Fewer than 8,000 sellers now generate half of Amazon’s estimated $300 billion in U.S. third-party GMV – roughly 68% of total U.S. GMV – representing just 1.6% of the active seller base. The concentration has intensified dramatically since 2023, when 15,000 sellers drove that same 50% threshold, marking a near-halving in less than three years.

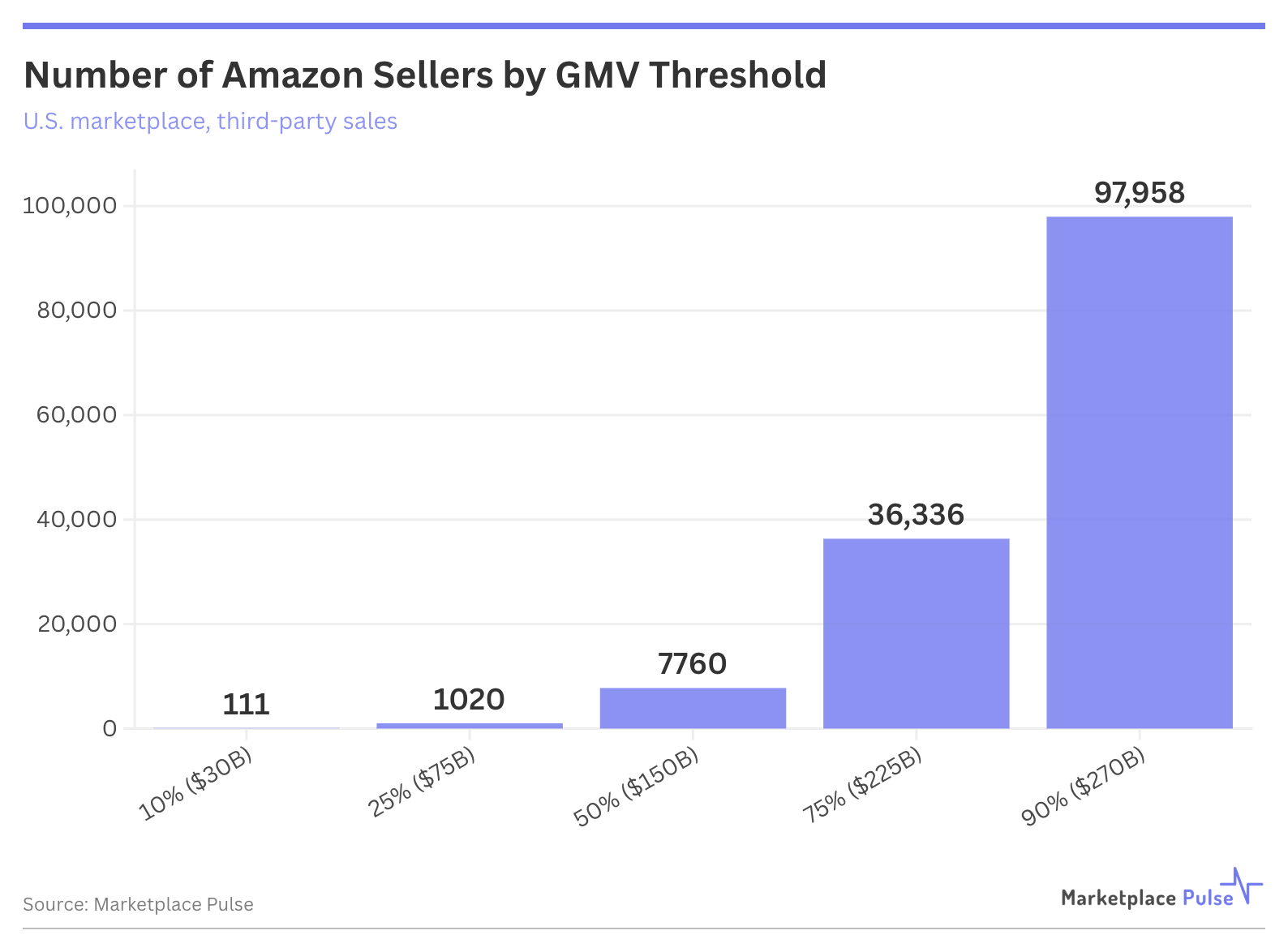

The data reveals concentration that extends across all revenue tiers. According to Marketplace Pulse research, just 111 sellers produce 10% of Amazon’s third-party GMV, while 1,020 sellers account for 25%. The distribution follows Pareto principle-like dynamics where approximately 20% of the active seller base generates 90% of total revenue, while the remaining 10% of GMV spreads across hundreds of thousands of sellers. There are approximately 500,000 active sellers in the U.S. marketplace today, defined as those receiving at least one seller feedback in the past year.

This acceleration reflects the so-called ‘Great Compression’ documented in Marketplace Pulse’s Year in Review, where margin pressure from fees, tariffs, and advertising costs elevated execution requirements. The marketplace increasingly rewards sellers with operational sophistication and capital reserves capable of navigating these complexities.

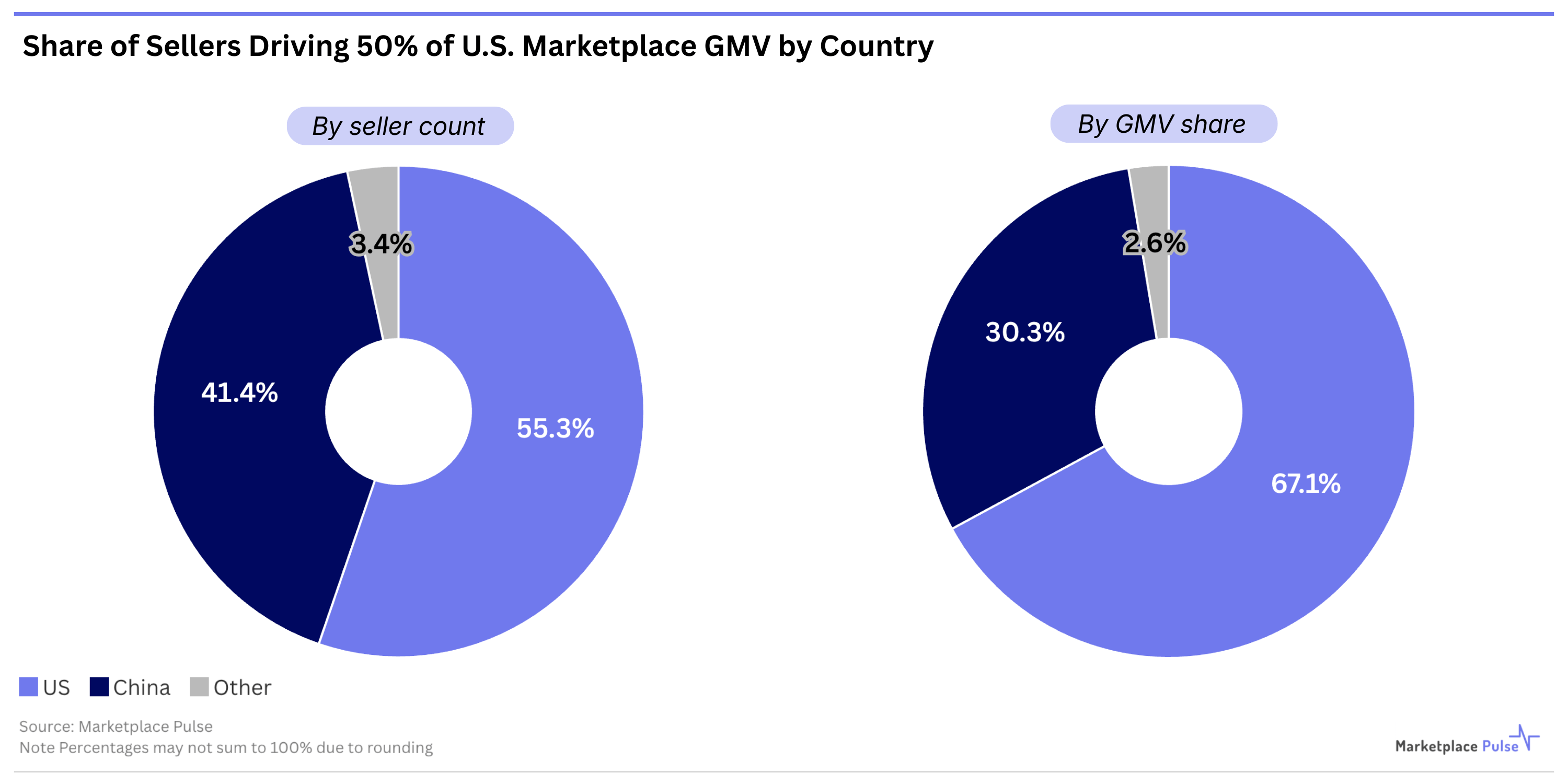

The 7,760 sellers driving 50% of GMV represent a dramatic narrowing from the 15,000 who held that position less than three years ago. The shift reflects top sellers capturing growth disproportionately - while the seller count halved, the GMV at the 50% threshold increased from approximately $115 billion to $150 billion, with average per-seller revenue in this cohort more than doubling to nearly $20 million annually. U.S. sellers dominate at this scale, representing 55% of these top sellers while controlling 67% of their combined GMV. Chinese sellers account for 41% of the cohort but generate 30% of GMV, demonstrating that American sellers maintain significantly higher per-seller revenue at the top end of the marketplace.

Each of the 7,760 sellers generating half of marketplace GMV exceeds $5 million in annual sales – there are approximately 9,000 in the $5m+ tier. Some top sellers surpass $1 billion on the platform, including Woot, an Amazon-owned electronics retailer, and Pattern, the recently IPO’d e-commerce accelerator. The concentration among this cohort of fewer than 8,000 sellers represents the clearest measurement yet of how power-law dynamics have intensified as the marketplace matures.