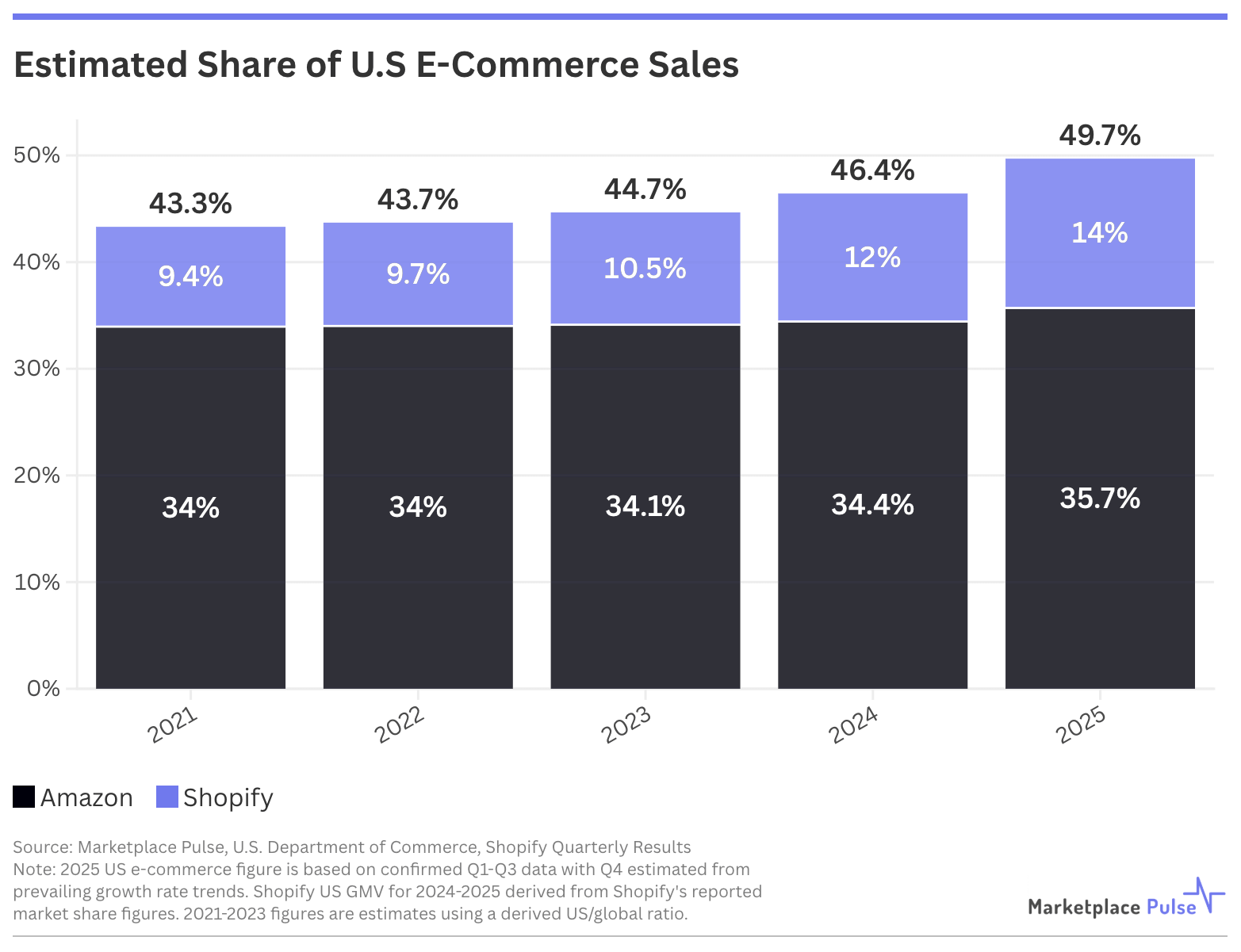

Amazon and Shopify together now account for approximately 50% of U.S. e-commerce.

According to Marketplace Pulse estimates, Amazon generated roughly $440 billion in U.S. sales in 2025, representing a 35.7% share of the $1.2 trillion U.S. e-commerce market. Shopify, reporting a U.S. market share figure for just the second time in its Q4 2025 earnings call, claimed a 14% share, up from 12% a year prior. The combined figure lands at 49.7% — Amazon’s encompassing both its own retail and marketplace operations, Shopify’s aggregated across millions of merchant storefronts.

As recently as 2021, the two together held an estimated 43%. The gap closed slowly through 2022 and 2023, then accelerated across the last two years as both companies compounded growth against a maturing market.

Shopify’s public claim is notable in itself. It has previously declined to express its scale in market share terms — retail market share is conventionally a metric for destinations, places consumers go to spend money. Amazon has a market share because shoppers go to Amazon. Walmart has one for the same reason. No consumer goes to “Shopify” to shop. Its GMV is the aggregate of millions of independent storefronts, each with their own URLs and brand identities, making it closer in structure to a payment network than a retailer.

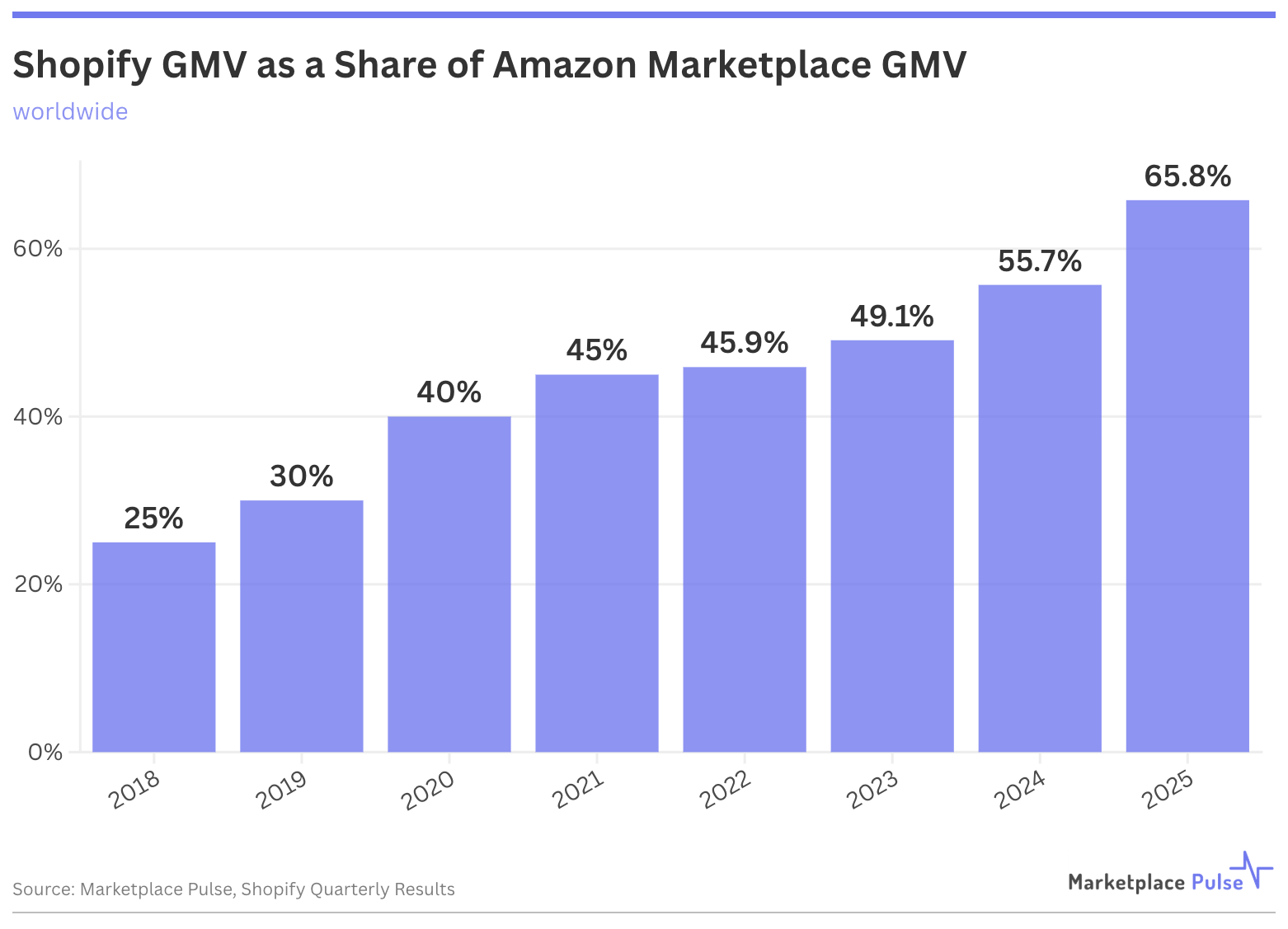

That the company now frames its scale this way reflects both the sheer size of the number and a broader industry acceptance that aggregating merchant GMV into a platform-level figure is a valid measure of infrastructure-layer market presence. The data supports the confidence. Shopify’s global GMV of $378 billion is now 66% as large as Amazon’s third-party marketplace GMV of $575 billion, up from 40% in 2020 and 25% in 2018.

The two companies represent divergent answers to how commerce should be organized online, not competing shopping destinations for the same consumer. Amazon’s marketplace is infrastructure that sellers inhabit but shoppers rarely see — buyers interact with Amazon, not the millions of sellers behind the listings. Shopify’s merchants own their storefronts, their customer relationships, and their brand identity, selling directly to consumers who arrive at their door. Both models are growing, but they arrived at this combined 50% share from opposite directions, and the line between them, though blurring at the edges as Amazon sellers build DTC sites and Shopify merchants list on Amazon, remains fundamentally intact.

The flip side of this is that every other player in U.S. e-commerce is operating in the remaining half, and that half is increasingly contested. Walmart remains the most important presence there — the only genuine competitor to Amazon at scale — but its marketplace, estimated at roughly $10 billion in GMV, is still a fraction of Amazon’s volume. eBay posted $39.1 billion in U.S. GMV in 2025, up 10% year-over-year, having found its footing by refocusing on enthusiasts and collectors rather than chasing new-in-season goods it acknowledged it couldn’t win. TikTok Shop reached an estimated $15.1 billion in U.S. GMV in 2025, genuine scale for a platform in what was only its second full year, though still a rounding error relative to the two leaders. Temu and Shein occupy the ultra-low-price segment, their de minimis advantage now structurally eroded. Target’s marketplace has never meaningfully scaled.

Two models — centralized marketplace and decentralized infrastructure — each reached maturity at roughly the same time. U.S. e-commerce has quietly organized itself around both, and the space between them is where every other player is now making its case.