The summer sales calendar now revolves around Amazon’s anchor, with most major U.S. retailers scheduling competing events within days of Prime Day’s expanded four-day window.

Amazon’s decision to double Prime Day from two to four days (July 8-11, 2025) has triggered an industry-wide response, transforming mid-July into a mandatory shopping season. The expanded event forces competitors into an escalating arms race for summer shoppers, with each retailer under increased pressure to stake out their territory in the same compressed timeframe.

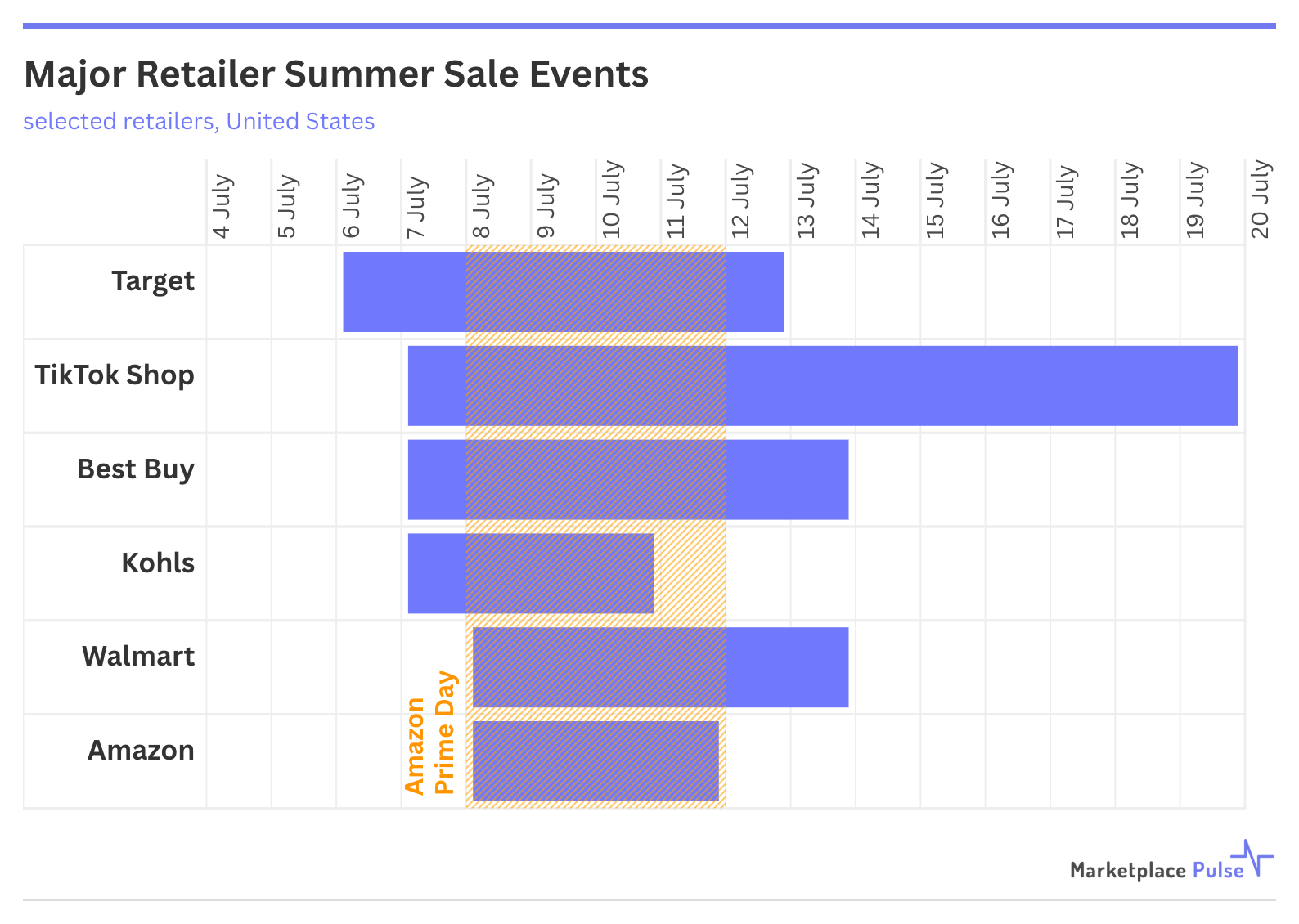

The timing of competing retailer events is no accident. TikTok Shop is the newest contender in the summer sale season, having launched in the U.S. less than two years ago. It will run its “Deals for You Days” from July 7 to 19, essentially bookending Amazon’s event with the longest competing sale. Walmart extends its competing “Walmart Deals” to six days (July 8-13), up from four last year. Target’s “Circle Week” spans from July 6 to 12, while Best Buy revives “Black Friday in July” from July 7 to 13. This isn’t a coincidence – it’s strategic coordination around the date Amazon set.

The dates are similar, but the tactical differences vary among retailers. Amazon restricts Prime Day to its 200+ million paying members, creating exclusivity but limiting reach. Target and Walmart counter by making their events accessible to all customers while offering early access to their paid loyalty members. This inclusive strategy aims to capture bargain-seekers who might otherwise join Prime specifically for the event.

Meanwhile, Trump’s tariffs are quietly reshaping participation. Some third-party sellers who previously relied on China-made goods are reportedly pulling out of Prime Day, citing increased tariffs as responsible for a lack of flexibility around pricing. This creates opportunities for retailers with domestic supply chains – notably Walmart, which claims two-thirds of its sourced goods are made in America – to fill gaps where Amazon’s marketplace could struggle.

The competitive response reflects how Prime Day has become the kickoff to a mid-year retail season. What started as Amazon’s birthday celebration has now evolved into a week-long deal frenzy that generates billions in industry-wide sales. Amazon still captures the lion’s share, but the competing events have created an unofficial “Summer Shopping Week.”

The timing coordination extends to category focus. Multiple retailers are emphasizing back-to-school shopping, with Target leading this positioning most aggressively through teacher discounts and maintaining 2024 pricing on school products. This strategic focus allows retailers to differentiate from Amazon’s broader “everything store” approach while capitalizing on seasonal shopping patterns.

The expansion also reveals the limits of membership-gated commerce. While Amazon’s Prime exclusivity drives subscriptions, competitors benefit from opening deals to all customers. This access strategy becomes more important when economic pressures encourage price comparison over convenience.

Prime Day everywhere isn’t just about competing with Amazon – it’s about competing for the same compressed shopping window that Amazon created. The result transforms July into retail’s most concentrated month outside of the holiday season, with every major player forced to participate or risk losing market share during a period when consumers are primed to spend.

This coordination represents retail’s adaptation to Amazon’s calendar dominance, but it also shows the industry’s recognition that fighting Amazon’s timing is less effective than leveraging it. By clustering competing events around Prime Day, retailers are attempting to transform Amazon’s exclusive member event into an industry-wide sales season where multiple winners can emerge.