Shopify launched a consumer shopping app, called Shop, on Tuesday. The app is both a glimpse of what a marketplace built of Shopify stores would look like, and an underwhelming first take at appealing to consumers. It does little to drive product discovery for brands on Shopify.

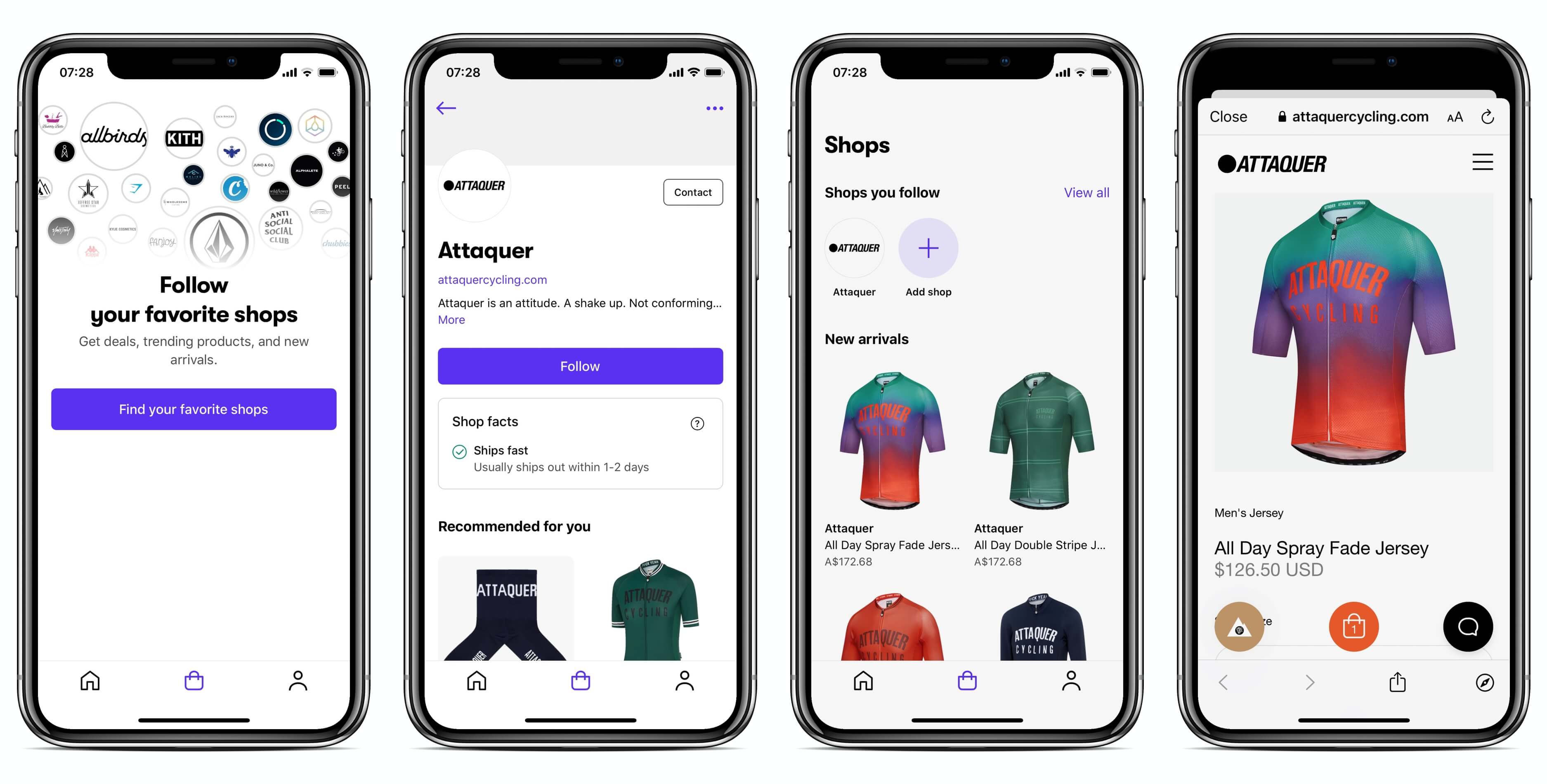

The app is updated and rebranded Arrive, an app built by Shopify for tracking packages. It includes those same tracking capabilities, but it also allows consumers to follow individual Shopify stores and get product recommendations.

However, it doesn’t do curation, discovery, or content, nor it has modern functionality like product drops or exclusive items. It doesn’t allow searching for “shoes” to discover the best stores in the category either; the search is limited to the store name. From a consumer point of view, it provides little reason to use the app. It’s unclear why a consumer would follow the brand on the Shop app rather than the brand’s profile on Instagram. Thus, it’s a Shopify store bookmarking tool with package tracking.

“In the battle against Amazon, Shopify’s opportunity is not better fulfillment options or more tools. It’s the ability to use their sheer size to drive down customer acquisition costs for small brands, thus enabling them to grow faster and more efficient, which would, in turn, expand the overall ecosystem.”

The idea is bigger than the initial execution. It doesn’t do the one thing it should do - find more customers for Shopify stores.

In comparison, Instagram Checkout has a clear advantage to users and brands. Users already use the app, and brands are already posting content to the app - adding in-app shopping is a no brainer. The checkout process, importantly, doesn’t open a pop-up of the brand’s website, unlike on the Shop app. Shopping on Instagram also plays on the strengths of the company, while Shopify is in the business-to-business market, trying to branch out to the consumer market.

“Merchants are not a point of leverage for Shopify to build a consumer brand; they are Shopify’s reason to exist, and no growth hack is going to change that,” wrote Ben Thompson at Stratechery.

But, the Shop app is a text-book example of a marketplace built using the single-player mode. The single-player mode is the process of establishing one side of a marketplace (e.g., sellers) before introducing the other (buyers). “OpenTable sold software to restaurants that created value for them without requiring any diners on the “buyer” side of the marketplace. The initial benefit to restaurant customers was the software. Once OpenTable acquired hundreds of restaurants in a city, they started to have a compelling diner value proposition,” said Eli Chait, ex-Director of PM at OpenTable.

The app is useful to consumers by providing packages tracking. That has grown app users to 16 million according to the company. By adding more features to the app, like automatically following shops consumers have bought from before, it gets more useful. All while there is no transacting on the Shop app itself. Over time, as the app continues to grow users, it can enable an in-app shopping cart and transactions, turning it into a fully-fledged marketplace.

The Shop app could be something more as the company develops its functionality. The opportunity Google Shopping and Shopify have - maybe together - is big. Both at the moment haven’t answered why would consumers use them, however. It’s still unclear, too, if Shopify even wants to build a marketplace. Many argue that Shopify is better served acting as a platform, rather than trying to attract customers and becoming a middleman. If they don’t want to build a marketplace, though, an app like Shop is a distraction for consumers.