The newly heightened tariffs on Chinese imports should theoretically benefit American businesses. However, recent comments from Amazon CEO Andy Jassy suggest they may have the opposite effect, further cementing the dominance of Chinese sellers in marketplaces like Amazon by creating greater price advantages for direct-from-factory sellers.

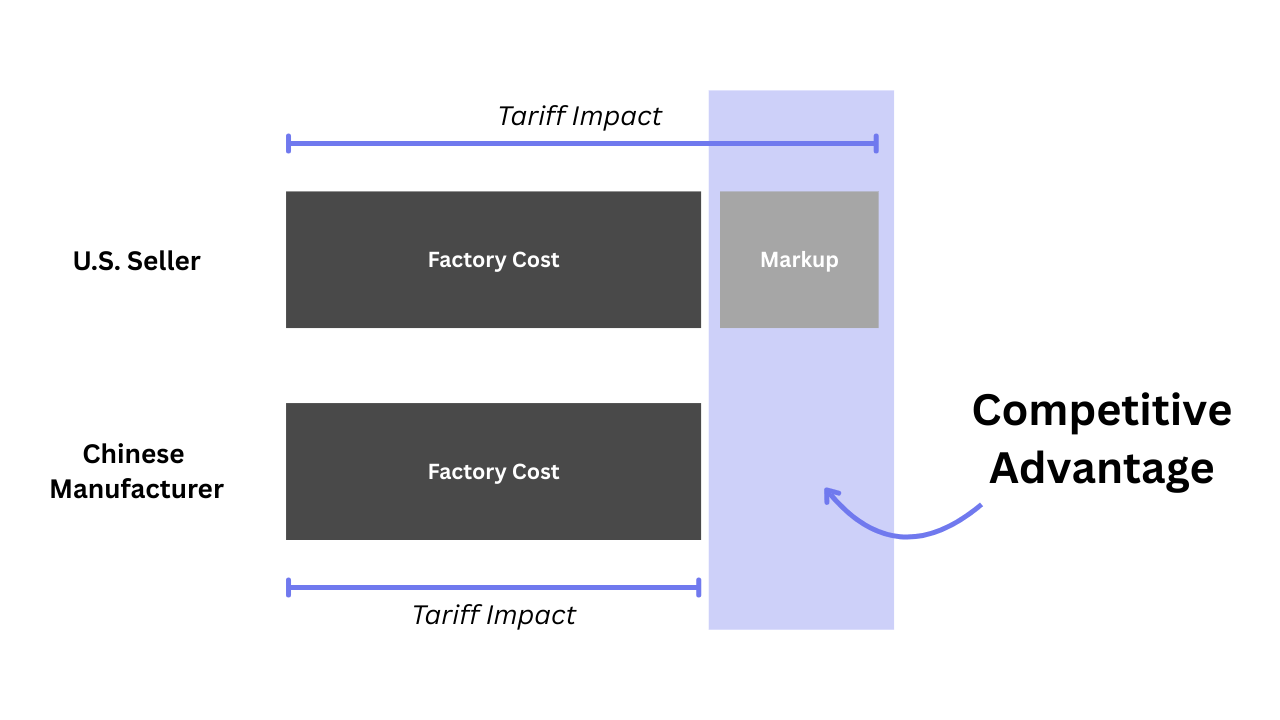

“Retailers who aren’t buying directly from China are typically buying from companies who themselves are buying from China, marking these items up, rebranding, and selling to US consumers,” Jassy explained during last week’s earnings call. “These retailers are buying the product at a higher price than Chinese sellers selling directly to US consumers in our marketplace, so the total tariff will be higher for these retailers than for China direct sellers.”

The mechanics are straightforward. When a U.S. seller sources products from Chinese manufacturers, they pay a markup to their supplier, then face tariffs on that higher wholesale price. Chinese manufacturers selling directly to U.S. consumers through Amazon face tariffs on their manufacturing cost – a significantly lower baseline. With a shorter supply chain and lower starting prices, Chinese sellers maintain more pricing flexibility even as tariffs increase.

This advantage comes after a decade of explosive growth for Chinese sellers on Amazon. In January, Marketplace Pulse data showed Chinese sellers surpassing the 50% threshold among top Amazon sellers for the first time, with U.S. sellers falling to roughly 45%. The shift was so significant that Amazon finally acknowledged it in SEC filings this year, describing Chinese seller market share as “significant.”

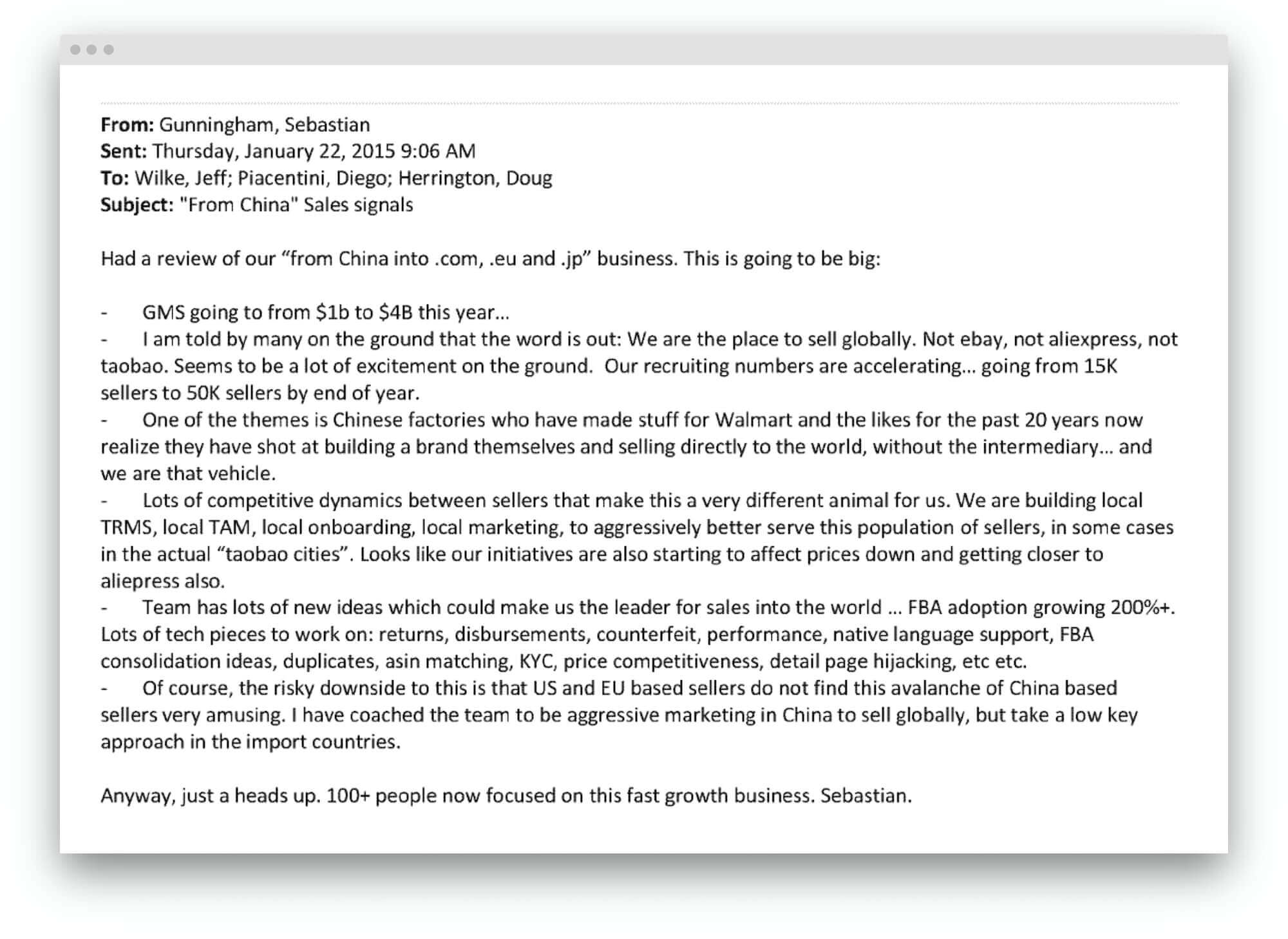

The current tariff situation validates a prediction made in 2015 by then-Amazon executive Sebastian Gunningham, who wrote in an internal email: “Chinese factories who made stuff for Walmart and the likes for the past 20 years now realize they have shot at building a brand themselves and selling directly to the world, without the intermediary… and we are that vehicle.”

Gunningham predicted it was ‘going to be big’. It is big, and it’s only getting bigger. According to Marketpace Pulse data, over 50% of sellers joining the platform in 2025 are Chinese. A little over 30% are American.

Jassy suggests that history shows that Amazon stands to benefit from current market disruption: “When there are uncertain environments, customers tend to choose the provider they trust most… we have emerged from these uncertain areas with more relative market segment share than we started.”

While that may be true, Walmart’s marketplace continues to gather pace, adding over 30,000 sellers already in 2025 - the same number that joined in the entirety of 2023. 60% of these are from China, meaning the same structural advantages that benefit Chinese sellers on Amazon will also play out on other marketplaces.

With Amazon’s 2 million+ active sellers, Jassy emphasized that pricing strategies will vary widely. “We have a lot of sellers in lots of different countries, and not all of them are gonna pursue the same tack,” he noted. With several references to Amazon’s commitment to low pricing throughout the earnings call, it’s clear that the expectation is for a portion of sellers to maintain competitive pricing and gain market share.

There were also several references to seller location. Jassy alluded to it a third time, saying, “We’re trying to make sure that we have the right diversity of sellers and low prices for our customers.” Amazon understands that its ability to offer tariff-resistant low pricing depends on ensuring Chinese sellers continue to make up a large share of the third-party seller mix.

This paradox exposes a fundamental miscalculation in current trade policy. By targeting the country of origin without addressing the country of the importer, tariffs strengthen the direct-to-consumer pipeline from Chinese factories to American households, precisely the opposite of their intended effect.

For U.S. sellers, the competitive landscape grows more challenging. Without vertical integration from manufacturing to sales, American businesses on Amazon face a structural disadvantage that tariffs intensify rather than relieve.

The ultimate irony? A policy designed to reduce Chinese influence in American commerce may entrench it further, accelerating the decade-long shift from “Made in China” to “Made, Sold, and Marketed by China”.