Amazon’s Prime Day is a rising tide that is beginning to lift all boats. This year’s event was a catalyst behind 30% growth across all U.S. e-commerce, yet Amazon itself remained conspicuously quiet about its own specific growth figures.

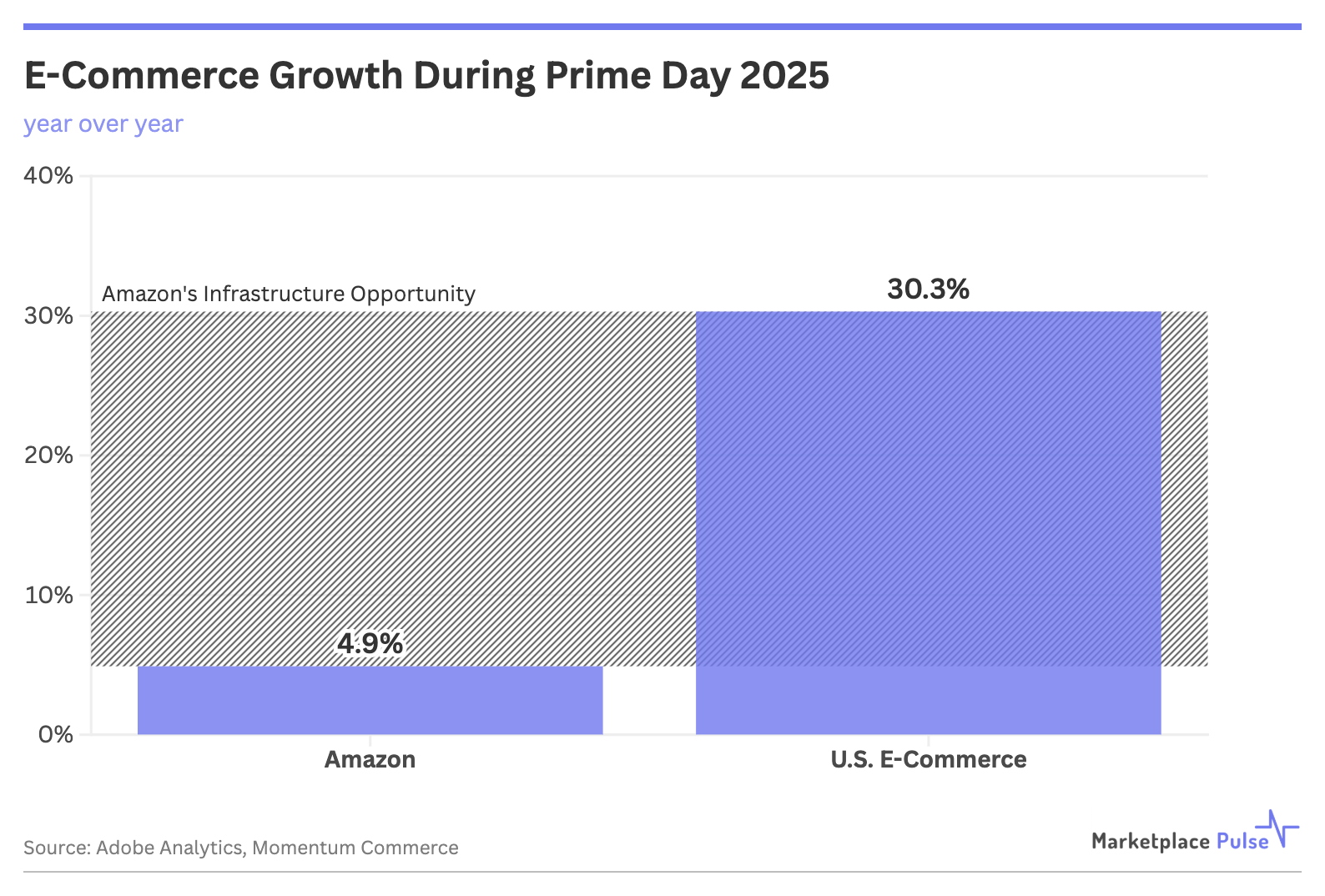

The four-day event generated $24.1 billion in industry-wide online spending, according to Adobe, but Momentum Commerce’s analysis of $750 million in Amazon transactions revealed just 4.9% growth for the platform itself. Prime Day has evolved from Amazon’s exclusive sales domination into a retail catalyst that benefits the entire industry.

Adobe Analytics tracked 30.3% year-over-year growth across all U.S. retailers during Prime Day week, representing “the equivalent of two Black Fridays” in consumer spending. If Amazon had achieved anything close to the industry’s 30% lift, those figures would have led every press release.

Amazon’s careful language, however, reveals the reality. The company specified that Prime Day 2025 was both “its biggest Prime Day event ever” and “bigger than any previous four-day period that included a Prime Day event.” This deliberate phrasing attempts to deflect from the obvious: it was only bigger because it was longer.

It wasn’t just bigger because it was longer; it was bigger because Amazon grows by default each year. With Amazon’s post-COVID growth in units sold hovering around 10%, sub-5% Prime Day growth appears modest against the industry’s 30% lift.

Prime Day’s growth has been stalling since 2021, but a plateau does not mean the event is failing; more so that it has found a new purpose. The industry-wide boost reveals Prime Day’s evolution into retail’s most effective non-holiday demand generator, and Amazon’s transformation from retail conqueror to market maker and infrastructure provider.

Every major retailer now schedules competing events around Amazon’s dates, creating what’s essentially Prime Day everywhere, capturing the event’s spillover demand. Amazon creates the consumer expectation of mid-July deals, and competitors now more than ever help fulfill it. Rather than try to establish independent shopping holidays, retailers have embraced Prime Day as the kickoff to an industry-wide summer sales season. This dynamic benefits everyone except Amazon’s exclusive dominance.

For Amazon sellers, it represents an opportunity rather than a threat. The diversification of summer sales events reduces over-reliance on a single platform while expanding the total addressable market. Brands that previously depended entirely on Prime Day performance now have multiple channels to capture summer shopping demand. The rising tide creates more opportunities for marketplace sellers across platforms rather than concentrating all activity within Amazon’s ecosystem.

Amazon’s primary sales event having such a significant impact on wider U.S. e-commerce may not have been intentional, but it’s reshaping retail nonetheless. While competitors celebrate capturing Prime Day spillover, Amazon benefits regardless through the fulfillment, advertising, and logistics services it now provides across the industry. The company created a shopping holiday that now benefits the entire industry, transforming exclusive dominance into distributed opportunity where Amazon takes a cut of everyone’s growth.