA turned sellers’ inventory Prime-eligible. That effectively hid the marketplace from the shoppers and unlocked Amazon’s growth but also made FBA a requirement. Later, it also allowed international sellers to appear local to shoppers. Today, most sellers use FBA — over 90% of top sellers and nearly 100% of international sellers use it.

Amazon’s fulfillment network is now one of the world’s largest. However, the bigger and more complex it became and the faster delivery speed it tried to achieve, the more expensive it became for sellers. Some of that increase was because the underlying real-world costs increased, and some because the service changed. For example, this year, sellers started paying inbound placement fees if they didn’t split their shipments into multiple separate shipments to Amazon’s regional centers. They will also soon begin paying fees for having less than 30 days of inventory on hand; they’ve been paying for having too much for years. “When sellers carry low inventory relative to unit sales, it inhibits our ability to distribute products across our network, degrading delivery speed and increasing our shipping costs,” said Amazon.

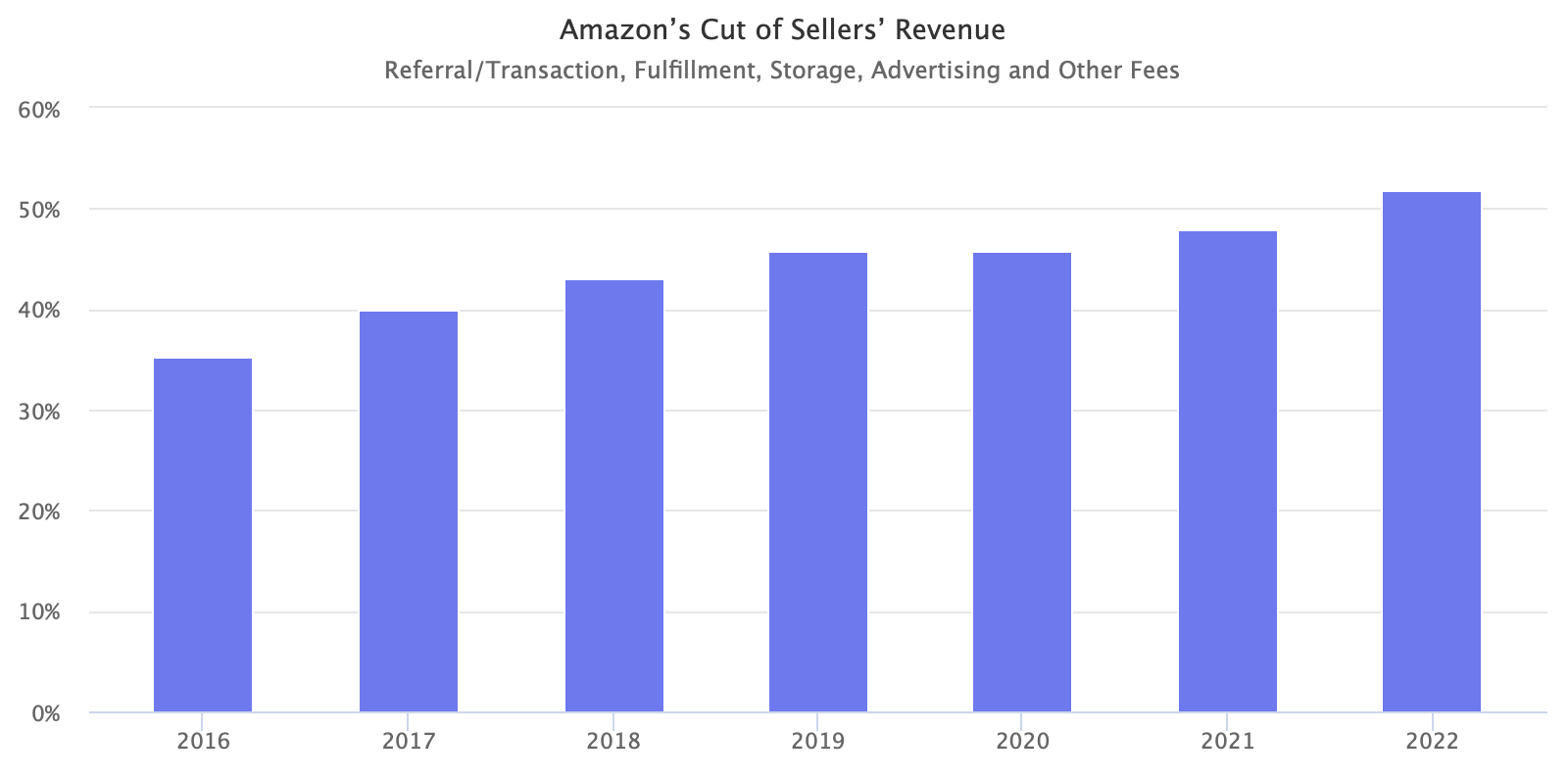

Amazon said “many” sellers will end up paying less fees. According to Marketplace Pulse research, sellers pay more fees as a percentage of their sales every year. Last year, Amazon charged a typical private-label seller 50-60% of their sales in various fees. They will pay even more now because, in practice, most sellers cannot manage their supply chains as perfectly as Amazon theorizes, and they cannot always increase prices to maintain their margins.

Advertising, fulfillment, and the marketplace are inseparable parts of Amazon. That combination has worked better than eBay, Walmart, and everything else, leading to Amazon’s commanding market share. However, it also allowed Amazon to directly and indirectly control and incentivize behavior by introducing services and fees. Sellers must pay for advertising because everyone else is, and they must use FBA because Prime requires it. Because they must do both of those, they must also adapt to all fees and requirements that come later.

40% of U.S. e-commerce and 80% of U.S. e-commerce marketplaces is Amazon. Most sellers remain a distinctive business type, built for and around selling on Amazon. They often cannot diversify to other channels because other channels are 20% of U.S. e-commerce marketplaces combined, and they cannot avoid using FBA or advertising because the ecosystem requires it. They have no leverage or bargaining power to protest Amazon’s changes. “Amazon sellers resemble gig workers and franchisees in that they assume forms of risk and responsibility that entrepreneurship entails, while relinquishing much of the freedom it has historically provided,” wrote Moira Weigel, Assistant Professor at Northeastern University.

The counterargument to Amazon’s seemingly egregious increasing take rate is that it is aligning the marketplace to serve its long-term vision, and that’s working — Amazon and its sellers sold $700 billion worth of goods in 2023. For example, without FBA, it wouldn’t have grown as big, and the marketplace would be tiny compared to today. Consequently, FBA is required because most Amazon shoppers are Prime members, and nationwide, one-day Prime delivery is complex and expensive. However, many regulators, including the FTC, are reviewing whether this is anti-competitive tying and whether higher fees on Amazon forces sellers to raise prices on other channels.

Amazon wants more commerce to flow through Amazon — last year, it introduced Supply Chain by Amazon — which means sellers will pay more fees as a percentage of their sales to Amazon. Sometimes as a choice, sometimes because the new service created a lock-in, sometimes because they didn’t grasp the complexity, sometimes because Amazon overcharges them, and sometimes because they cannot avoid it.