Booked shipping volumes from China to the U.S. have plummeted by almost 60% in recent weeks as carriers blank sailings on a scale not seen since COVID. The sudden pause sets up a familiar dynamic: as trade restrictions now ease, pent-up demand will send container rates rising again, echoing post-pandemic trends.

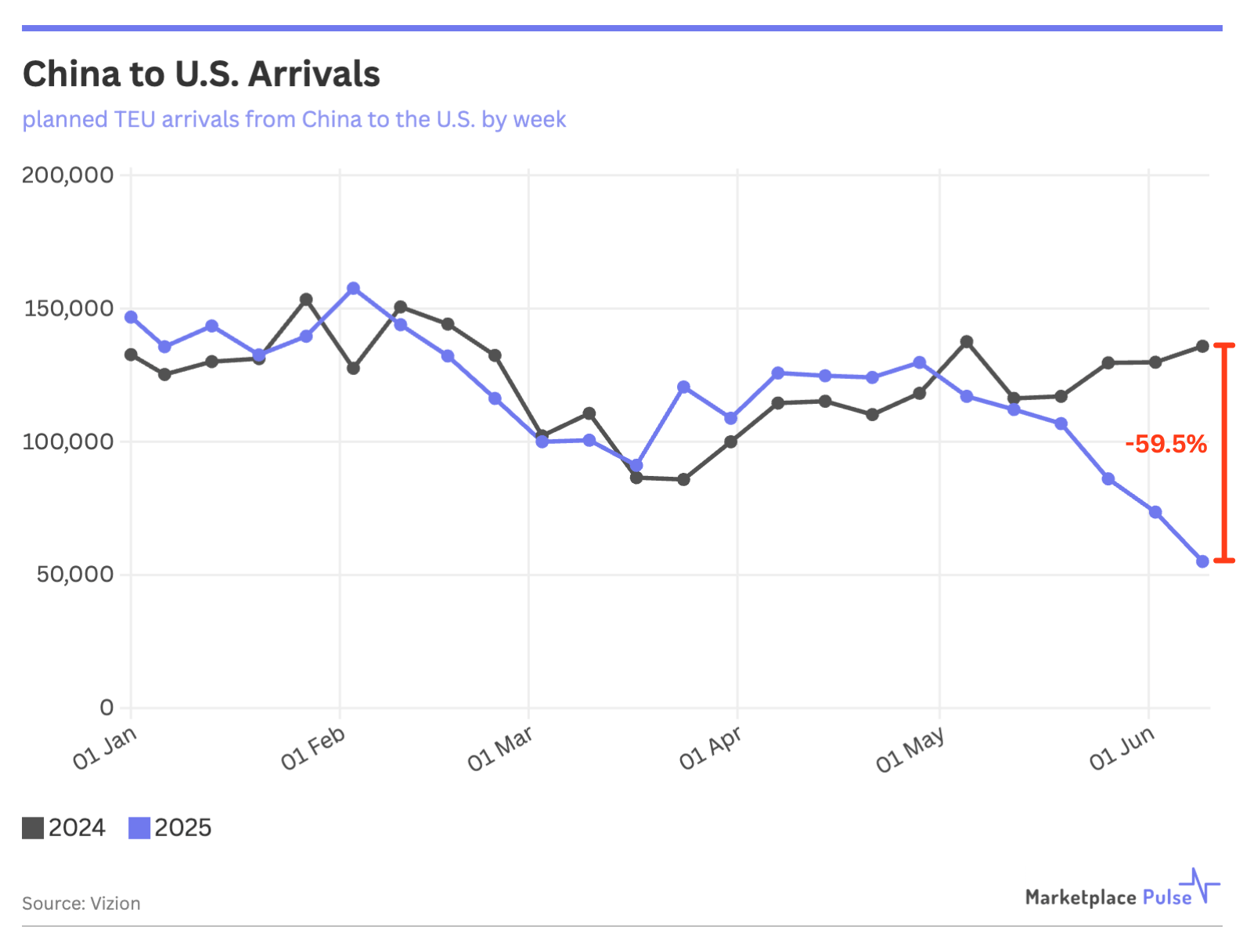

Blank sailings – when carriers skip scheduled port calls due to low demand – have surged past COVID-era levels. Sea Intelligence data shows carriers blanked more than 80 sailings in April 2025, surpassing the 51 from May 2020. “This level of escalation in blanked capacity illustrates a dramatic change in the market,” noted the maritime analysis firm. Vizion data shows that U.S. arrivals to China will fall 59.5% year-over-year by mid-June based on current bookings.

According to maritime analysts Drewry, the current outlook for container shipping is “more uncertain now than it was at the onset of the Covid virus.”

This stop-start rhythm certainly bears striking similarities to the COVID pandemic’s initial impact on shipping. In early 2020, trade volumes dropped suddenly as the world went into lockdown. An unprecedented surge followed that brief pause in demand that overwhelmed shipping capacity and sent container rates from China to the U.S. soaring from $1,500 to over $20,000 per container by September 2021.

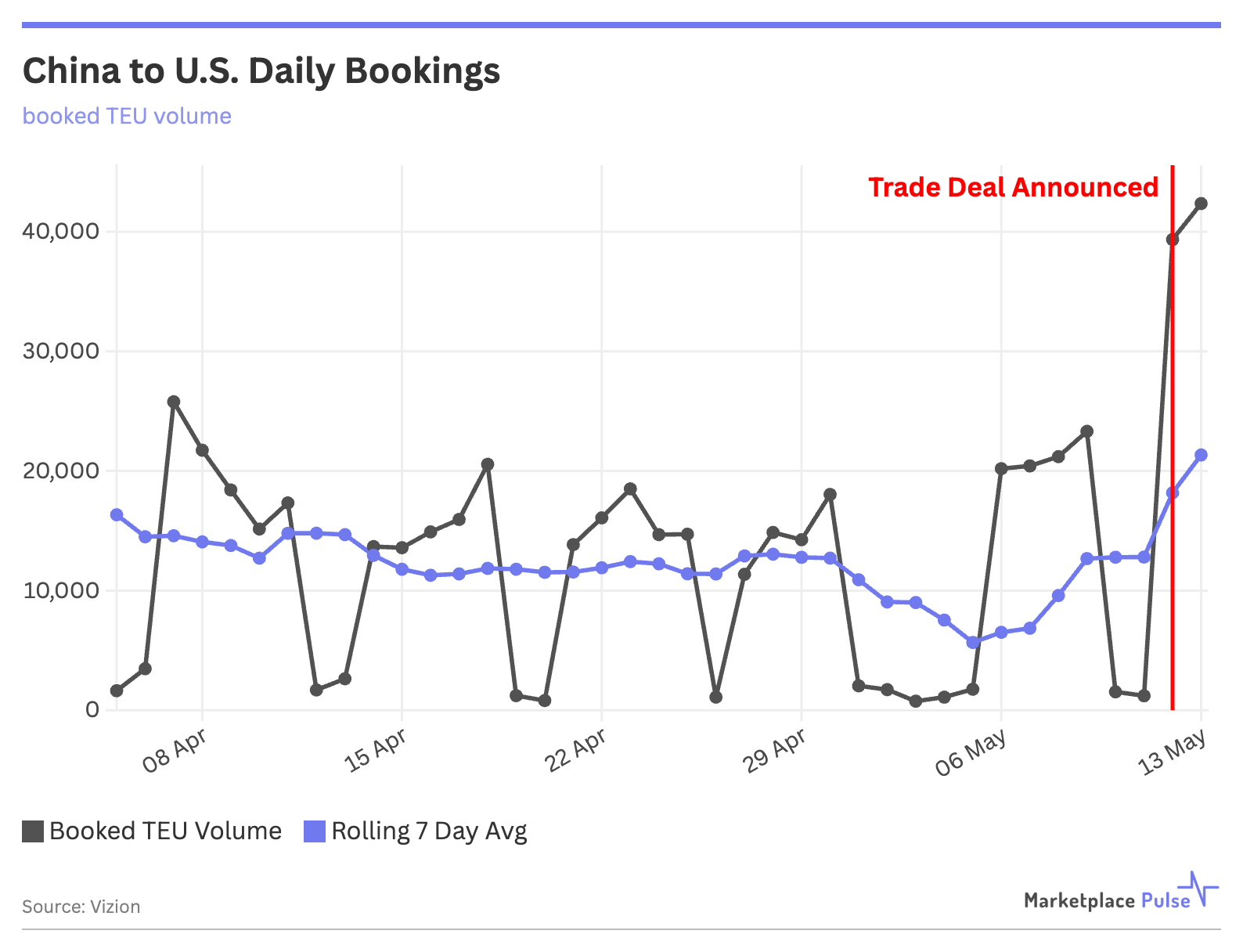

The current situation follows a similar pattern. After a U.S.-China trade deal saw tariffs on Chinese goods reduced from 145% to a far more manageable 30%, shipping demand began recovering quickly. Vizion data shows that daily China to U.S. bookings increased by 82% between May 9 and May 13, following the deal announcement.

Ryan Petersen, CEO of freight forwarder Flexport, echoed similar trends: “Our ocean freight bookings from China to US increased 35% in the first day since the trade deal. A big backlog is looming, soon the ships will be sold out.”

While the shipping dynamics mirror COVID, the broader context differs. COVID created unprecedented demand for consumer goods as people shifted spending from services to products. The current situation involves businesses rebuilding inventories rather than a fundamental shift in consumer behavior. Additionally, this disruption centers on the China-U.S. trade lane specifically, while non-Chinese ports remain far less affected.

Despite these differences, container rates are already showing upward pressure. The combination of reduced capacity from blank sailings and recovering demand is creating conditions for another rate spike. For businesses dependent on Chinese imports, higher shipping costs will initially offset any benefits from lower tariffs.

The question isn’t whether rates will rise, but how quickly and by how much. Blank sailings that should have departed Asia in late April and early May would typically arrive back in June and July, meaning the full impact of supply and demand imbalances won’t be seen until then, as container shortages become more acute.

This trade war pause-and-rebound cycle should not recreate the extreme $20,000 container rates of 2021, nor should the ripple effects last as long. However, it follows the same playbook, and e-commerce businesses face a familiar choice: book now at rising rates or risk being priced out as demand continues to recover.