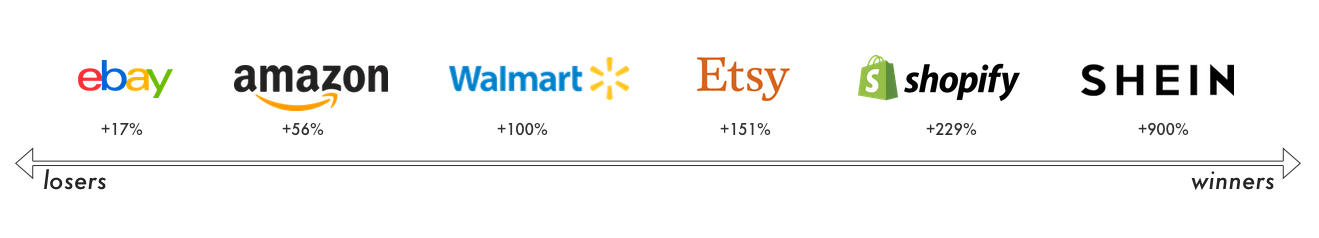

Shein and Shopify were the biggest e-commerce winners in 2022. Their sales are still significantly above pre-pandemic levels too. Etsy was strong, Walmart with Amazon did okay, and eBay struggled the most.

U.S. e-commerce grew 8% in 2022 - the slowest growth in over a decade. Adjusted for inflation, it likely didn’t grow at all. But it reached $1 trillion in yearly sales and is still up 81% from 2019. The last few years have been challenging to compare growth for because an exceptional year (2020) was followed by uncertainty and challenged supply chains (2021) which led to e-commerce spending continuing to reset (2022). Thus, it is perhaps best to consider three-year growth, comparing the pre-pandemic 2019 to 2022.

Shein’s global GMV grew 50% in 2022 to reach $30 billion, and in just three years, it is now more than ten times larger than its 2019 sales. In internal documents reviewed by the Financial Times, Shein projects $80 billion in GMV in 2025 (then, it will be bigger than eBay). A big part of that will surely be its upcoming marketplace in the U.S.

Shopify’s global GMV grew 12% in 2022. More significantly, it has grown 229% since 2019. Some of that growth has come from new merchants joining Shopify. Nevertheless, its growth indicates the readiness of brands to sell directly to consumers and their willingness to buy from those brands.

Etsy’s global GMV shrank by 3% to $11.8 billion in 2022. But it is still up 151% from the pre-pandemic 2019. Behind that growth, it has more than doubled the number of active sellers and buyers on the platform. Etsy’s GMV has the most visible step-change.

Walmart’s e-commerce sales in the U.S. grew by 12% in 2022; globally, its e-commerce business is now $80 billion, most of which is in the U.S. Walmart’s e-commerce GMV is more than double its 2019 size, accelerated by its online grocery business. During the last three years, the company expanded its advertising platform, doubled down on its marketplace, and pushed sellers to use its fulfillment service.

Amazon’s global first-party (1P) sales were flat in 2022. However, they were still up 56% from 2019 and even more in the U.S. The company doesn’t report total GMV nor breaks out third-party (3P) marketplace sales, but they likely grew more than Amazon’s 1P business. Ultimately, Amazon is both driving e-commerce adoption and failing to grow when consumers return to shopping in stores.

eBay’s GMV in the U.S. decreased 11% in 2022, down to $35.9 billion from $40.1 billion in 2021. Its GMV in the U.S. was still up 17% compared to 2019. Globally, eBay’s GMV was down 15% on an as-reported basis and 11% on an FX-neutral basis. Its global GMV is only slightly above 2019 levels.

| Company | 2022 vs. 2021 | 2022 vs. 2019 |

|---|---|---|

| Shein (global GMV) | 50% | 900% |

| Shopify (global GMV) | 12% | 229% |

| Etsy (global GMV) | -3% | 151% |

| Walmart (U.S. online sales) | 12% | 100% |

| U.S. E-commerce | 8% | 81% |

| Amazon (global 1P online sales) | 0% | 56% |

| eBay (U.S. GMV) | -11% | 17% |

Each of the six companies represents a unique market position, growth, and competition case study. Crucially, their competition is not a strict zero-sum game; many shoppers use more than one.