Despite Shopify’s new-found narrative of being an integrator, it’s a poor one. And as a business, it assumes other channels will not succeed, because that would render Shopify obsolete.

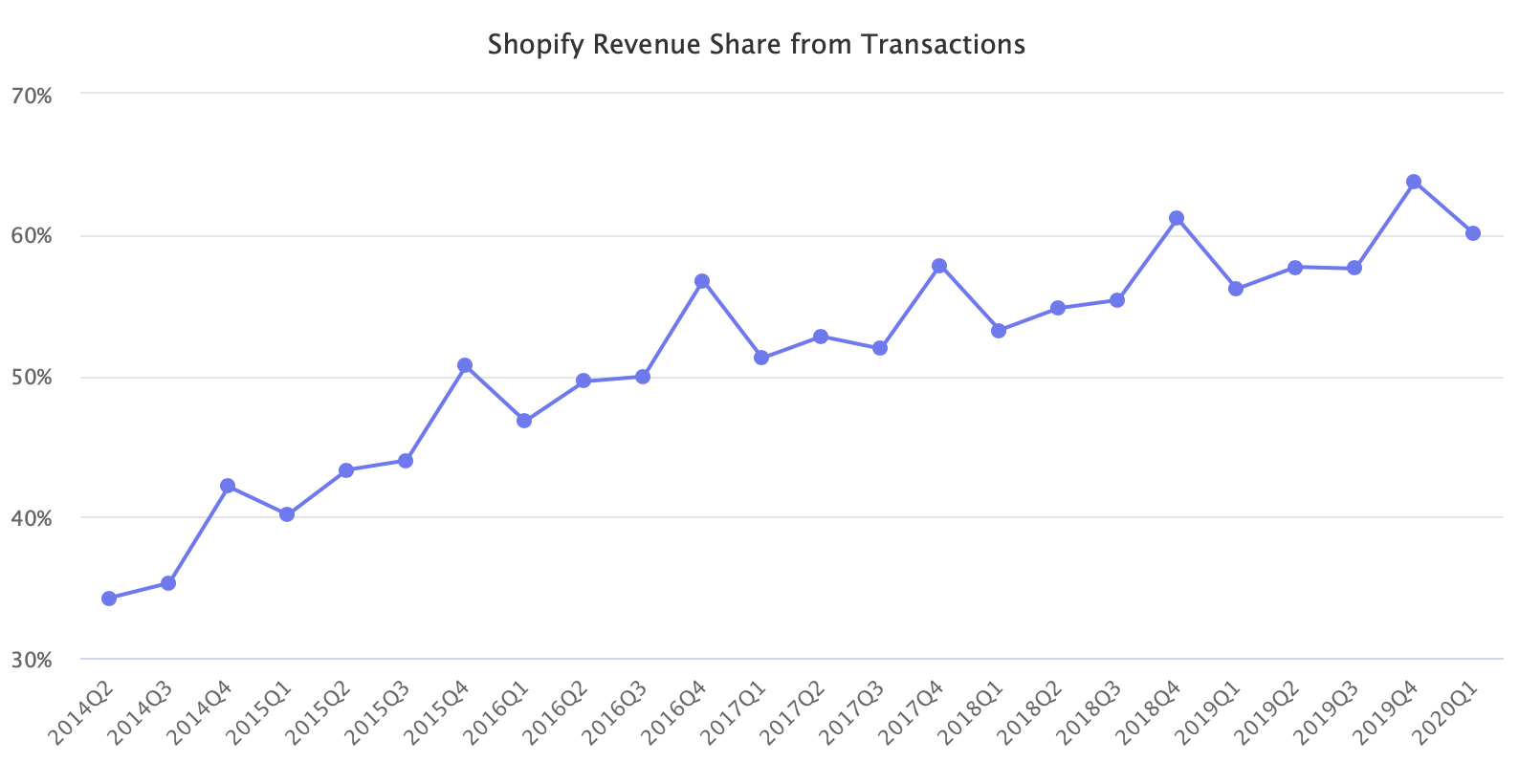

Shopify’s business model is processing transactions. 60% of the company’s revenue was from payment processing fees in the first quarter, compared to 40% in the first quarter of 2015, when the company went public. Shopify’s primary revenue growth driver has been transactional revenue, rather than revenue it collects from hosting stores - 38% growth in subscription solutions revenue vs 54% in merchant solutions revenue. Thus, Shopify is in the business of growing transactions processed by Shopify.

Shopify’s upside could also be from focusing on enabling more merchants, rather than increasing per-merchant revenue. However, that view makes valuing Shopify as a business harder and ultimately puts it in competition with other integrators. Neither of which commands the nearly $100 billion market capitalization Shopify currently has.

In May, Facebook announced Facebook Shops, a tool to set up online stores on Facebook and Instagram. Shopify is one of the partners, allowing Shopify stores to upload their inventory to Facebook. However, assuming Facebook Shops is successful, this partnership benefits those stores and Facebook, not Shopify.

First, Shopify will not be processing transactions on Facebook, so it will see no incremental revenue as stores grow on Facebook. Second, Facebook and Instagram are crucial channels of customer acquisition for Shopify stores; if those customers never leave Facebook, Shopify’s revenue will instead shrink. Third, and finally, Facebook will continue building functionality that enables managing a store without an external tool like Shopify.

If Facebook Shops is successful, and a brand using it is now generating 90% of its sales by directly selling through Facebook and Instagram, that leaves little room for Shopify to provide value. Shopify sees Facebook as one of the channels; Facebook wants to become the channel. Short-term goals are aligned, but long-term, there is no doubt that Facebook is trying to become a platform itself.

In June, Walmart announced plans to add Shopify stores as merchants to its third-party marketplace. Shopify is Walmart’s first platform partner ever, although Shopify had integrations with Amazon and eBay for years. The partnership adds a channel for Shopify stores and allows Walmart to onboard brands that the company could ultimately approach more seriously with no initial risk. For example, to be sold in stores.

However, the partnership suffers from the multi-channel fallacy, the assumption that adding more channels increases sales. It does not, at least not meaningfully. Naively while a product can be copied to Amazon, eBay, Walmart, and elsewhere and thus should be discoverable by customers there, a mere act of adding products doesn’t create liquidity. Every channel requires optimization, often different SEO tactics, and, more recently, focused advertising.

Shopify will be able to add stores and assortment to Walmart, but that doesn’t mean that inventory is going to sell. The Walmart channel requires different optimization than those stores had done for Shopify. Those that do not invest in selling on Walmart beyond enabling the channel on Shopify’s dashboard are unlikely to see material sales. And the management tools provided by Shopify integration are simple, ultimately requiring the use of additional software tools.

Those other additional tools, largely integrators themselves, are also considerably more feature-rich compared to Shopify. Shopify does the assortment and orders syncing, but little else. By comparison, established integrators provide full channel management tools that include content optimization, advertising, product research, and others. Shopify is a simple integrator that does the bare minimum, which is enough to start, but not enough to generate sales.

Shopify has become the darling of the anti-Amazon movement. Perhaps deservingly so, as the platform holds the second place by market share in the US e-commerce, second to Amazon, but ahead of Walmart and eBay. More recently, though, Shopify has become louder about wanting to be an operating system for retail, as Harley Finkelstein, COO at Shopify, described it in an interview with CNBC.

However, Shopify’s value comes not from syncing products to major retail platforms, but by being a self-contained platform. Announcements with Walmart and Facebook are great for attracting press and thus investor value, but those initiatives are not going to grow Shopify or its impact. Hundreds of integrators could do what Shopify is claiming to be building already and better, and have valuations at one percent of Shopify’s value. The anti-Amazon fight is not going to be won by Shopify becoming an integrator. Instead, it is the fulfillment, financing, and other on-platform initiatives that are important.