One product has sold 1.2 million units on TikTok. More than any other since TikTok Shop launched in the US in September.

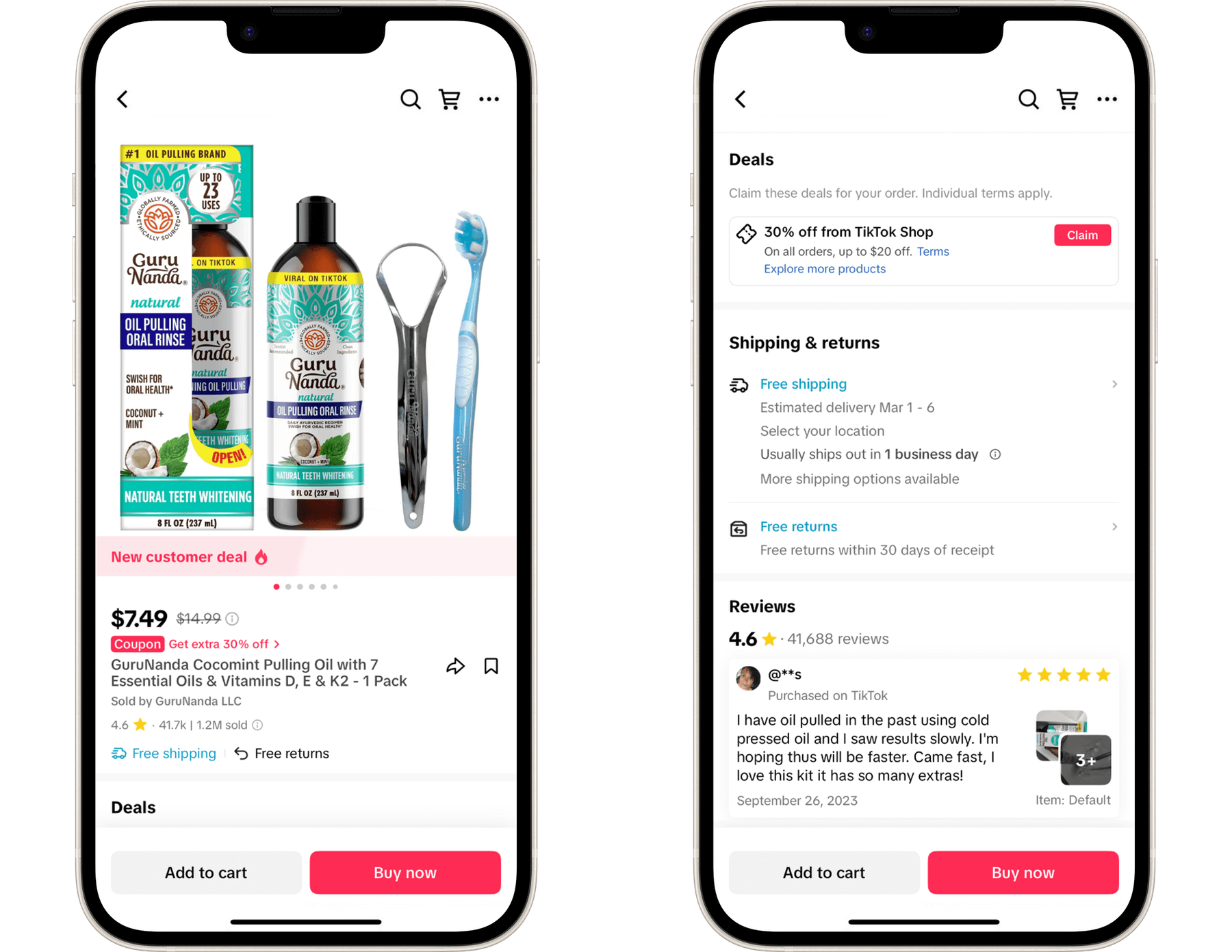

GuruNanda Cocomint Pulling Oil is selling more than 100,000 units a week on TikTok Shop and has totaled 1.2 million sales on the app. It has more than 40,000 reviews and a 4.6 out of 5 rating. It often sells for $7.49, minus the 30% discount for first-time shoppers, and comes with free shipping. The nearly 30,000 videos tagged with #gurunanda on TikTok from thousands of creators, some with tens of millions of views, are responsible for those sales.

TikTok users didn’t seek out GuruNanda, at least not before it got popular. They bought it because of the videos mentioning the product intermixed in their regular TikTok feeds. TikTok is content-first, while Amazon, Walmart, and other internet retailers are search-first. Most sales on Amazon happen because the shopper searches for that item. While TikTok has a separate tab for Shop, which also has a search bar, consumers shop when they see a video they like. The video creates demand. Then, TikTok Shop allows users to checkout in-app with billing and shipping details stored in their accounts by clicking a Shop button on the video.

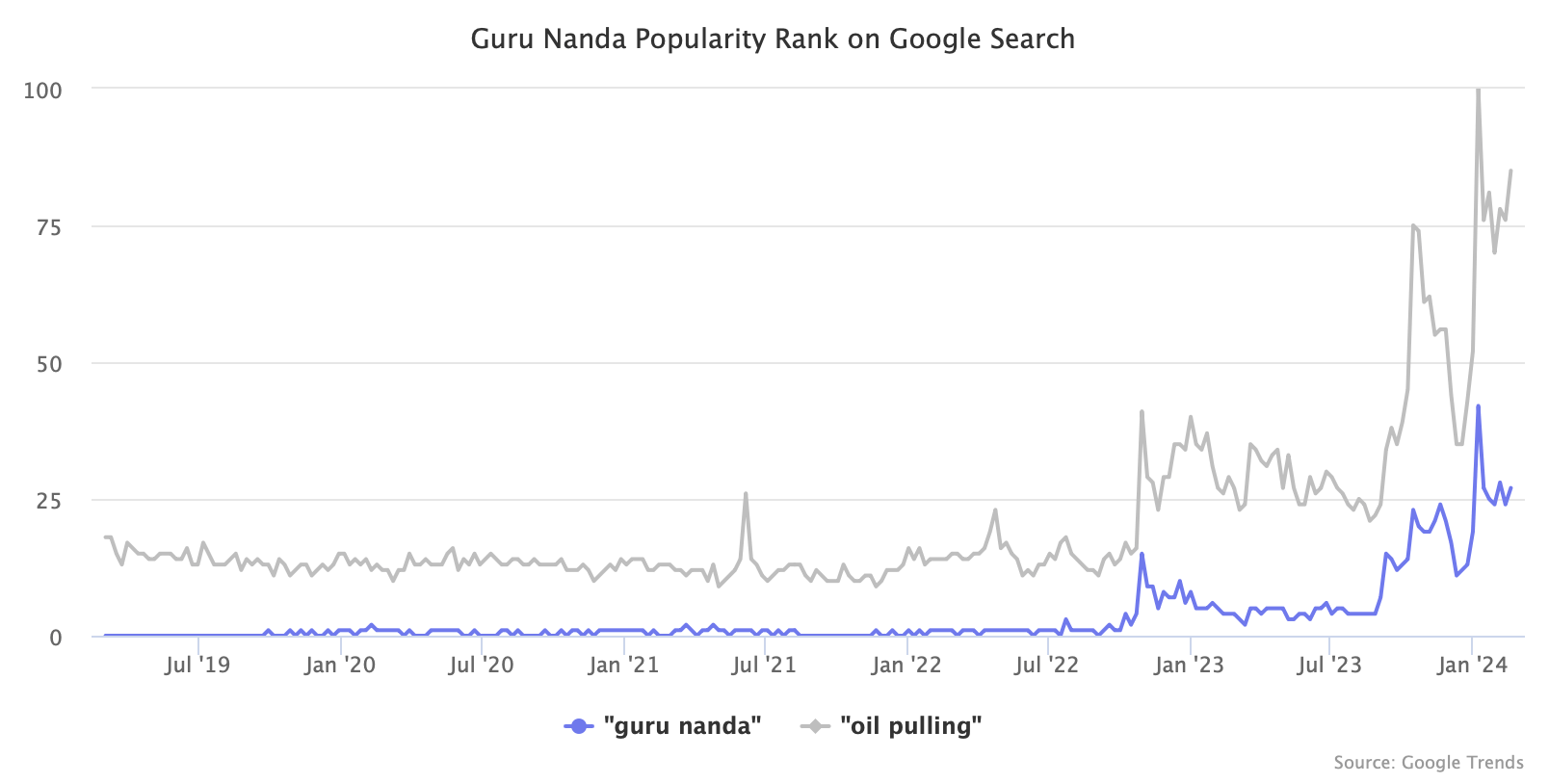

GuruNanda’s success on TikTok spilled over to other channels. In January, the product also became Amazon’s #1 bestseller in the Health & Household department, outselling millions of other products, including batteries, paper towels, and trash bags. The term “guru nanda coconut oil pulling” was among Amazon’s top 10 most-searched phrases. On Google, “oil pulling” was rarely searched during the past decade, but starting in early 2023, GuruNanda began to get attention, lifting searches for both “guru nanda” and “oil pulling.”

Bestsellers on TikTok are not items from established brands, and stores with the most sales volume are not big-box retailers. It is not Away luggage or Glossier makeup or a retailer like Walmart or Target. Nor is it Mr. Beast’s chocolate or Logan Paul’s Prime drink. It’s an eclectic mix of affordable products from unknown brands that work well for impulse buys instead. For now, TikTok will likely continue to work best for TikTok-focused rather than established brands. That also means there is an opportunity for different types of products to succeed.

The challenge is that the formula for TikTok is considerably less straightforward than a typical retail sales channel. It might not even be a formula but rather an unpredictable game of finding what pleases the TikTok algorithm. Because there is no commerce on TikTok without videos, what videos users see and what goes viral is a guessing game. So far, TikTok’s suggested strategy for answering that question is through volume - more videos and more different videos until one of them clicks.

TikTok is not a sales channel; it’s an entertainment platform that competes with YouTube and Netflix for attention and sometimes acts as a discovery engine for commerce. It doesn’t replace Amazon or any other retailer. But many people spend many hours using it every day, and TikTok is aggressively pushing shopping content to them. Thus, while it’s not Amazon, people will buy some things, often different things, and more of them as TikTok Shop grows.

Over the past few years, Amazon launched a new breed of brands that leveraged the Amazon marketplace to reach scale and brand recognition. Anker, which sells electronics, is the best example of the Amazon-native brand. GuruNanda is a glimpse of a TikTok-native brand. While its success on TikTok ultimately led to success on Amazon, too, and even broad recognition as shown by its popularity on Google, it only worked because it hit take-off speed on TikTok.