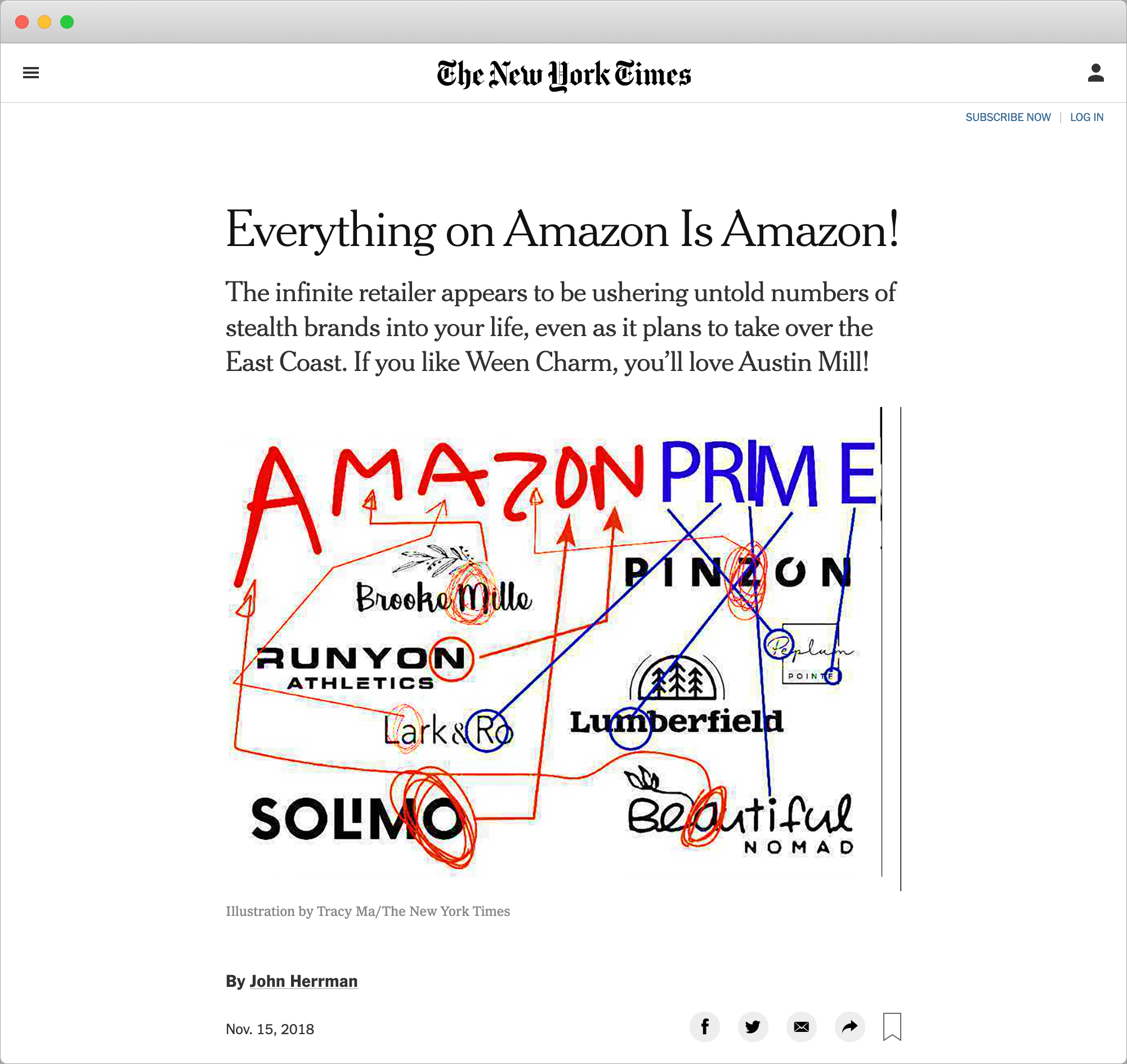

Revenue from Amazon private label brands pales in comparison to the negative attention they have attracted. In 2009, the company quietly entered the private label business by offering a handful of items under a new brand called AmazonBasics. Ten years later Amazon’s brands have only grown to a few billion dollars in sales a year - less than 1% of company’s total sales - while drawing increasing critique from the industry and the press, and more recently scrutiny from government regulators.

Amazon has gained a reputation for copying successful products, using data from other brands, modifying its website to redirect shoppers to its brands, changing the search algorithm to surface its brands higher, and more. Even if, according to Marketplace Pulse research, most of its private label brands are far from successful, perception is reality. The company has walked itself into a perception corner, and still appears to keep going deeper.

There are 70,800 results for “amazon private label unfair” on Google News. Most recent articles included “Aggressive Amazon tactic pushes you to consider its own brand before you click ‘buy’” by Washington Post and “Amazon Changed Search Algorithm in Ways That Boost Its Own Products” by the Wall Street Journal. While some of the covered issues are inconsequential in the grand scheme of Amazon, they make a story.

“The day we put the bike on sale, Amazon will start vacuuming up information about our customers, our margins, and the market’s potential. If it ever decides to get into the e-bike business, we’ll have hand-delivered all the data it needs to squash us,” said a brand executive. Most brands have a similar perception of Amazon, and the many news articles highlighting the company’s anticompetitive behavior continue to reinforce it.

Amazon’s use of data to launch brands is also an antitrust concern: “if you as Amazon get the data from the smaller merchants that you host, well, do you then also use this data to do your own calculations?” asked Margrethe Vestager, European Union’s competition commissioner. EU opened a formal investigation on Amazon in July.

As a whole, Amazon’s brands contribute an insignificant amount of revenue, and hundreds of brands launched after AmazonBasics are not even remotely as successful. For comparison, Costco’s Kirkland Signature private label brand brought in more than $39 billion in 2018, making up almost a third of all Costco sales. Amazon’s most successful brand AmazonBasics is at best a tenth of Kirkland Signature.

What makes Amazon’s behavior problematic, and other retailers’ not, is Amazon’s unique position in the market, however. “When a retailer that is not dominant has its own brands, like a local grocery store, it doesn’t violate the antitrust laws because it does not have monopoly power. The types of conduct that are exclusionary and illegal when a firm has monopoly power are not illegal when a firm does not have monopoly power,” said an antitrust expert Sally Hubbard in an interview.

Amazon’s private label efforts is not a best-seller-generating magic box. For example, in March, Amazon launched Belei, a skincare brand. Six months later, the brand has failed to impress consumers. Amazon is often described as a company of systems, the best examples of which are AWS, Marketplace, and FBA. “Each piece of Amazon is being built with a service-oriented architecture, and Amazon is using that architecture to successively turn every single piece of the company into a separate platform - and thus opening each piece to outside competition,” wrote Zack Kanter. Launching hundreds of brands, with so few of them resonating with consumers doesn’t fit the Amazon model.

Amazon’s brands upset other brands on the platform, give voice to antitrust concerns, provide an endless stream of negative press coverage, and ultimately amount to tens of thousands of unsuccessful products once AmazonBasics is excluded. All the negatives are not meriting the consumer benefit of having slightly cheaper batteries and phone charging cables. The company could have addressed those through partnerships with established brands, instead of starting from scratch.

Amazon sold $117 billion worth of products last year, plus the third-party marketplace sellers transacted an additional $160 billion. It is baffling for a platform with a total of $277 billion in sales last year, and on target to surpass $300 billion in 2019 to be launching brands with insignificant incremental sales. Much attention has been given to the number of new brands the company has launched; however, the only meaningful metric is how successful in the aggregate they are. Most of the brands launched in the past few years have flopped.

“It started with a simple battery,” wrote Julie Creswell for the New York Times. That AmazonBasics battery became the best-seller on Amazon; however, the company didn’t stop there. It continued to build a portfolio of hundreds of brands and tens of thousands of products. It will turn out to have been a wrong path to follow. What looks to be inevitable antitrust regulation and general platform distrust by brands is not going to be worth the total revenue Amazon’s brands will bring.