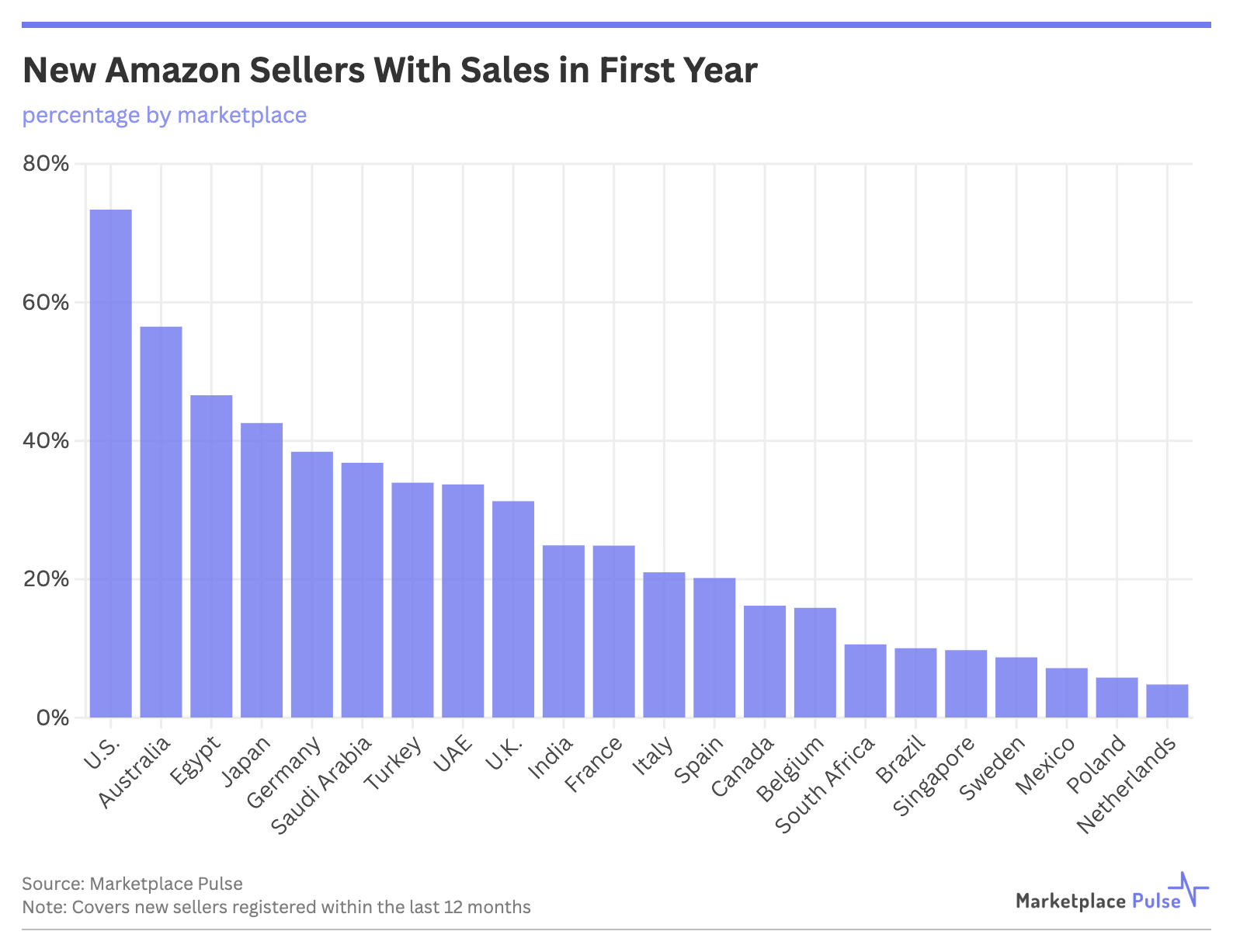

Amazon’s U.S. marketplace continues to be the most conducive environment for new sellers to achieve their first sales, with over 73% of sellers who registered in the past 12 months going on to make sales. This far outpaces other major marketplaces like Germany (38%), the UK (32%), and Canada (16%).

This data reinforces that, despite growing challenges, including Amazon’s increasing take rate that now exceeds 50% for many sellers, ongoing uncertainty around tariffs, and perceived increases in competition, the U.S. marketplace remains the premier opportunity for new e-commerce businesses.

According to Marketplace Pulse data, nearly three-quarters of new U.S. sellers make their first sale within 12 months, while sellers in smaller marketplaces face significantly lower odds. In Canada, fewer than one in six new sellers achieved sales, while even established European markets like the UK saw only one-third of new sellers register sales within the year.

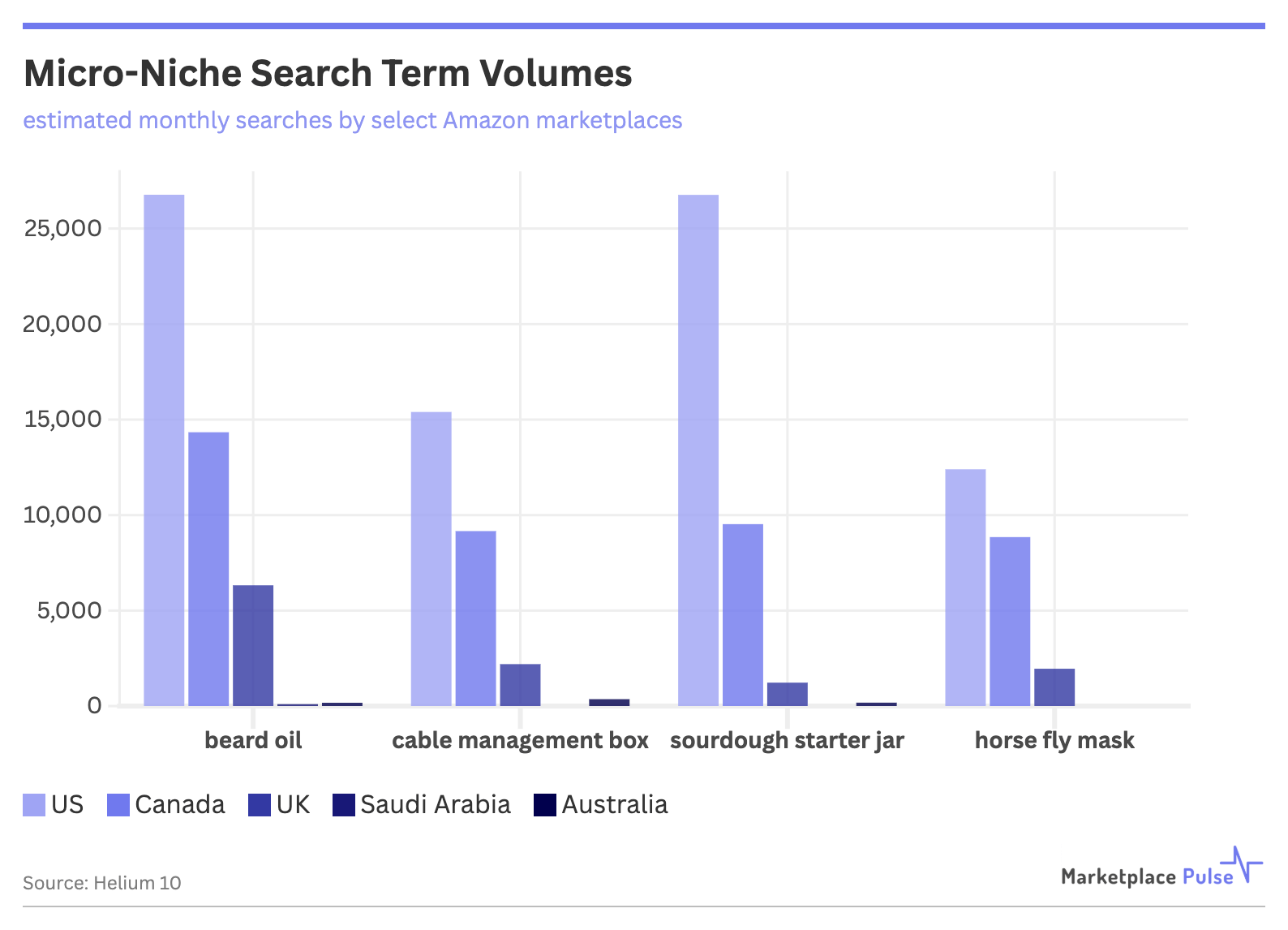

This advantage stems from the U.S. marketplace’s unique combination of massive traffic volume and micro-niche viability. Search volume data shows niche terms like “sourdough starter jar” generate 26,766 monthly searches in the U.S. compared to just 179 in Australia and zero in Saudi Arabia – a marketplace with more monthly visits per seller than the U.S. but far less micro-niche viability.

The term “beard oil” registers just 21 monthly searches in Saudi Arabia compared to 26,773 in the U.S. and 6,323 in the UK.

These numbers explain why the U.S. marketplace can support sellers in deep specialty niches like sourdough baking, beard grooming, and horse care, while smaller marketplaces often leave sellers listing products that never generate meaningful sales. The micro-niche volume means that in the U.S., Amazon is a true go-to-market platform for a wide range of businesses. At the same time, in many other countries, it often serves only as a supplementary channel.

Recent analysis showed that Amazon is actually less competitive than four years ago, with over 30% more traffic per active seller available. While some smaller marketplaces – like the aforementioned Saudi Arabia – now show better traffic-to-seller ratios, their lower total traffic ceiling means the U.S. remains the big opportunity. In the U.S., there are more sellers than anywhere else, but also significantly more sales to go around.

The data also reveals the challenge of international expansion. Despite launching 22 marketplaces beyond the U.S., most new sellers outside America struggle to gain traction. This explains why 69% of Amazon sellers remain active in just one marketplace, and only 1% of American sellers sell outside of North America – the effort required to expand internationally often doesn’t justify the returns.

Of course, making a first sale doesn’t guarantee long-term success – many new sellers still fall away after initial attempts, and less than 8% of seller accounts registered before 2019 remain active today.

However, the first-year cohort data suggests the U.S. marketplace provides the best environment for testing ideas and getting to market quickly. The combination of search volume depth and marketplace maturity creates conditions where even specialized products can find their audience.

For new sellers considering Amazon, the data is unambiguous: despite fee increases, tariff complexities, and growing competition, the U.S. marketplace remains the optimal launching pad for e-commerce businesses. The combination of massive traffic, micro-niche viability, and a 73% first-sale success rate creates an environment unmatched by any other marketplace globally.