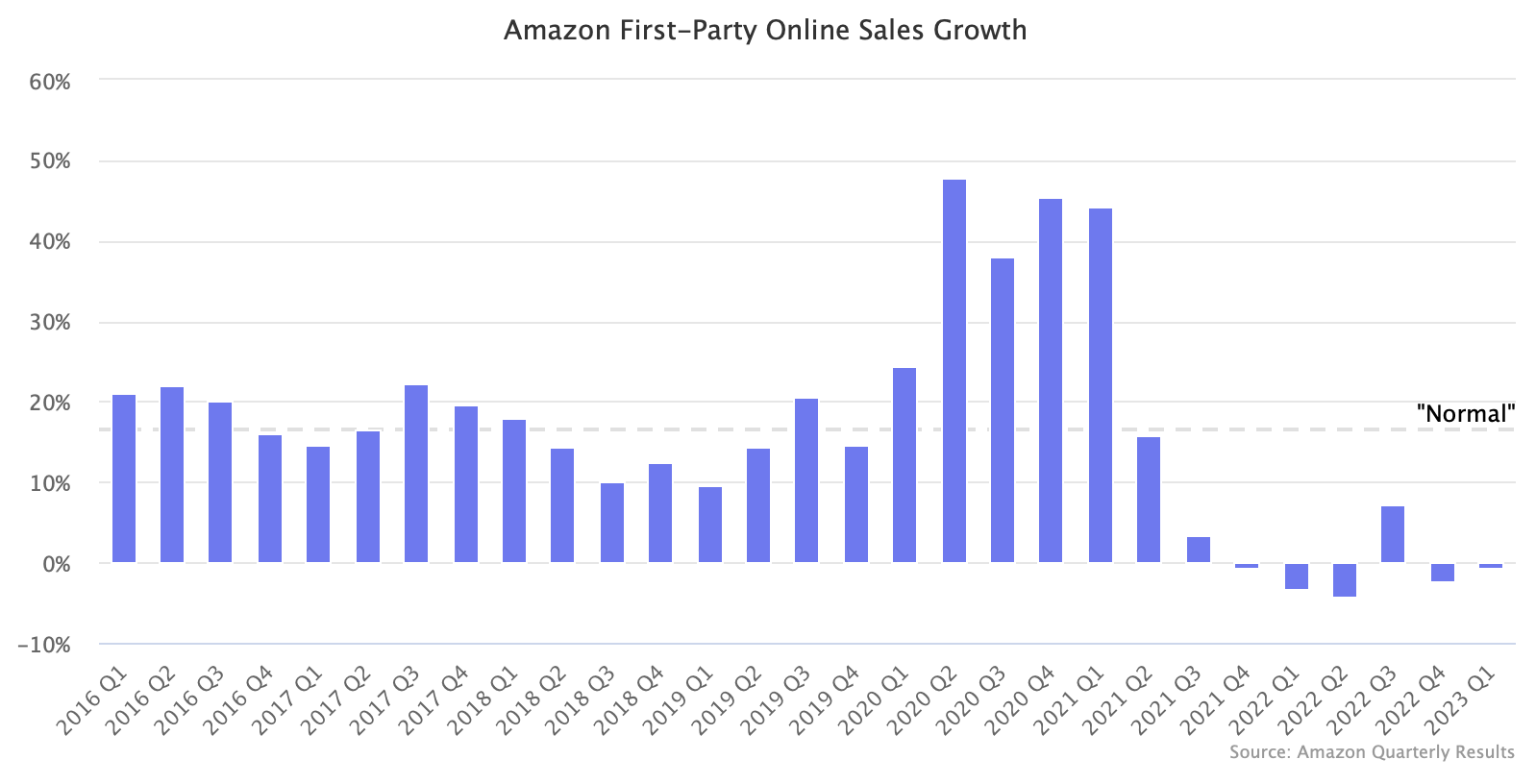

Amazon’s growth is yet to return to historical levels set before the pandemic. Amazon is still growing, but its growth is weak.

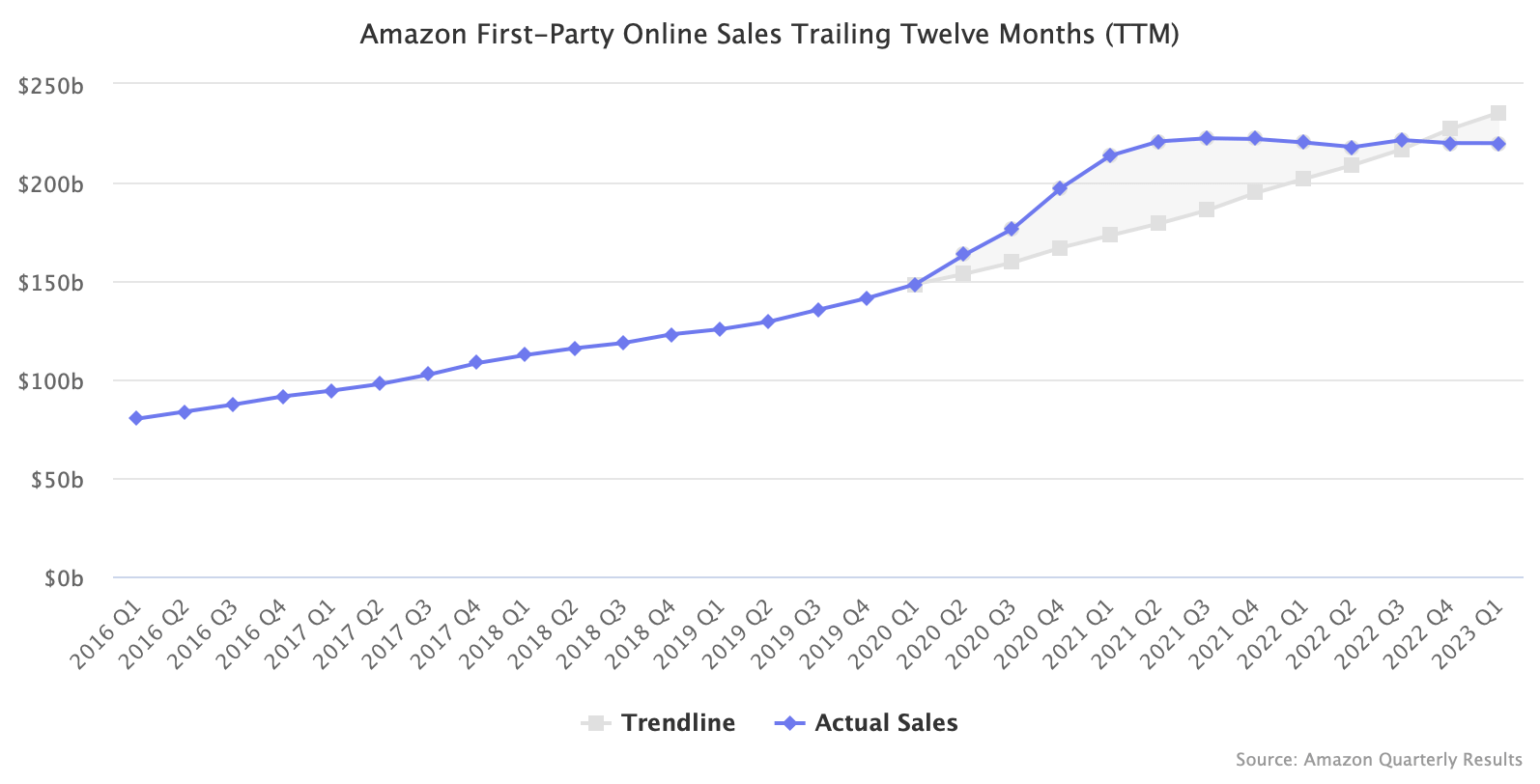

The pandemic first looked like it would boost e-commerce spending overnight. Then its effects faded, and it fell back to the trendline. And now, three years since the pandemic began, the industry was predicted to grow from that new base. Amazon is not yet back to that expected growth - instead, it has fallen below the trendline.

Amazon’s first-party (1P) sales in the first quarter have been near-identical for the past three years - the same $51 billion in 2021 Q1, 2022 Q1, and 2023 Q1. One reason for that was unfavorable foreign exchange rate changes. However, first-party growth is practically flat nevertheless (flat overall; Amazon is doing better in the U.S. than in some international markets).

Amazon’s third-party (3P) revenue from its marketplace has been growing, but increasing fulfillment fees contributed - not all of that growth translates to sales growth because sellers are paying more in fees. The company doesn’t report third-party sales, but they appear to be growing slower than before because third-party revenue is growing slower.

The sum of first-party and third-party growth is the number of products sold on Amazon. After a few near-zero growth quarters in 2022, the growth of products sold on Amazon is back to positive. Yet it still looks weak compared to the years prior - just 8% growth compared to 15-25% over the five years leading up to the pandemic.

Amazon advertising is growing slower than it did pre-pandemic too. That’s expected because most of that advertising drives sales on Amazon; thus, because sales growth was weak, ads growth was limited too.

First-party sales, third-party revenue, paid-units growth, and advertising are four indicators of Amazon’s performance. All are now under the pre-pandemic trendline. Some of that is out of Amazon’s control - Amazon’s growth ceiling is e-commerce expansion; it is both driving e-commerce adoption and failing to grow when consumers return to shopping in stores.

Normal for Amazon is growth. There is barely any today; thus, it is a unique and different time in Amazon’s history, most of which previously saw unstoppable growth.