Amazon doesn’t sell goods. It sells goods that ship in one to two days and, for some shoppers, same-day. The logistics are as much part of the product as the products themselves.

Amazon has spent the last two decades building warehouses and investing in fulfillment infrastructure to deliver more goods to more zip codes faster. It has trained shoppers that infinite selection combined with fast delivery is the model for online shopping. Fulfillment is not the cost center or unavoidable business unit - it is what Amazon sells. Amazon’s biggest competitors, like Walmart, have spent most of the last ten years trying to replicate the same. There is no path to offer the same selection nationwide with 15min delivery, but next-day or same-day shipping is virtually “now.”

Amazon’s two recent competitors making the most noise - China’s Shein and Temu - chose a different product to focus on than “now.” Shein’s differentiator is its ability to invent new clothing designs daily and have them for sale immediately. Temu has many of the same products sold on Amazon but sells them for significantly less.

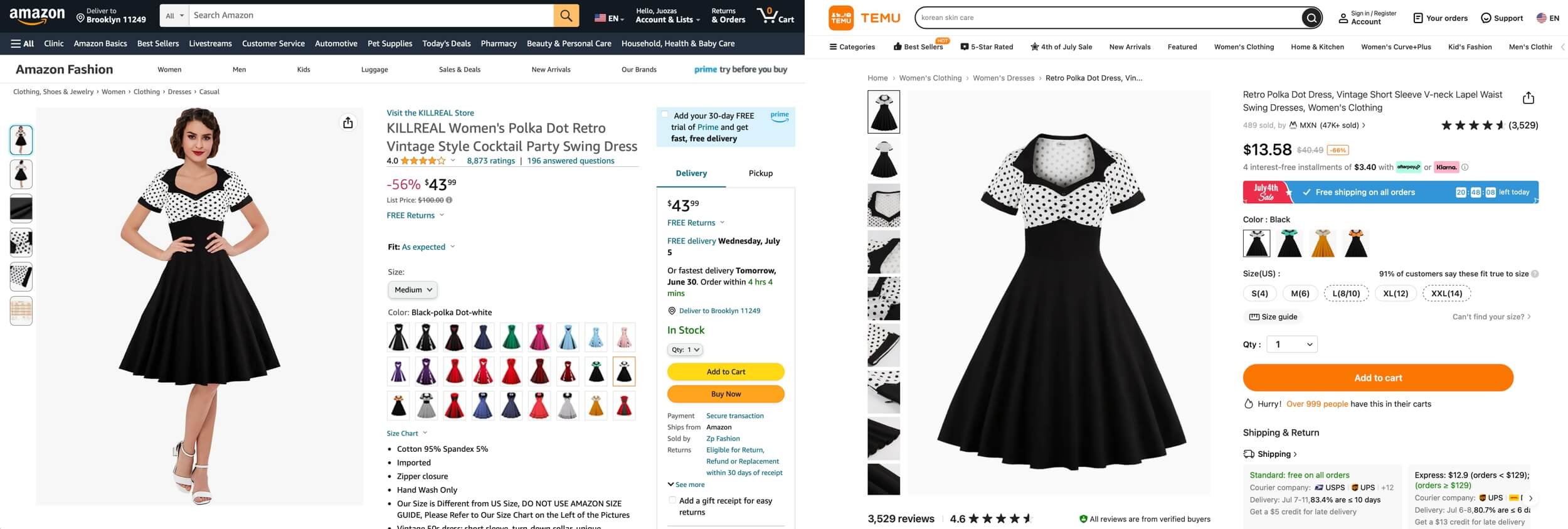

The same retro polka dress is $43.99 on Amazon with one-day delivery in New York City, but only $13.58 on Temu with shipping that will take at least a week. Amazon’s fast delivery speed is not the only reason, as there is more nuance to this and likely subsidization too. However, without offering fast shipping, Temu can offer prices Amazon can’t match - Amazon sells products and fast shipping; Temu sells products and slow shipping.

Every product on Amazon has the fulfillment cost priced in. Because of Amazon’s scale and investments, its costs to warehouse and deliver most products are likely lower than the competition. However, the costs are higher than the competition’s if they ship slower or don’t first warehouse the goods in the U.S. Hence, sometimes there are cheaper options than Amazon. But Amazon’s bet is that most shoppers prefer to get it fast.

Most shoppers will not revert to slower shopping for lower prices, but this highlights Amazon’s single-minded offering. Shein and Temu are the only competitors it can’t directly compete with because Amazon could offer the same selection, but it couldn’t match the low prices of Temu or the fast-iteration of designs of Shein. Yet, those are edge cases.

“Amazon sells anything that can be stored on a shelf in a vast warehouse and shipped in a cardboard box,” wrote analyst Benedict Evans. That could be expanded to: Amazon only sells anything that can be stored on a shelf in a vast warehouse and shipped in a cardboard box nationwide in one to two days. As long as shopping fits into that model, Amazon is unbeatable. But when it doesn’t, the competition can offer something it can’t. Unfortunately for them, that space is relatively small (but not non-existent).

Many of the same goods can be bought on Amazon, eBay, Temu, Costco, Walmart, and DTC websites. But while the underlying physical product is the same, the discovery process, buying experience, and delivery speed differ. They all sell the same goods but not the same product.