Retailers continue to launch marketplaces to fix their lacking online presence by offloading the work to third-party sellers; however, those marketplaces never work.

Marketplaces appear as obvious add-ons for retailers. Most big-box retailers have many visitors to their websites, despite most of their revenue originating in stores. Thus they have the demand side of the two-sided marketplace solved. Adding a marketplace to the retailer’s website allows expanding the catalog with no inventory risk to the retailer, which generates transactional revenue. On paper, this improves customer experience because they have increased selection.

However, most marketplaces launched by retailers fail to generate significant sales volume. Because first, the added selection is often already available elsewhere. Second, that selection expands the long tail but not the head. Third, shipping speed and experience are different. Fourth, customer support is often different too. Fifth, the marketplace doesn’t integrate into store pick up or other store-powered experiences.

For example, in February 2019, Target launched a marketplace called Target+, or Target Plus. It started with 30 merchants. One and a half years later, it has 200. Meanwhile, Target’s online sales grew 141% and 195% in Q1 and Q2, respectively. Most of that growth came from store-powered e-commerce. “Stores enabled more than three-quarters of Target’s digital sales,” said Brian Cornell, CEO at Target, discussing Q2 results. The company added that “More than 90% of our Q2 sales growth involved our stores, whether a guest’s order was purchased at the register, put in their car or shipped from a store.”

Best Buy launched its marketplace in the US in 2011. It shut down in February 2016 for the same reasons other retailers realize now - the inability to offer in-store pickup for third-party items. Jeff Shelman, Best Buy spokesperson at the time, said, “There are two key reasons for the closure: to invest the money the company is spending on supporting the marketplace business into other areas of strategic growth, and customer confusion over marketplace purchases. That confusion stemmed from the inability to offer in-store pickup for items offered for sale by third-party merchants, and from the fact that customers could not return marketplace items to Best Buy’s retail stores.” Unsurprisingly, in Q2 2020, Matt Bilunas, CFO of Best Buy, said, “Buy online and pick up in-store, or curbside, was 41% of online sales.”

Kroger is due to launch a marketplace, adding to its existing Kroger Ship service. Yet for Kroger, the stores are what makes customers shop on Kroger online - Rodney McMullen, the CEO, said, “Kroger began investing in digital several years ago to build a seamless ecosystem that would deliver anything, anytime, anywhere. As a result, we have over 2,100 pickup locations and 2,400 delivery locations, reaching 98% of our customers with a seamless customer experience that combines the best of our physical stores with digital.”

Walmart’s marketplace has been operating since 2009, but it took the company until 2016 to start approaching it as a marketplace rather than a handpicked dropshipping platform. By now, the marketplace has grown to over 55,000 sellers and is the only retailer operated marketplace to achieve scale. However, the company is yet to embrace it fully. For example, it launched a Walmart Plus membership on September 15th, but it doesn’t integrate and thus doesn’t benefit the marketplace. The marketplace will benefit from the residual traffic as more shoppers go to Walmart.com, but the marketplace is not yet part of one cohesive experience.

There were also marketplaces launched by Albertsons, Sears, Newegg, Buy.com, and even J. Crew, Toys R Us, Groupon, Crate and Barrel, and Urban Outfitters. None of those worked.

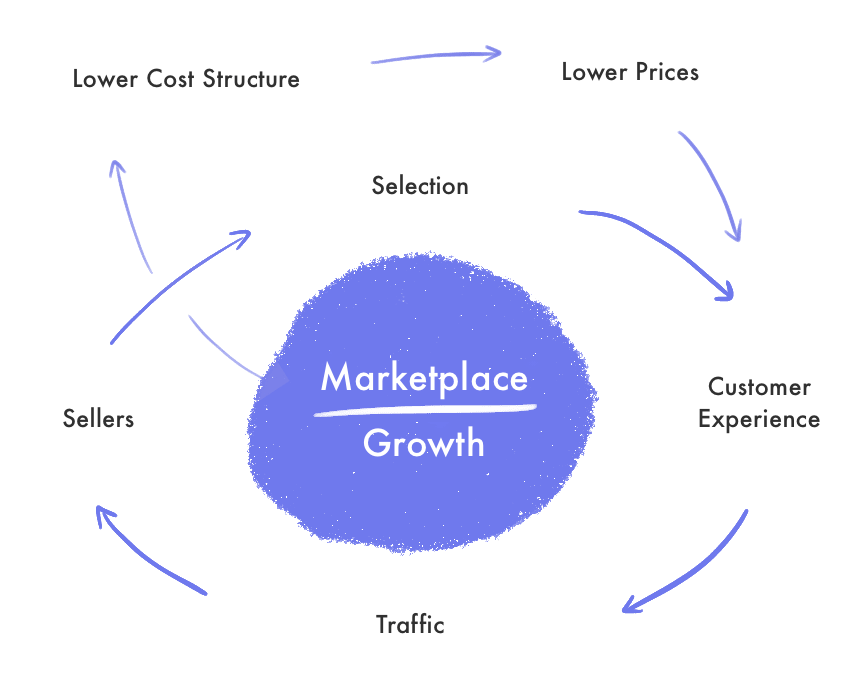

Even though many retailers are looking at the marketplace Amazon built and are hoping to replicate the same, they approach it less as a business model but rather as a risk-free and investment-free way to patch up their struggling online business. Marketplaces need network effects to work and take size to start spinning the flywheel. They are not add-ons, but rather fundamentally different business models. Retailers are trying to benefit from having them while hoping to keep them as one of the dozen options online. Amazon is not a retailer that also happens to run a marketplace.

The size of selection online is not the reason why retailers are struggling to compete against Amazon. Retailers’ problem is that their online experience doesn’t offer the same value proposition as the stores did, such as curation. Retailers that build curated marketplaces, such as Target, that only add a few tens of thousands of products don’t even achieve that. Thus, adding a marketplace solves the wrong problem and leaves the retailer with little potential to acquire new customers.

The first half of 2020 showed that retailers who invested in stores as pick up and delivery points did well. Major retailers like Best Buy, Target, Dicks Sporting Goods, Lowe’s, Home Depot, Kroger, Albertsons, and Walmart grew over 100% in online sales outpacing the overall e-commerce market. Stores are also an asset that pure-play e-commerce companies do not have.

Ultimately, in the world of e-commerce dominated by Amazon, the opportunity is not being more like Amazon. That’s why marketplaces are a solution to the wrong problem. They improve selection, but at best, make the retailer’s website a worse-Amazon. Instead, the opportunity is in differentiation. The strength of retailers is curation and stores.