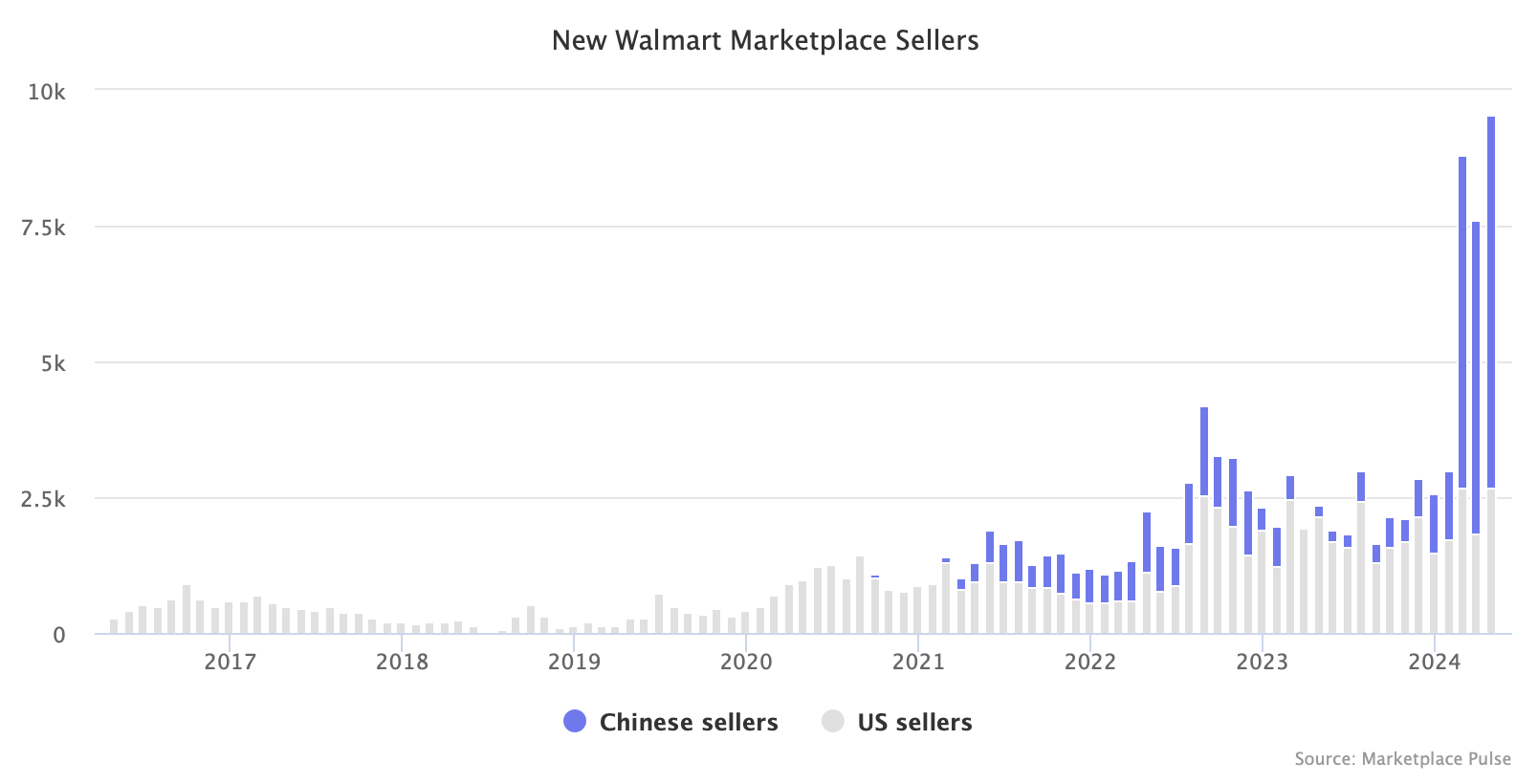

In April, three-quarters of new sellers on the Walmart marketplace were from China, surpassing records set just a month prior. Walmart wants to sell what Temu is selling.

According to Marketplace Pulse research, 73% of new active sellers on the Walmart marketplace were based in China in April, beating the previous record of 67% set in March. Tens of thousands of new sellers apply monthly, but it only approves 10-20% of registrations. Only approved and active sellers based on information on Walmart.com were counted.

Walmart added the same number of U.S. sellers in April 2023 and 2024, but while they represented 91% of the total in 2023, they were down to 23% this year. The drop was caused by a massive increase in new sellers from China — in April, it added nearly as many as during the whole of 2023. Walmart started allowing international sellers in March 2021, but except for small groups of sellers from India, Canada, the United Kingdom, and Vietnam, they are all China-based.

“Two-thirds of what we sell in the U.S. has made or grown in the U.S.,” said Doug McMillon, CEO of Walmart, in an interview at Stratechery. Walmart online is going to be different. Amazon has been on a similar path for nearly a decade — China-based sellers represent nearly 50% of the top sellers on Amazon. This year, Amazon acknowledged the Chinese seller market share on its marketplace for the first time, calling it “significant.”

Walmart hosted the first seller summit in Shenzen in March of this year. In February, it launched a Chinese-language version of the Seller Central dashboard and started allowing sellers to submit support cases in Chinese. It is also running a beta program to simplify imports into WFS, its fulfillment service.

Walmart and Temu — the new disruptor that has captured everyone’s attention — are becoming more similar than different. Walmart and Amazon allow buying directly from China with fast shipping enabled by Walmart’s and Amazon’s warehouses storing sellers’ imported goods. AliExpress, Shein, and Temu allow buying from China without fast shipping but at lower prices. But often, it is the same seller behind each marketplace. The overlap between Temu and Amazon was already big, and now Walmart is catching up, too.