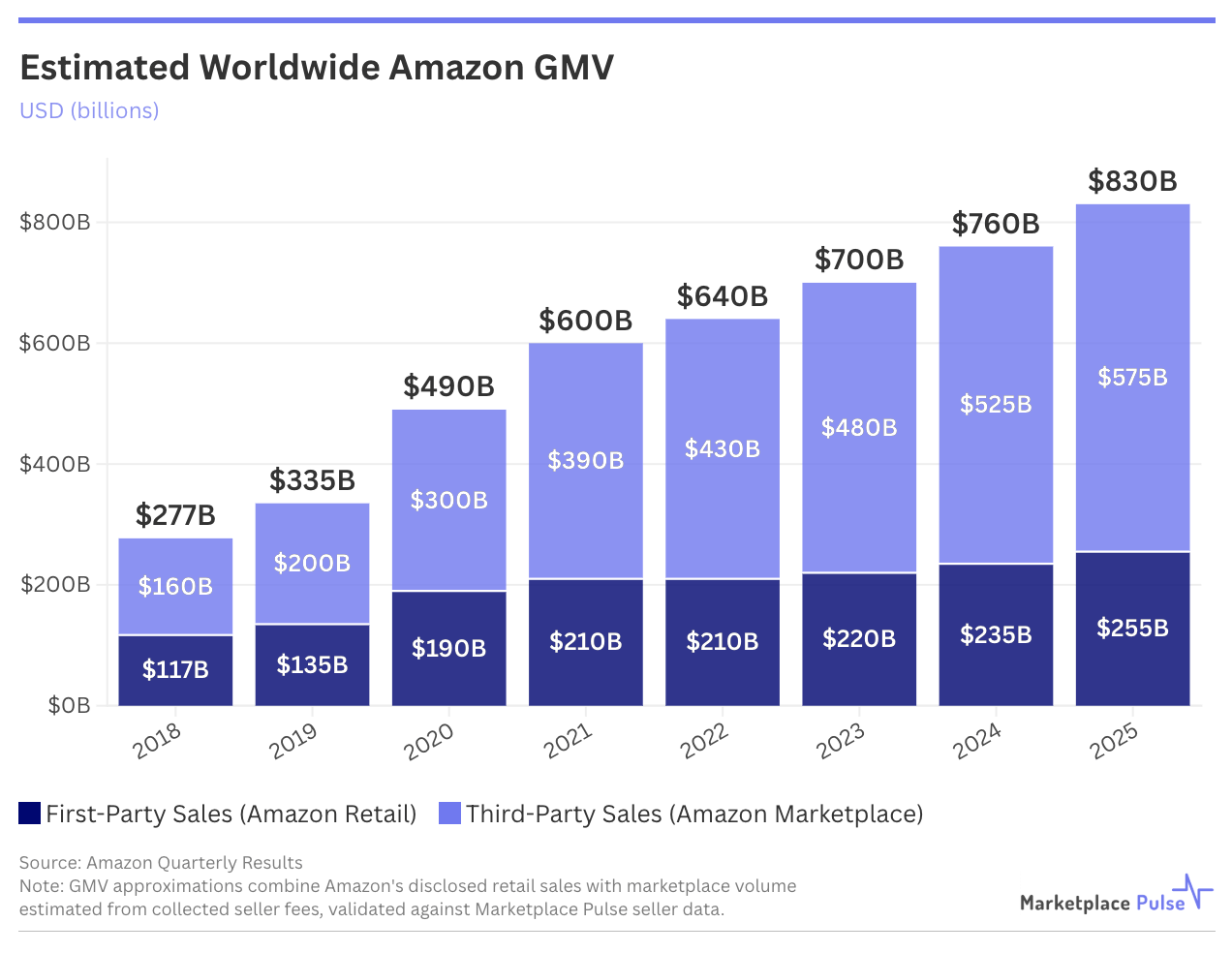

Amazon and its sellers sold $830 billion worth of goods in 2025, tripling its GMV from $277 billion seven years ago.

According to Marketplace Pulse estimates based on Amazon disclosures, first-party sales reached $255 billion and third-party marketplace sales reached $575 billion, with both segments growing at nearly identical 9% rates. This marks a continuation of the 6-10% growth range Amazon has maintained since 2022, returning to steady expansion after the exceptional 46% surge during the 2020 COVID peak.

The third-party marketplace remains the primary growth engine, though its expansion has moderated. Since 2019, sales on Amazon have grown by an estimated $495 billion, with the marketplace responsible for roughly 76% of that incremental GMV. The steady shift from first-party to third-party sales continues – sellers now represent 69% of total GMV, up from 60% in 2019 – but the pace has slowed from the 150 basis points annually that characterized the prior decade to just 20 basis points in 2025.

The deceleration becomes clearer when examining unit share rather than GMV share. Third-party sellers’ portion of total units sold has plateaued at 61-62% for five consecutive quarters, even as their GMV share continued climbing to 69%. This divergence reveals Amazon’s strategic positioning: the company retains control of high-volume, low-price categories – consumables, basics, private label products – while the marketplace handles higher-value goods. Amazon retail generates more transactions but less revenue per unit, while marketplace sellers command better prices on specialized products and branded items. Everyday essentials now represent one out of three units sold in Amazon’s U.S. store and grew nearly twice as fast as all other categories in 2025, underscoring this strategic focus. The gap between unit share (62%) and GMV share (69%) thus represents a structural advantage, allowing Amazon to extract a growing percentage of sellers’ revenue in fees on higher-value transactions while maintaining price leadership on everyday essentials.

Marketplace Pulse estimates that the U.S. accounts for just over 53% of Amazon’s worldwide GMV, putting total U.S. sales at approximately $440 billion in 2025, representing roughly 36% of the total U.S. e-commerce market. Amazon is not just the largest marketplace; it is larger than the next several competitors combined. Yet this dominance comes with maturation. Growth has decelerated from the double-digit rates that characterized the past decade to single digits, reflecting both Amazon’s massive scale and broader e-commerce market dynamics.

Amazon’s 2025 results demonstrate how it maintains dominance by competing simultaneously on price, speed, and discovery. The company invested $200 billion in capital expenditures, primarily in AI infrastructure, while Rufus – its agentic shopping assistant – delivered $12 billion in incremental sales. Amazon expanded Haul to over one million items under $10, directly targeting Shein and Temu’s price positioning, while delivering over 8 billion items same or next day to U.S. Prime members – up more than 30% year-over-year. The dual capability of matching competitors on price while delivering in hours rather than weeks represents a competitive advantage that direct-from-China retailers cannot replicate.

The $830 billion represents not just transaction volume but the infrastructure that enables it: fulfillment networks, advertising systems, seller services, and increasingly, AI-powered discovery. Amazon’s flywheel still spins, constrained only by scale approaching trillion-dollar territory.