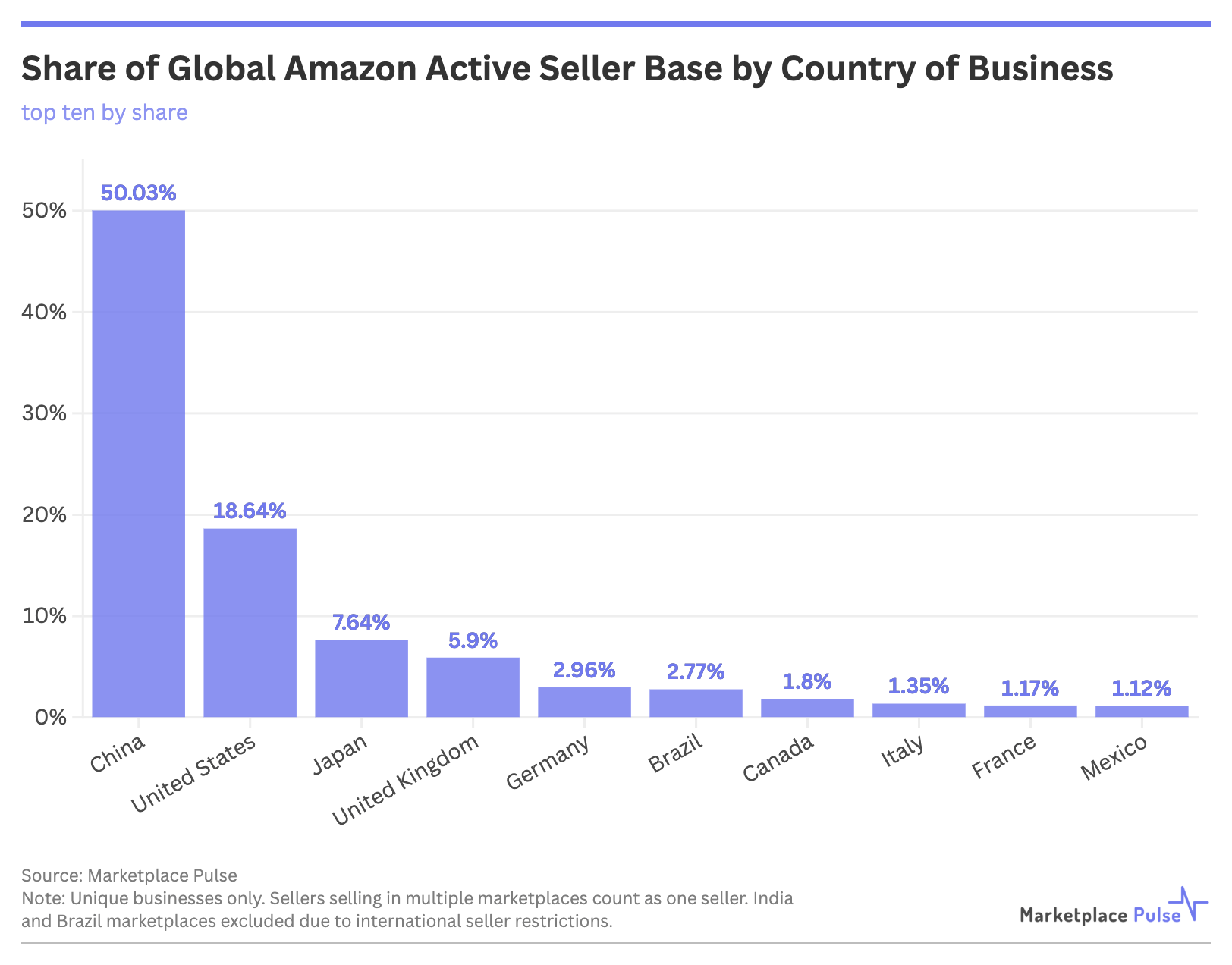

Chinese sellers now represent 50.03% of Amazon’s global active seller base, marking the first time they’ve crossed the 50% threshold across all of Amazon’s international marketplaces. But while Chinese sellers have won the numbers game, American sellers maintain an edge in revenue generation.

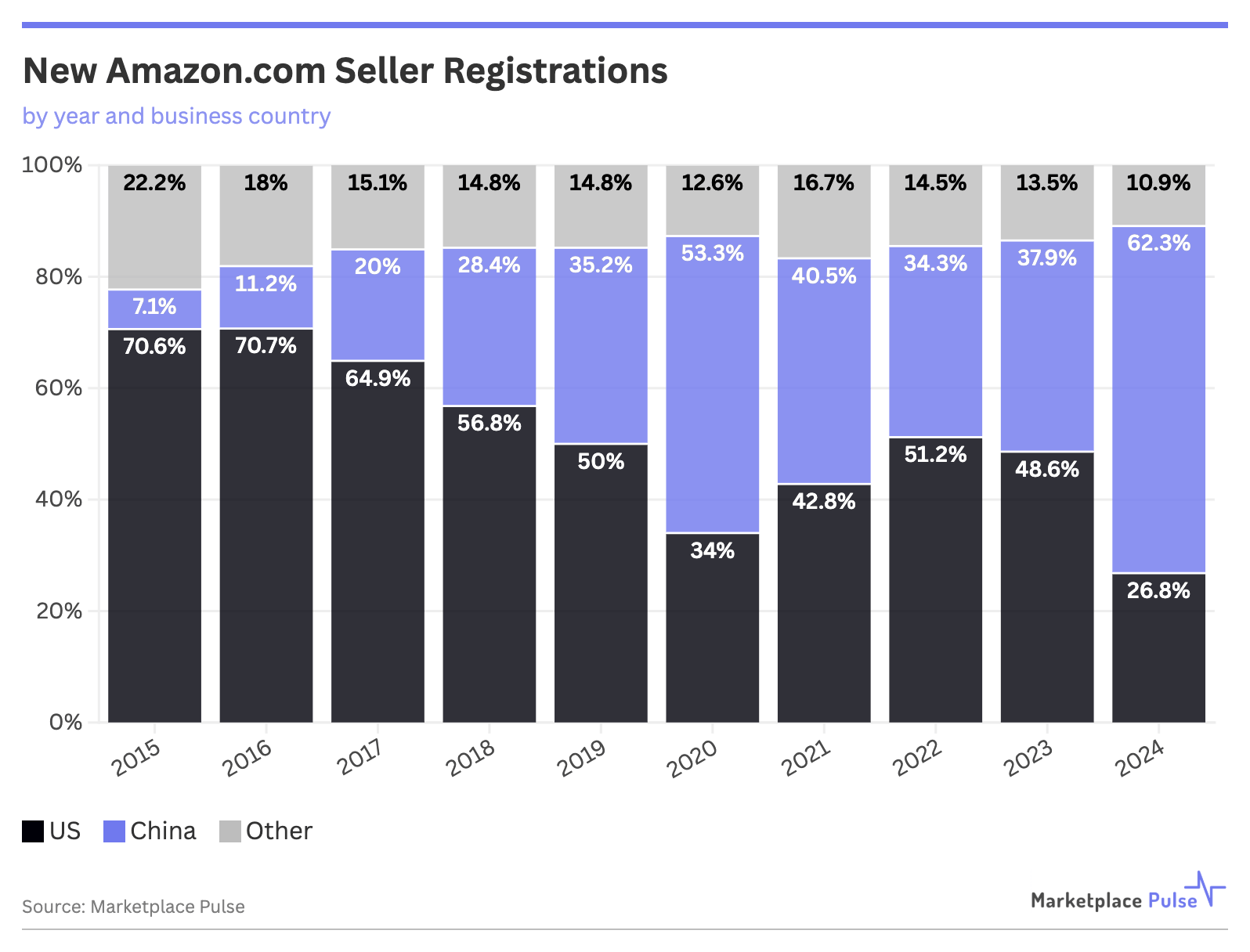

The milestone reflects a decade-long trend that started with Chinese sellers accounting for just 7.1% of new registrations on Amazon.com in 2015, compared to 70.6% from the United States. By 2024, Marketplace Pulse data indicates that these figures had almost completely reversed, with Chinese sellers comprising 62.3% of new registrations, while American sellers had fallen to 26.8%.

This global majority extends a pattern that began in the United States, where Chinese sellers surpassed 50% market share earlier this year. Now that dominance spans Amazon’s entire international footprint, with Chinese sellers holding the largest share in every major marketplace except Japan.

The growth persists despite mounting trade tensions, driven partly by how AI tooling has leveled the playing field for international sellers. Previously, Chinese sellers’ biggest weakness was creating listings and imagery that resonated with local buyers. Now, AI handles translation, optimization, and even cultural adaptation at scale. Amazon’s own recently improved AI capabilities, including Creator Studio for professional content creation, have removed barriers that once favored native speakers.

This technological democratization complements traditional Chinese advantages, including proximity to manufacturing, direct relationships with manufacturers that eliminate middlemen, and government export subsidies. The result is a seller base that can offer lower prices while maintaining its margins – a combination that has proven irresistible to price-conscious consumers globally.

As Chinese sellers achieve global majority status on the world’s largest marketplace, they’re reshaping international e-commerce norms around pricing, fulfillment, and customer expectations.

For American sellers, like other local sellers, the path forward requires acknowledging that the marketplace they once dominated has undergone a fundamental change. Yet while Chinese sellers now outnumber American ones, the economics tell a more nuanced story.

According to Marketplace Pulse estimates, US sellers account for approximately $157 billion of Amazon.com’s $305 billion in third-party GMV, compared to $132 billion for Chinese sellers. The average US seller generates $884,958 in revenue, more than double that of their Chinese counterparts at $393,557. Globally, the pattern holds – Marketplace Pulse estimates Chinese sellers capture just 39% of third-party revenue worldwide, despite a majority seller share.

While the Chinese seller share continues to increase, revenue generation retains a more balanced outlook. For that balance to continue, local sellers must continue to adapt by leveraging the same tools that have empowered Chinese sellers, improving operational efficiency to compete on cost, and finding differentiation beyond just geography that justifies premium positioning.