Despite disruptions to global supply chains and Amazon’s warehouse space restrictions, inventory levels at Amazon warehouses are high. As other retailers are fearing empty shelves, Amazon has turned its vast marketplace into an advantage.

This year, importing goods is considerably slower and more expensive than pre-pandemic. After years of progression towards a just-in-time retail model - low quantity levels in warehouses, frequent imports - the industry had to adjust. Most experts predict it will take until the second quarter of 2022 or later for these slowdowns to recede.

Amazon is additionally playing catch-up since the pandemic started by building warehouses and hiring staff to support the increased demand. Before it gets ahead of that, it has severely limited how much warehouse space it allocates to each seller. The previously infinitely elastic fulfillment service now requires resource planning and third-party temporary storage from sellers.

Both of these suggest that many sellers and brands would be running out of stock by now. Unable to get items imported on time or giving up on orders because of increased freight rates and limited by Amazon’s warehouse space and running out of stock before new inventory could be checked-in. But that hasn’t happened, at least on a macro level.

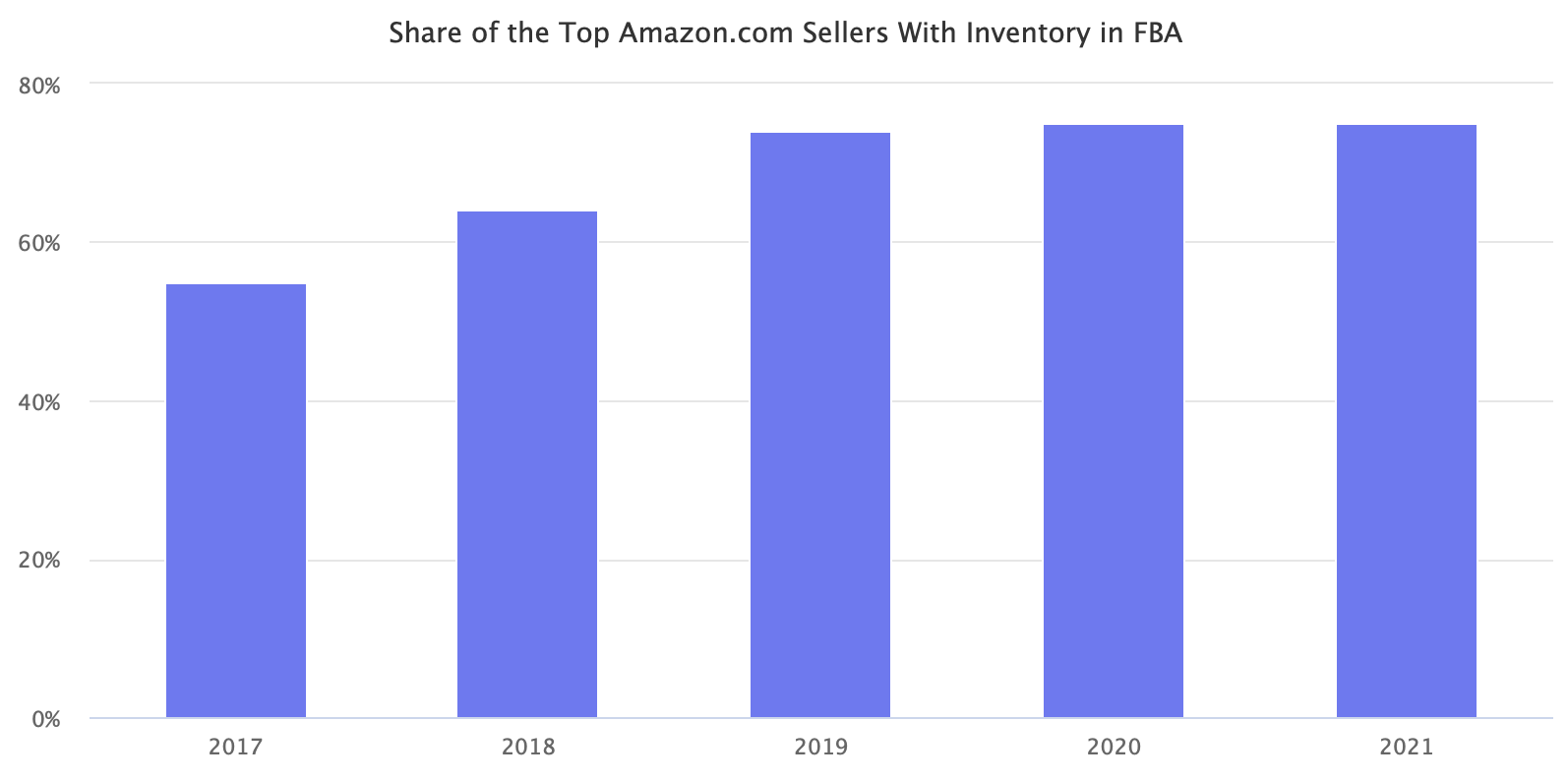

According to Marketplace Pulse research, 75% of the top 100,000 sellers on Amazon.com have most of their inventory stored in FBA. At this time last year, the figure was also 75%. Across a large enough sample of businesses, all the supply chain issues had practically no impact.

The Prime availability index of the top sellers acts as an indicator for the overall Prime-enabled catalog. Last year, from May to July, a twelve-month low of the top Amazon sellers offered Prime shipping for most of their catalog. At the time, the Prime assortment had decreased because, on March 17th, 2020, Amazon started prioritizing the stocking of household staples and medical supplies.

Over the next sixty days - until holiday shopping is over - that vast number of sellers with Prime shipping enabled because of FBA will keep Amazon’s shelves stocked. That’s not to say that those headwinds didn’t have an effect, however. Many sellers had to increase prices to account for increased costs. Some that sell large items like furniture had to give up on purchase orders because their unit economics didn’t work anymore. And plenty more could be selling more if Amazon allocated them more warehouse space.

But since many sellers compete with hundreds or more selling similar items, shoppers likely won’t notice if any of them are out of stock. On the other hand, retailers that compete with Amazon and rely on a significantly smaller set of suppliers will have more difficulty staying in stock. Many of them are signaling to shoppers to start holiday shopping earlier. The thirty days that follow Black Friday will be won by those that kept warehouses stocked.