Amazon sellers now face less competition than in 2021, with over 30% more traffic per active seller available across its global marketplaces.

Despite adding nearly a million new sellers annually, the number of active sellers has declined from over 2.4 million to under 1.9 million in four years, creating a significant opportunity for those who can successfully navigate Amazon’s evolving ecosystem.

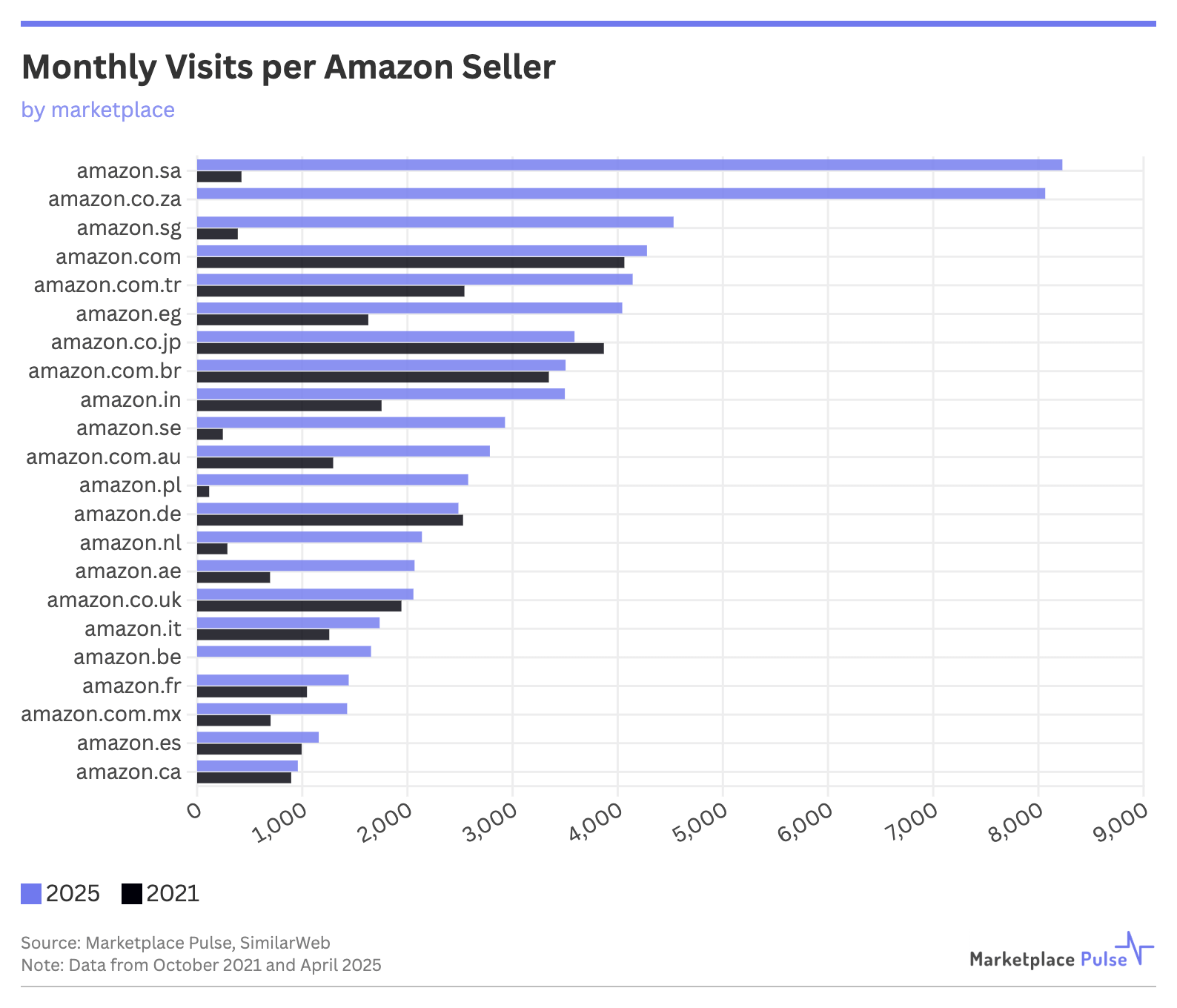

According to new Marketplace Pulse research, while Amazon’s traffic has remained relatively stable since 2021, the reduction in active sellers has increased the monthly traffic per seller ratio from 2,162 visits per seller in 2021 to 2,837 visits per seller in 2025 – a 31% improvement.

In a similar timeframe, Amazon’s topline revenue grew 36% from $470 billion (2021) to $638 billion (2024). Amazon doesn’t report third-party seller revenue, but it does report the share of units they sell. That figure rose to an all-time high of 62% in Q4 2024, up from 56% in Q4 2021. An increasing share of increasing revenue means sellers are capturing more opportunity even as their numbers decrease.

The paradox of more sellers joining yet fewer remaining active – defined as sellers receiving at least one feedback in the last year – highlights both the opportunity and challenges of Amazon’s maturing marketplace. Today, more than 60% of the top 10,000 sellers on Amazon.com registered before 2019, demonstrating that longevity remains the strongest predictor of success.

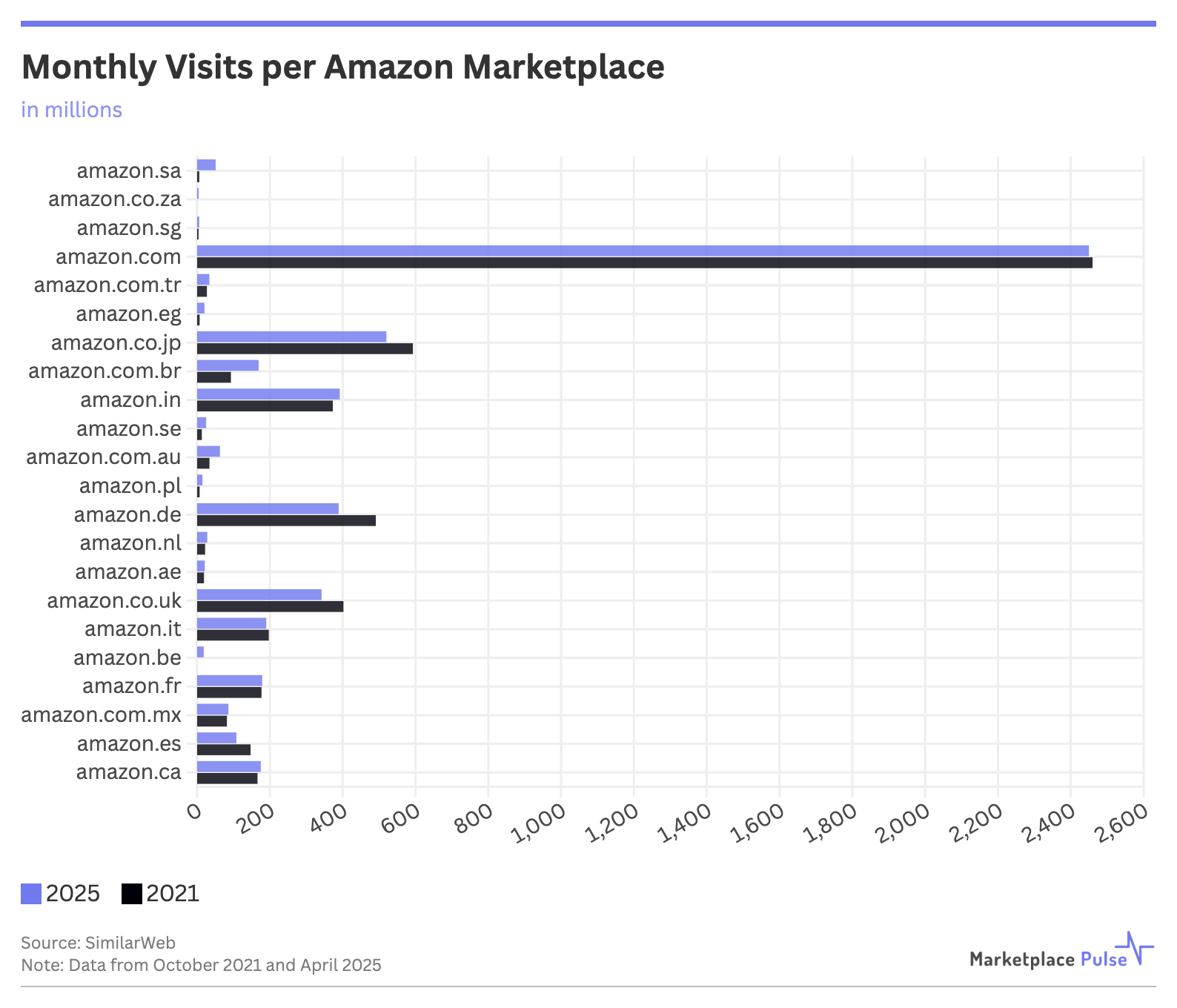

While the U.S. marketplace remains the most attractive in terms of total traffic and sales volume, with over 2.45 billion monthly visits, some smaller marketplaces now show better traffic-to-seller ratios. Saudi Arabia’s marketplace leads with 8,228 visits per seller, followed by South Africa (8,065) and Singapore (4,531). However, these markets have substantially lower overall traffic volumes, limiting both the overall revenue ceiling and the diversity of niche opportunities.

The changing competitive landscape comes amid significant challenges for sellers, including Amazon’s ever-increasing fees that now exceed 50% of revenue for many sellers. Chinese sellers continue to gain market share, now representing more than 50% of top sellers on Amazon.com, intensifying pricing pressure as manufacturers increasingly sell directly to consumers. Sellers are also facing increased regulatory complexity and uncertainty around tariffs.

Despite these headwinds, the data shows a growing opportunity for sellers who can navigate Amazon’s complex ecosystem. The increase in traffic per seller, combined with the growing share of third-party sales, means the potential rewards for successful sellers are greater than they were four years ago.

While newer sellers lack some advantages their predecessors enjoyed – and built still-in-place moats from, such as once-permissible strategies like offering free products for reviews – the declining competition provides a notable counterbalance to Amazon’s maturing marketplace challenges.