OpenAI’s Instant Checkout feature turns ChatGPT into a direct and instant threat to Amazon’s most profitable business segment. With 700 million weekly active users generating an estimated 75.6 million product-related conversations per week, ChatGPT becomes a marketplace with nearly 4 billion annual product queries, and thus inevitably, a billion-dollar GMV almost overnight.

However, transaction volume overlooks a bigger threat. Amazon sellers paid $56.2 billion in advertising in 2024, and the global adoption of ChatGPT offers sellers something Amazon stopped providing years ago: organic, unpaid product discovery.

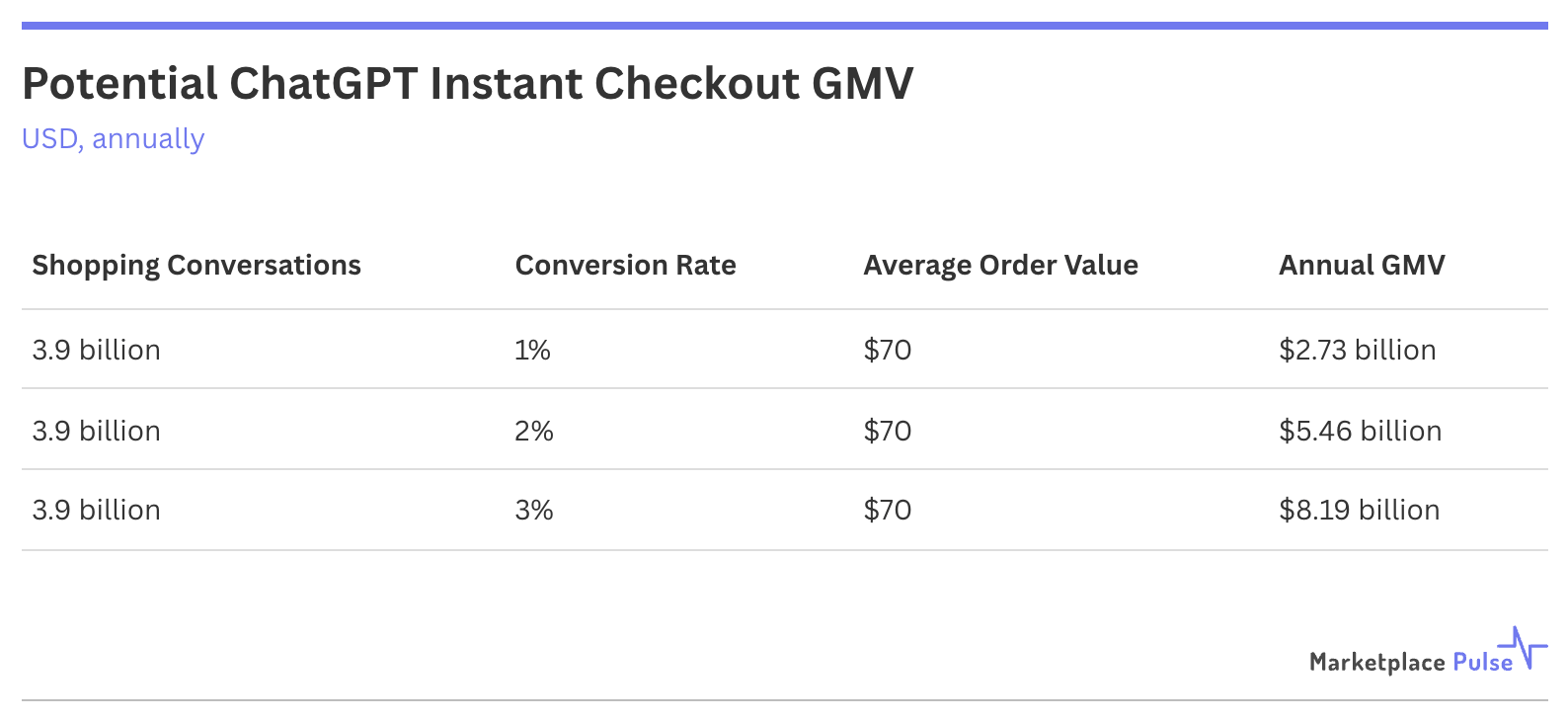

OpenAI research shows 2.1% of ChatGPT conversations involve purchasable products. Using the paper’s methodology of approximately five messages per conversation, with 18 billion messages sent weekly, this translates to 75.6 million weekly shopping conversations or 3.9 billion annual product queries. Even modest conversion assumptions – just 2% of product conversations resulting in purchases with an average order value of $70 – would generate $5.5 billion in annual GMV, roughly half of Etsy’s global marketplace.

To ensure supply meets the demand, OpenAI announced integrations with Etsy and “over 1 million Shopify merchants coming soon,” including Glossier, Skims, Spanx, and Vuori. That’s hundreds of millions of products instantly available for discovery. Shopify’s integration feeds real-time pricing, inventory, images, and variants directly into ChatGPT, making its merchant catalog searchable through conversational queries rather than keyword matching. For sellers, this represents fundamentally different discovery mechanics where shoppers can describe specific needs in multiple sentences, adding context that keyword searches can’t capture.

The timing amplifies the threat. Amazon’s advertising business reached 9.36% of total revenue in Q2 2025, its highest share ever, and its most profitable segment. The business model depends on scarcity: limited screen space forces sellers to pay for visibility. ChatGPT’s conversational format changes the economics. Where Amazon search rewards keyword optimization and bidding, chat-based shopping enables contextual queries. A shopper describing specific needs across multiple sentences surfaces niche products unreachable through keyword matching. This benefits both shoppers, by helping them find more relevant products, and sellers, by allowing their unique product solutions to gain discovery without ad spend – at least not yet.

Because, perhaps more significantly, OpenAI also benefits by training advertising algorithms on billions of preference-rich conversations – detailed context that keyword searches never capture. While the Instant Checkout release documentation notes a “small fee” akin to Amazon’s referral fee on completion of a successful sale, the advertising opportunities for OpenAI are vastly more economically meaningful.

The near-term GMV impact will be modest – even a highly optimistic 5% conversion rate yields just $14.7 billion annually, compared to Amazon’s third-party GMV that Marketplace Pulse estimates to be approaching $600 billion globally. However, Amazon has been building its third-party marketplace for 25 years and its highly profitable advertising business for over a decade. In contrast, OpenAI becomes a direct competitor and a not-insignificant threat almost overnight.

Stripe CEO Patrick Collison said in announcing its partnership with OpenAI, “It’s clear that internet purchasing modalities are going to change a lot.” The $56.2 billion Amazon sellers paid for advertising in 2024 funded a model where merchants buy placement. ChatGPT is now promising to offer the alternative Amazon eliminated: organic discovery at scale.