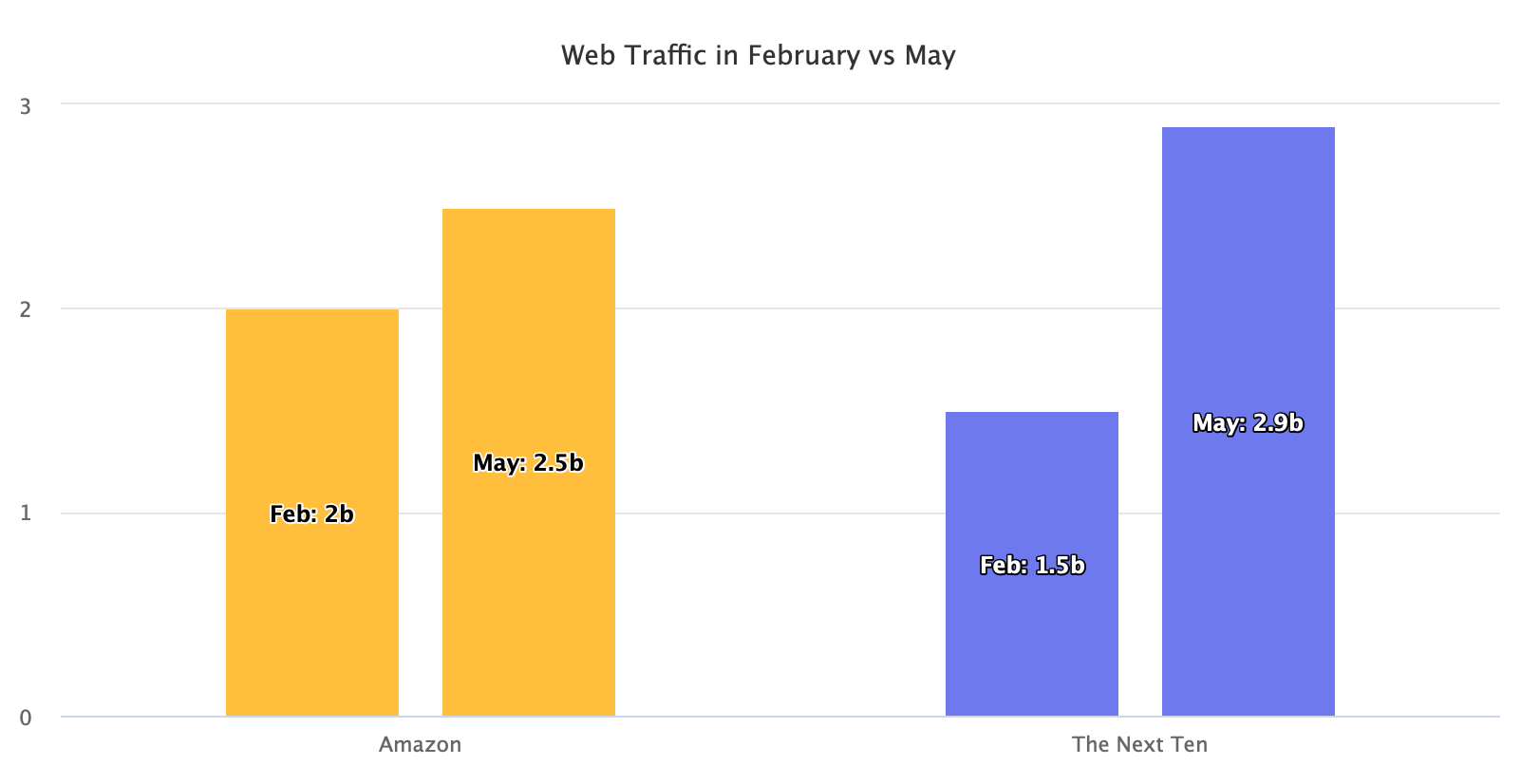

As e-commerce spending accelerated, Amazon grew slower than the next ten biggest online retail rivals. Amazon’s struggles with fulfillment as well as unique strengths by Walmart in grocery and Target in same-day delivery have created a growth spike.

In the U.S., most online retailers grew traffic, and thus sales, faster than Amazon. Compared to February, usually the lowest month for e-commerce that this year also happened to be the last one before the pandemic, Amazon’s traffic was up 24.6% in May. Key competitors like Walmart, Home Depot, Target, and Wayfair were up 50-100%, according to traffic estimates by SimilarWeb.

Amazon had 2.5 billion visits in May. Collectively, the next ten largest e-commerce websites had 2.9 billion. So while Amazon grew from 2 billion in February to 2.5 billion in May, the group of the next ten grew more by increasing from 1.9 billion to 2.9 billion visits. They added one billion monthly visitors, double the amount of Amazon. In terms of web traffic, Amazon lost market share to its main rivals.

Throughout March and April, Amazon prioritized essentials, restricted Fulfillment by Amazon (FBA) inbound shipments, and delayed non-essential items’ delivery. By mid-May, the company has resumed most of the operations. However, the months of essentials focus have created an opportunity for its rivals. In May, their growth has started to slow as Amazon’s recovery brought back its customers; nonetheless, some of them were able to double their traffic in just a few months.

| Website | Traffic in May | Traffic in February | Growth |

|---|---|---|---|

| amazon.com | 2.5b | 2.0b | 24.6% |

| ebay.com | 915m | 746m | 22.6% |

| walmart.com | 438m | 294m | 48.9% |

| etsy.com | 328m | 225m | 45.8% |

| homedepot.com | 270m | 129m | 108.5% |

| target.com | 223m | 128m | 74.6% |

| lowes.com | 162m | 70m | 132.1% |

| wayfair.com | 158m | 77m | 104.0% |

| bestbuy.com | 144m | 92m | 55.8% |

| wish.com | 141m | 91m | 53.8% |

| costco.com | 95m | 49m | 91.2% |

Among Amazon’s sixteen active markets, the growth was uneven. In India, it shrank because of the forced shutdown at the end of March. April was the worst month, however by May, it has started to recover and is mostly back to normal. Meanwhile, in the Netherlands, where Amazon launched in early March, Amazon saw the most growth because it started from virtually zero.

The U.K., Canada, Brazil, Mexico, Australia, Turkey, Singapore, and the Netherlands grew faster than the main Amazon.com website. At the same time, France, Germany, and Italy saw little growth, while Spain and Japan were somewhat strong. The one website where traffic declined was Amazon China, but that’s because the company shut down its China operations a year ago.

| Website | Traffic in May | Traffic in February | Growth |

|---|---|---|---|

| amazon.com | 2.5b | 2.0b | 24.6% |

| amazon.co.jp | 613m | 527m | 16.4% |

| amazon.de | 479m | 455m | 5.4% |

| amazon.co.uk | 464m | 362m | 28.2% |

| amazon.in | 200m | 257m | -22.2% |

| amazon.fr | 181m | 180m | 0.3% |

| amazon.it | 172m | 161m | 7.1% |

| amazon.es | 160m | 138m | 15.9% |

| amazon.ca | 156m | 117m | 33.8% |

| amazon.com.br | 72m | 51m | 41.1% |

| amazon.com.mx | 50m | 38m | 32.4% |

| amazon.com.au | 26m | 20m | 27.4% |

| amazon.ae | 16m | 14m | 12.5% |

| amazon.nl | 11m | 0.5m | 2,088.7% |

| amazon.com.tr | 10m | 4m | 116.5% |

| amazon.sg | 3m | 2m | 31.0% |

Amazon and some of its rivals operate marketplaces that benefited from the overall growth. Specifically, sellers on Walmart, eBay, Etsy, and Amazon saw a sharp acceleration in sales. Other retailers either do not have a marketplace to augment their assortment or, like Target, the marketplace is tiny.

Two truths are correct at the same time: Amazon did well during the pandemic, and Amazon’s struggles have created an opportunity for others to do well, too. Some of those retailers had difficulties, especially with fulfillment, but as e-commerce leapfrogged a few years in terms of retail market share, a few made it work.