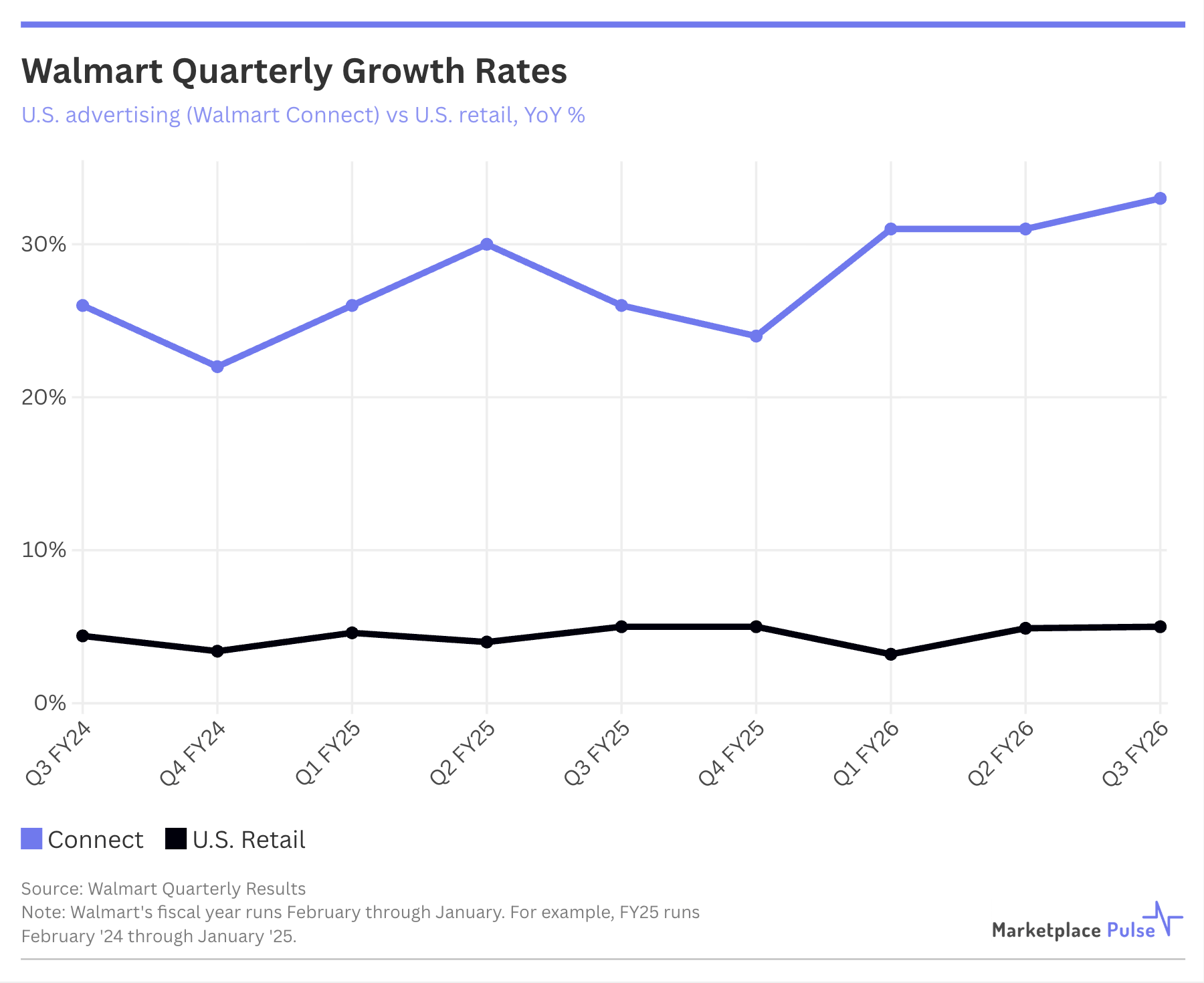

Walmart’s advertising business is growing at six times the rate of its overall retail sales. Walmart Connect, the company’s U.S. retail media platform where sellers and brands buy sponsored placements, grew 33% in the third quarter while U.S. retail sales grew just 5%. This isn’t a one-quarter anomaly either. Advertising has outpaced sales growth every single quarter since the company started reporting advertising metrics in the third quarter of fiscal 2023.

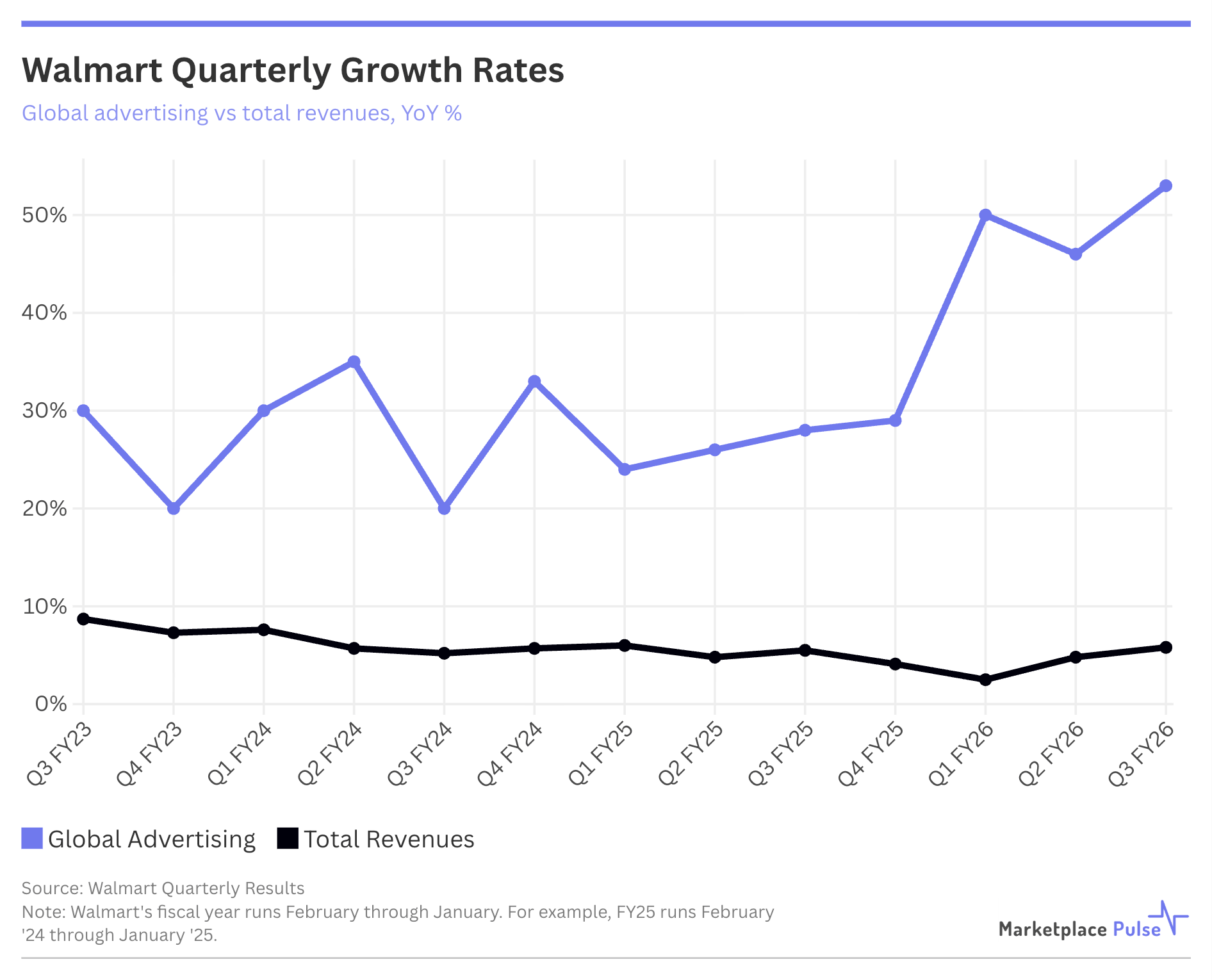

Walmart reports quarterly advertising growth rates but only annual revenue figures, making direct dollar comparisons difficult. The company consistently discloses two metrics: global advertising growth, which includes its international operations and the recently acquired TV manufacturer VIZIO, and Walmart Connect specifically, which represents the U.S. retail media business where marketplace sellers compete for visibility. Walmart Connect is the relevant metric for understanding what sellers face, and over the past nine quarters, when it has been consistently disclosed, it has grown between 22% and 33% – consistently outpacing both retail sales growth and e-commerce growth of 17% to 28% in those same periods.

The gap between advertising and underlying business growth reveals what’s actually happening: Walmart isn’t just riding e-commerce expansion. It’s extracting more revenue from existing traffic by selling more screen real estate to advertisers. Even looking at the broadest measure – global advertising growth against total company revenue – the disparity is stark. In the first quarter of fiscal 2026 (Walmart’s fiscal year runs February through January), global advertising grew 50% while total revenue grew just 2.5%, a 20x multiple that underscores how advertising has become a profit engine independent of overall business growth.

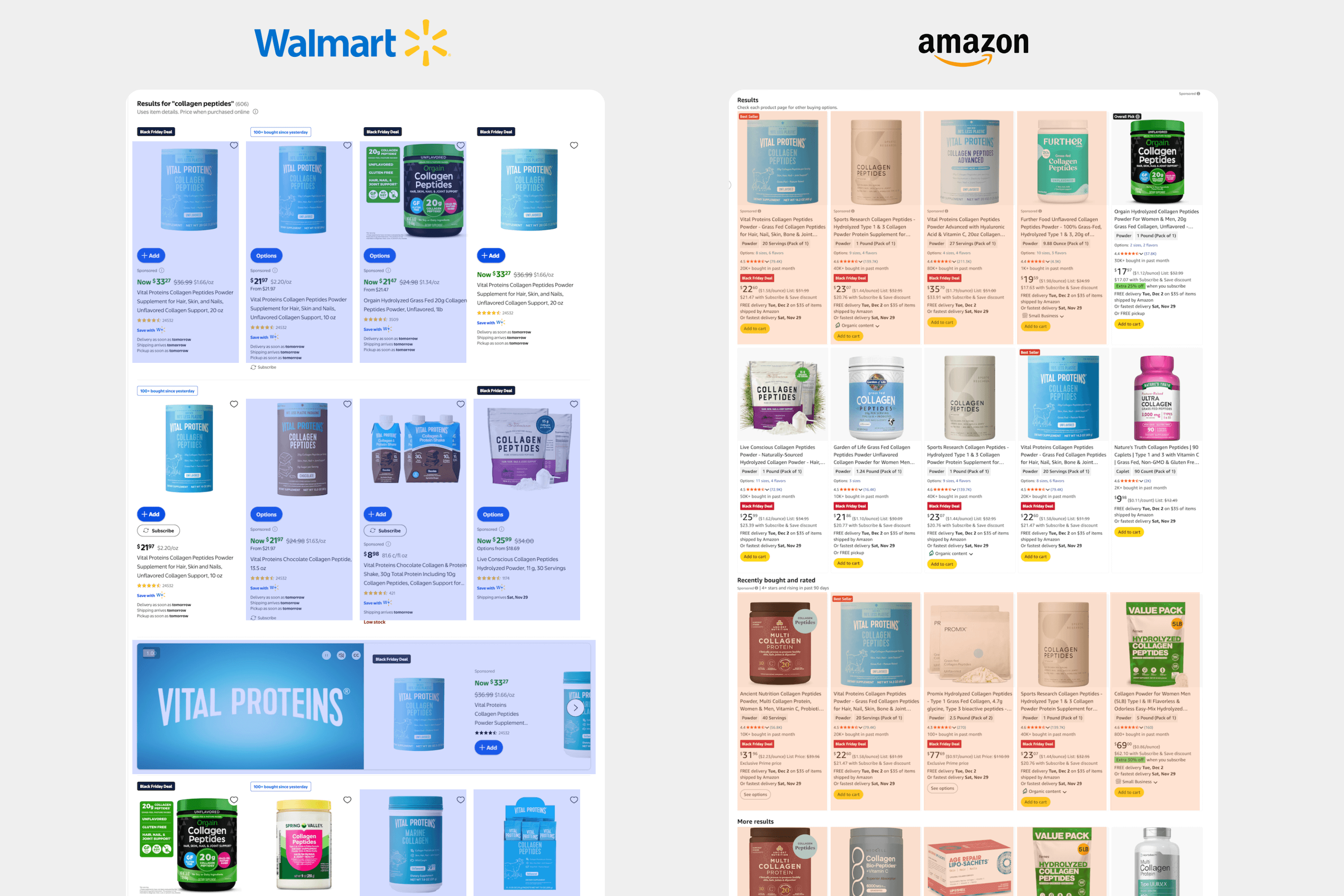

In 2019, Walmart’s e-commerce chief Marc Lore drew a distinction with Amazon, telling a conference audience, “You’ll notice that we don’t sell the No. 1, 2 slots in search – like some of our competitors do.” That positioning appears to have evaporated. Walmart’s search results now routinely lead with sponsored listings, pushing organic results down the page. A search for “collagen peptides” returns 12 sponsored placements in the first 20 results on Walmart; Amazon shows 13 out of 20 for the same query.

The transformation mirrors Amazon’s trajectory, where advertising now represents almost 10% of total revenue. Walmart isn’t quite there yet – its advertising business generated $4.4 billion in fiscal 2025, just 0.65% of its $681 billion in revenue – but Walmart’s CFO John David Rainey noted in 2024 that advertising had grown to nearly one-third of the company’s operating income – a stunning figure for a business that didn’t exist as a meaningful revenue stream five years ago. Like Amazon, where total fees now exceed 50% of seller revenue, Walmart is demonstrating that high-margin advertising can subsidize lower-margin retail operations.

For the 200,000-plus active sellers on Walmart’s marketplace, the math is straightforward: advertising is becoming mandatory, not optional. When ads grow six times faster than sales, it means sellers are paying more for the same visibility. Walmart isn’t inventing this playbook – it’s following the path Amazon paved, where organic search results gave way to paid placements years ago. The difference is that sellers once viewed Walmart as the lower-cost alternative. That gap is closing.