Despite widespread predictions that escalating U.S. tariffs would prompt American sellers to expand internationally as a risk mitigation strategy, Marketplace Pulse data reveals this anticipated pivot has not materialized.

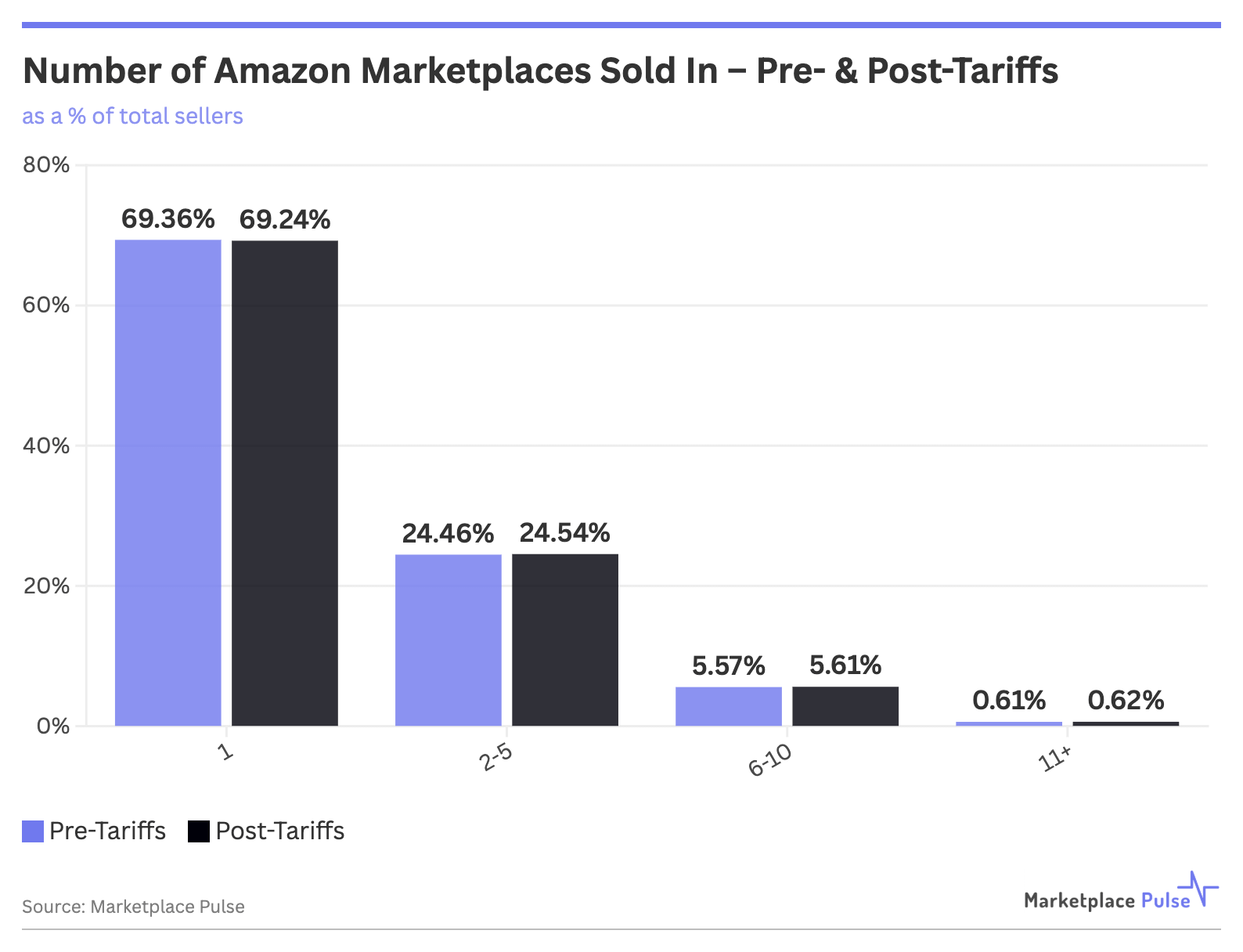

Four months ago, Marketplace Pulse analysis revealed that 69.36% of Amazon sellers operate in just one international marketplace. That figure remains virtually unchanged at 69.24%, showing that tariffs alone are an insufficient incentive to overcome the practical barriers of international expansion.

The expectation was logical. After President Trump announced “Liberation Day” duties on April 2, imposing steep taxes on America’s major trading partners, a wave of international expansion was anticipated as sellers sought to diversify away from tariff-exposed supply chains.

E-commerce accelerator Pattern reported a 47% increase in international expansion requests from brands since tariffs were announced. However, requests and actual execution represent vastly different realities.

Marketplace Pulse’s analysis of over 5 million Amazon sellers reveals minimal movement in expansion patterns between March and July – essentially, pre- and post-tariff periods.

Single marketplace sellers decreased by just 0.12 percentage points to 69.24%, while sellers operating in six or more marketplaces barely budged from 6.18% to 6.23%. The data demonstrates that while tariff concerns may generate consulting calls and strategic discussions, they haven’t yet translated into meaningful behavioral change among the seller population.

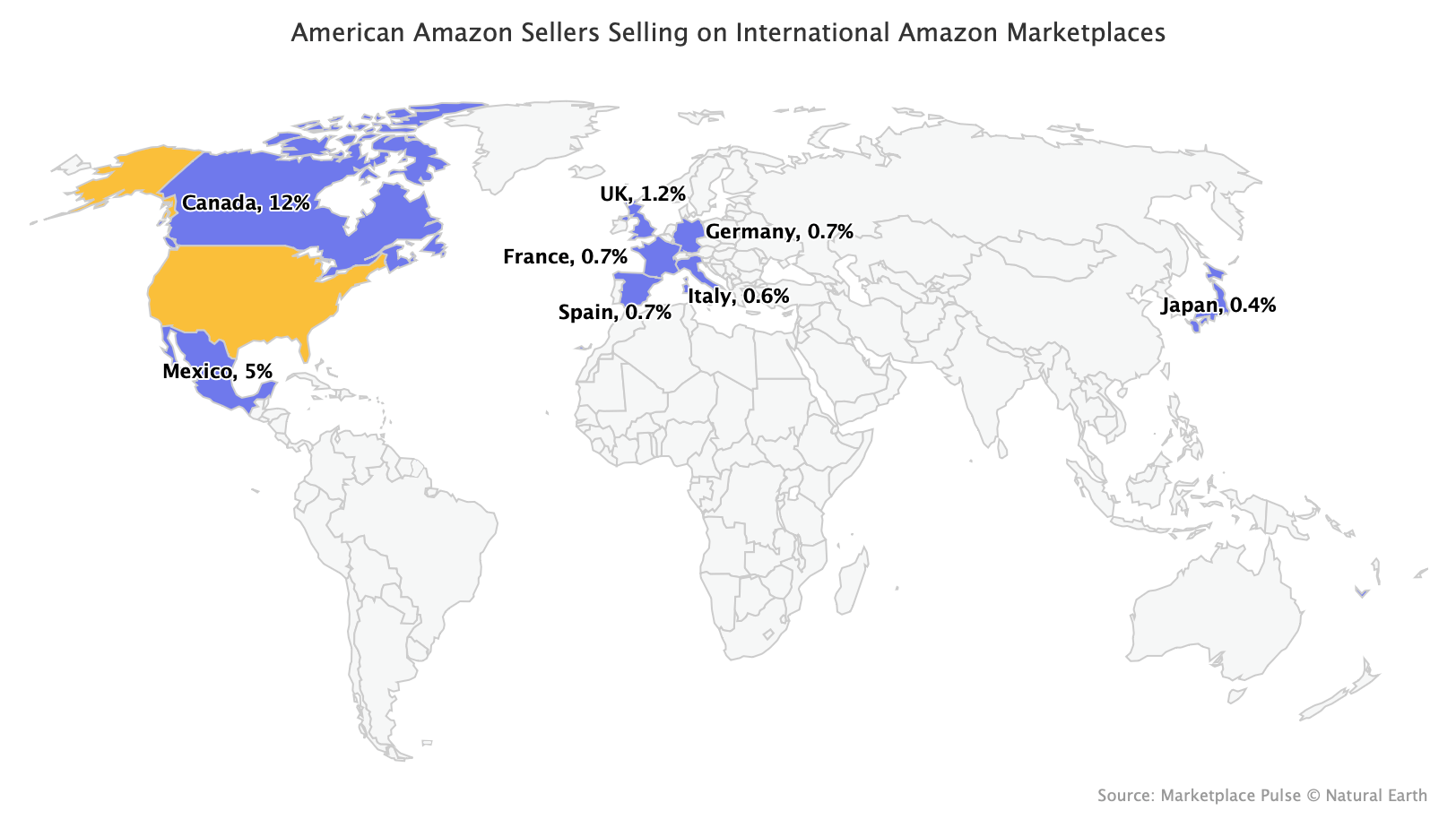

American sellers have historically shown a limited appetite for international expansion. One year ago, Marketplace Pulse data showed that American sellers accounted for less than 1% of the total sellers outside of North American marketplaces. One year on with tariff pressure building, that figure also remains almost identical.

Meanwhile, Chinese sellers demonstrate the most aggressive international expansion patterns irrespective of tariffs, with their presence dominating almost every major international marketplace. Japan remains the final established Amazon marketplace where local sellers represent the majority, though even this is under increasing pressure.

International expansion represents low-hanging fruit in theory – existing supply chains, established products, and Amazon’s unified global infrastructure should make geographic diversification straightforward. In practice, regulatory complexity, tax obligations, and operational overhead create substantial friction. The VAT reporting structures across European markets, Brexit-related complications, and new legislation, such as the General Product Safety Regulation, have created additional bureaucratic layers that persist regardless of tariff levels.

Market size disparities also influence decisions regarding expansion. Traffic across Amazon’s 22 non-U.S. marketplaces combined only marginally exceeds that of Amazon.com in the U.S., according to SimilarWeb data. When sellers evaluate effort against potential returns, many conclude the U.S. market alone offers sufficient opportunity.

Four months is a relatively short timeframe for analyzing macro international expansion trends. Still, the lack of movement within that timeframe shows that tariff uncertainty alone is not the micro-incentive to expand internationally that many thought it would be.