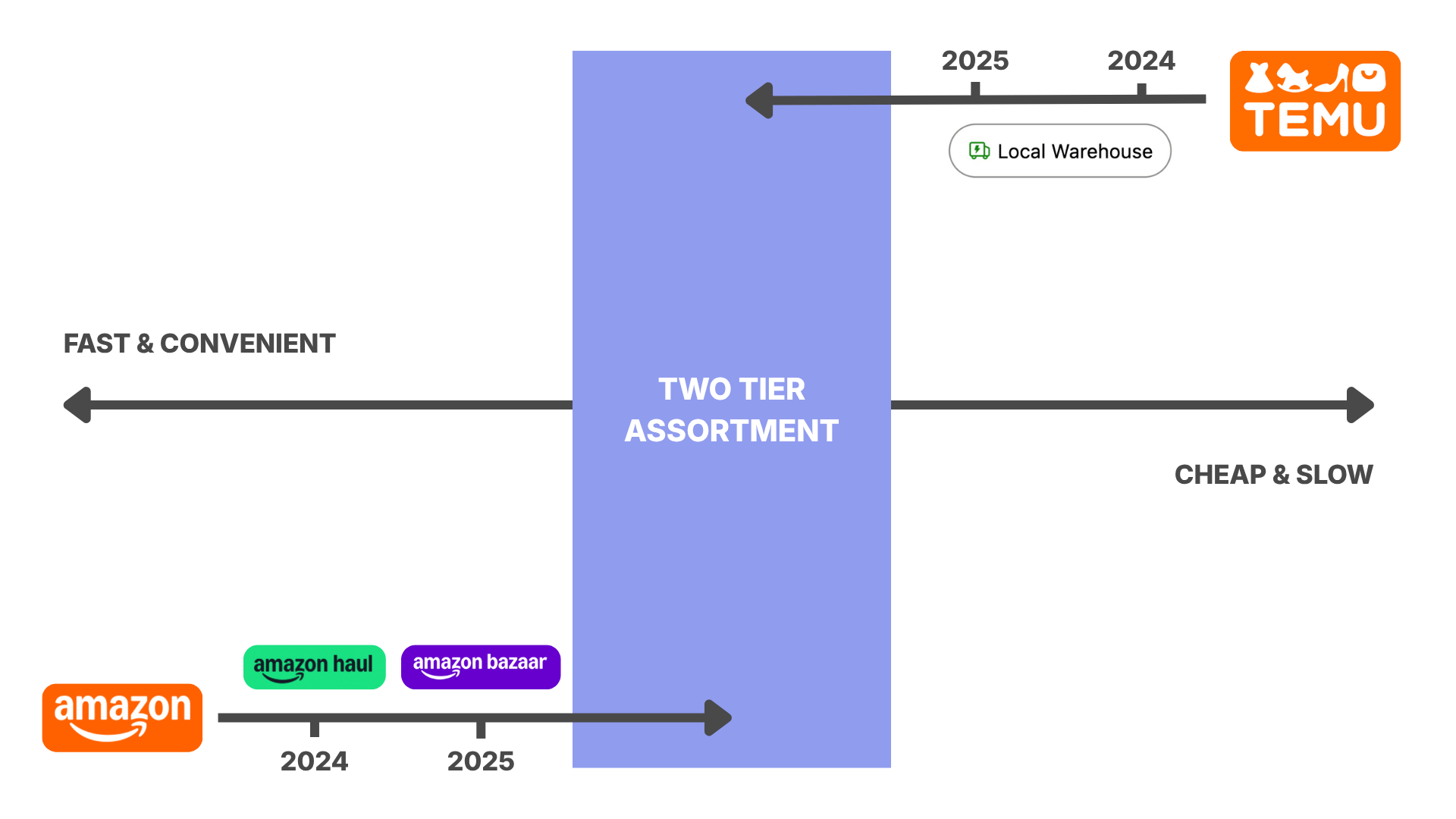

Just two years ago, the battle lines in e-commerce seemed clear. Amazon dominated through speed and convenience, built on decades and billions invested in domestic fulfillment. Temu and Shein disrupted through price, shipping directly from Chinese factories to exploit the $800 de minimis duty exemption. Today, both sides are sprinting toward what the other perfected, driven by evolving regulations worldwide and the realization that modern retail demands supply chain flexibility, not purity.

Temu’s transformation has been dramatic. In July 2024, 20% of its U.S. sales came from local warehouses – up from zero at the start of that year. That acceleration continues, with Temu targeting 50% local-to-local sales in the UK by the end of 2025 and aiming for 80% of European sales through local warehouses – suggesting similar ambitions for the U.S. Some Temu orders now arrive within two days rather than the weeks-long waits that defined its early reputation. The shift continues globally – Temu recently launched invitation-only local seller programs in Turkey, offering next-day delivery, while partnering with fulfillment providers like WINIT and Easy Export to handle domestic inventory without building its own warehouse network.

The strategy is attracting U.S. sellers. PopMarket, a novelty and collectibles brand, reports Temu is now its fastest-growing sales channel after joining in late 2024, with sales accelerating in March 2025. “There is a group of shoppers [who] want to be on Temu, that’s where they want to be to find stuff. And [we] will put our products in the place where the customer sees it,” said Tim Hinsley, SVP at PopMarket’s publicly-traded parent company Alliance Entertainment. Shein followed a similar path with its QuickShip option, importing best-sellers in bulk for faster delivery. At the same time, TikTok Shop continues to build fulfillment infrastructure with its Fulfilled by TikTok service expanding globally, regularly hiring for new logistics roles.

Amazon’s response shows equal commitment to the opposite direction. Two weeks ago, it launched Amazon Bazaar – a standalone app extending its Haul (mostly) direct-from-China experience to 14 additional countries, including Hong Kong, the Philippines, Peru, Nigeria, and several Middle Eastern nations. Combined with Haul’s presence in the U.S., UK, Germany, France, Italy, Spain, Japan, and Australia, Amazon’s low-price, slow-shipping model now spans over 25 markets. The platform ships directly from Chinese warehouses, offering items under $20 with delivery in two weeks or less. Before Amazon stopped including Haul information on product pages in May, Marketplace Pulse research showed Haul items fluctuating between 5-15% of Amazon.com’s top 100 bestseller lists, up from just 1-2% in the weeks following its launch. The global Bazaar expansion signals this isn’t an experiment Amazon plans to abandon.

The convergence is driven by regulatory and market realities. Direct-from-China enables lower prices through lean, on-demand production that wholesale imports cannot match, while local fulfillment provides speed and access to larger product categories. The elimination of the de minimis exemption accelerated this shift. The U.S. suspended its $800 threshold for Chinese imports in May 2025, forcing Temu and Shein to raise prices and restructure operations. Europe now follows – the EU agreed last week to end its €150 customs duty exemption, implementing an interim framework in 2026 before complete elimination in 2028 when its Customs Data Hub launches. With duty-free direct shipping disappearing, platforms must offer compelling reasons beyond just price to ship from abroad.

The result is two-tier assortment strategies. Temu and Shein maintain direct-from-China inventory for price-sensitive products while adding local fulfillment for speed and expanded categories. Amazon keeps FBA’s dominance while testing direct-from-China through Haul and Bazaar for ultra-low-price goods. Even TikTok Shop, which doesn’t depend on either model since content drives its sales, recognizes that fulfillment speed matters for sustainable growth.

Neither side abandons its core model – Amazon’s main quest remains Prime while Temu isn’t abandoning direct-from-China. But both admit that e-commerce is no longer one-dimensional. Logistics are as much a part of the product as the products themselves, and the winning platforms will be those that master both fast-and-convenient and cheap-but-slower simultaneously without sacrificing what made them successful in the first place.