Shopping platform Whatnot’s rapid growth to multi-billion dollar GMV proves live streaming commerce works when built for entertainment first and conversion second.

Live shopping was supposed to be e-commerce’s next big thing. According to Grand View Research, the U.S. market reached $12 billion in 2023, with projections hitting $78 billion by 2030. Yet most American platforms have failed to replicate China’s trillion-dollar success. The consensus had been that live shopping was culturally incompatible with Western consumers. That consensus was wrong.

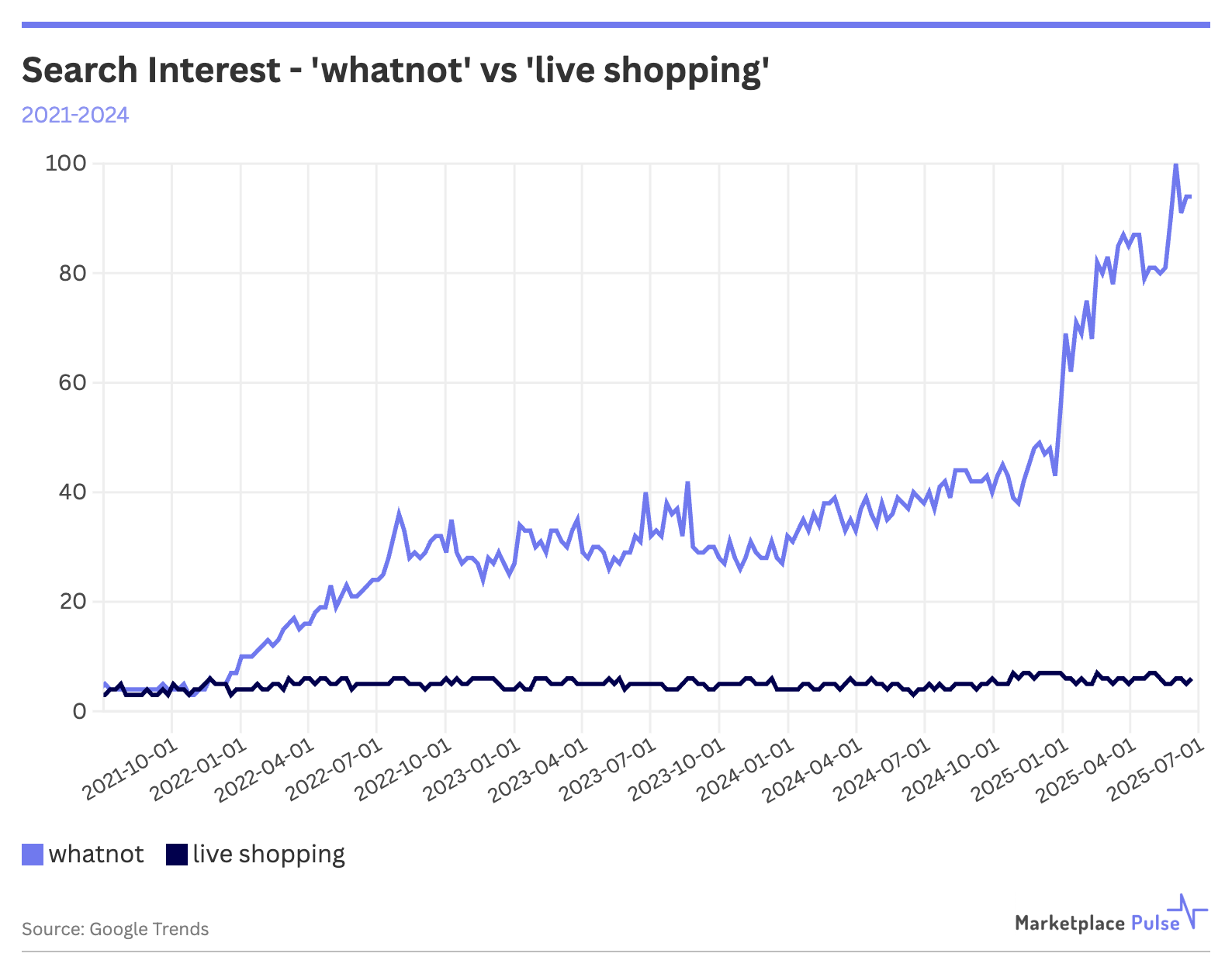

Whatnot’s trajectory suggests the problem wasn’t cultural compatibility but category selection. According to Fortune, the 2019-founded platform will double its GMV year-over-year to reach $6 billion in 2025 while ranking as the 15th most popular free iPhone app in the U.S. More telling: users spend an average of 80 minutes daily on the app – closer to Netflix than Amazon. The platform succeeded because it found product-market fit in the collectibles category and inverted the traditional e-commerce formula, prioritizing retention over conversion and community over transactions.

The contrast with Amazon Live is telling. Amazon Live historically maxes out at less than a thousand active viewers on a regular day because the content is too focused on selling rather than entertaining. Historically, because live viewer count is no longer displayed, likely because it would harm conversions more than help.

Amazon built live streaming as a sales tool - hosts demonstrate products, answer questions, and guide viewers toward purchase decisions. The format feels like an infomercial embedded in a shopping site designed for search, not browsing.

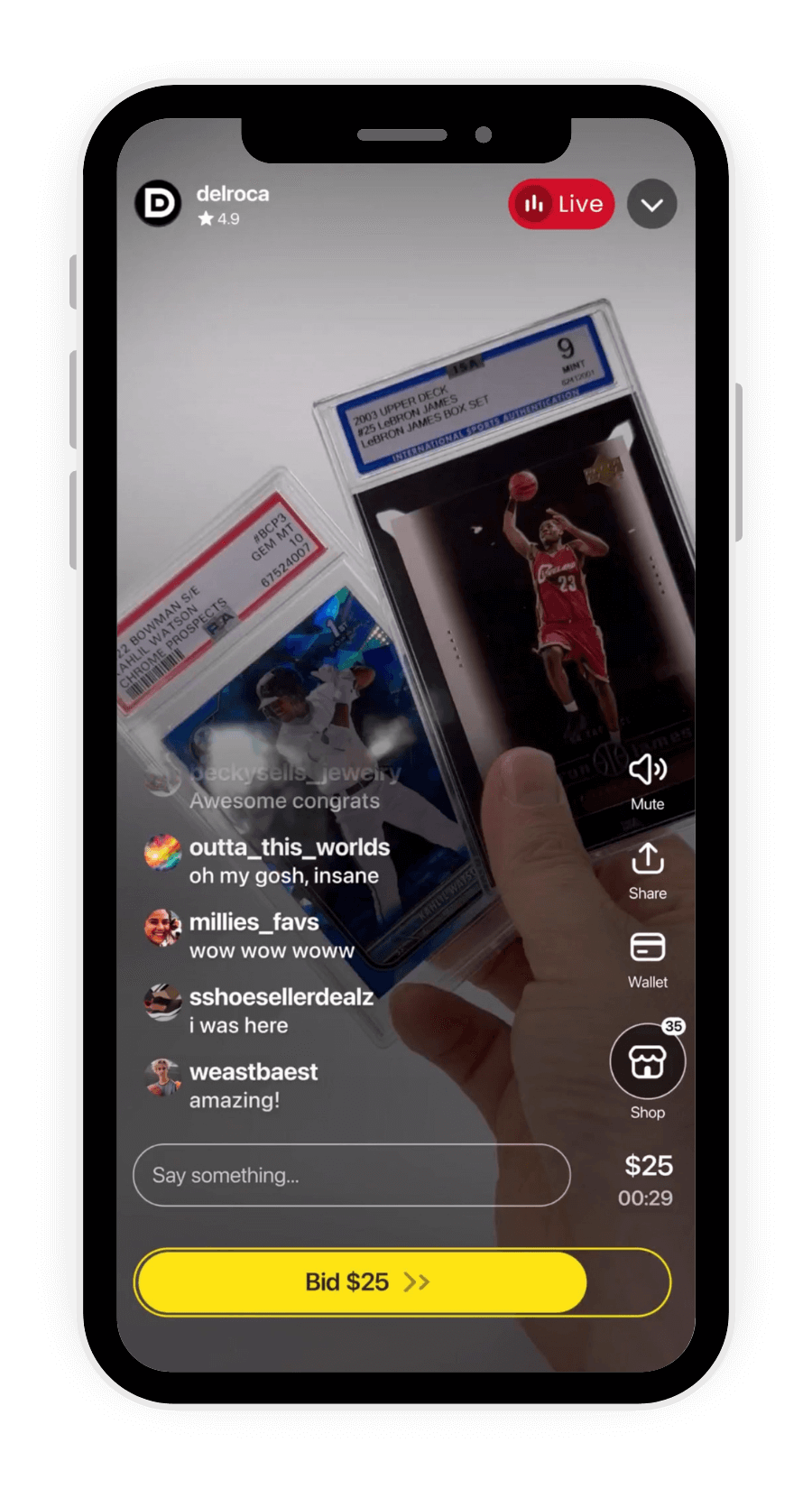

Whatnot built the opposite: an entertainment platform where commerce happens to occur. For example, when sellers “break” open cases of trading cards on camera, they’re not just selling products – they’re hosting events. Viewers participate in group purchases, watch authentication in real time, and engage with communities built around shared expertise. The platform succeeds in collectibles because these categories already operate on relationships, trust, and expertise rather than price comparison and feature lists.

This entertainment-first approach explains why Whatnot works where broader live commerce efforts have struggled. The platform’s core categories – trading cards, sports memorabilia, coins – benefit from the format’s inherent advantages: real-time authentication, community validation, and the drama of auction-style reveals. These aren’t products that benefit from Amazon’s search-optimized listings or eBay’s static auction format. They require the kind of expertise and theater that live streaming provides.

But Whatnot’s expansion beyond collectibles reveals both live commerce’s potential and its constraints. Women’s fashion has become the platform’s fastest-growing segment, with sellers like Circle City OC crossing $1 million in monthly sales through clothing hauls and liquidation streams. Fashion works for similar reasons as collectibles – viewers want to see how clothes move, understand fit and styling, and trust the seller’s taste. The format adds value that traditional e-commerce can’t provide.

Yet this success highlights live commerce’s fundamental limitation: it works for specific categories and specific audiences, not universal retail. A Dolby study showed live shopping appeals primarily to consumers aged 18-34, with conversion rates hitting 25-30% during streams compared to single-digit rates for traditional e-commerce. However, those high-engagement audiences represent a fraction of total retail spending, and the format requires significant time investment that most shoppers won’t make for routine purchases.

Even TikTok’s aggressive push into live commerce, despite generating multiple million-dollar livestreams, primarily succeeds with impulse purchases and viral products rather than comprehensive retail. The platform’s beauty brands collectively generated $104 million via livestream promotions in 2024, according to Glossy, but the format remains supplemental to traditional shopping for most categories and consumers.

Whatnot’s success proves live commerce has found a sustainable product-market fit in Western markets, just not where most expected. The platform discovered that live streaming works when it solves category-specific problems rather than trying to reinvent all of retail. Trading cards need authentication and community expertise. Fashion benefits from styling demonstrations and fit validation. Most other categories don’t require the entertainment value that makes live commerce compelling enough to justify the time investment.

The question isn’t whether live commerce works - Whatnot proved it does. It’s whether that success can scale beyond passionate communities and impulse-driven categories to become a meaningful alternative to search-based shopping. Early evidence suggests live commerce will remain a powerful but specialized channel, thriving in niches where entertainment and expertise add genuine value rather than becoming the broad retail revolution some predicted.