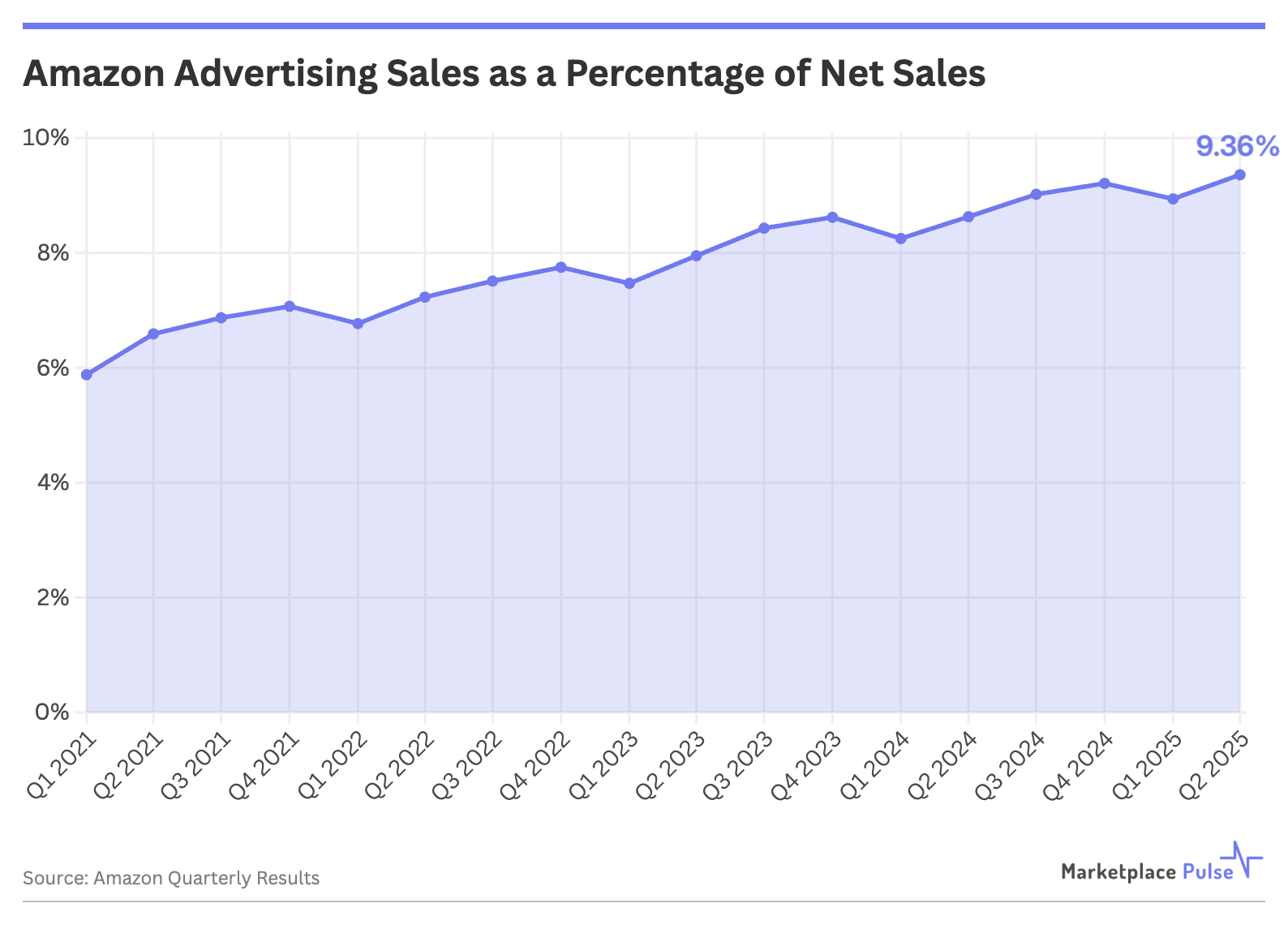

Amazon’s advertising business hit another milestone in Q2 2025, capturing 9.36% of the company’s total revenue – the highest share ever recorded. At $15.69 billion in quarterly revenue, advertising continues to be Amazon’s fastest-growing segment, and at its current trajectory, could breach the symbolic 10% threshold as soon as this year.

The progression is both predictable and remarkable. Since Q1 2021, when advertising represented just 5.88% of revenue, Amazon has systematically transformed every corner of its platform into paid inventory. The vast majority of its advertising revenue comes from in-search advertising, where search results have become an increasingly ad-saturated experience with fewer and fewer organic results visible amidst the myriad of paid placements over time.

Yet Amazon’s advertising ambitions extend far beyond stuffing more ads into search results. As the company noted in its Q2 earnings call, the advertising network now reaches “an average ad support audience of more than 300 million across our own properties” in the U.S. alone, spanning Prime Video, Twitch, Fire TV, live sports, and third-party websites. Recent partnerships with Roku and Disney’s real-time ad exchange demonstrate further how Amazon sees off-platform growth as vital to its continued advertising success.

The numbers dwarf historical context: Amazon made more in advertising during Q2 2025 ($15.69 billion) than its entire revenue in Q2 2012 ($12.83 billion). The trailing twelve months of advertising income now exceeds Amazon’s total 2012 revenue, illustrating the transformation from online bookstore to advertising behemoth.

This growth comes with both cost and opportunity for sellers. A growing reliance on advertising for visibility pushes customer acquisition costs ever-higher, and for many sellers, total Amazon fees now exceed 50% of revenue. Yet the expanding reach presents opportunities to access significantly larger audiences from the same, mostly stable advertising platform, particularly as Amazon ventures further into connected TV and off-platform inventory.

While key rivals Google and Meta still command larger absolute advertising revenues, Amazon’s quarterly growth rates frequently outpace both. In Q2 2025, Amazon’s 22% advertising growth maintained its position as the company’s fastest-growing segment for the second consecutive quarter, and fourth time in the past six quarters. Only AWS comes close to matching this consistency.

The broader context re-emphasizes Amazon’s strategic evolution. Services income – advertising, third-party seller services, subscription services, and AWS – now constitute almost 60% of Amazon’s income, up from 50% in 2021. As Amazon steadily and purposefully shifts from retailer to infrastructure provider, advertising revenue has become essential to subsidizing the rest of the retail operation.

Without the high-margin advertising revenue, Amazon’s retail business would be increasingly unprofitable. This dependency makes the trajectory toward 10% of revenue not just likely, but necessary for Amazon’s long-term retail strategy.

Amazon’s advertising business will exceed $60 billion in 2025 – a figure that will place it among the world’s largest media companies by revenue. For sellers, this means navigating an increasingly pay-to-play environment. For Amazon, it represents the transformation into what it has long aspired to be: not just a retailer, but the infrastructure powering commerce itself.