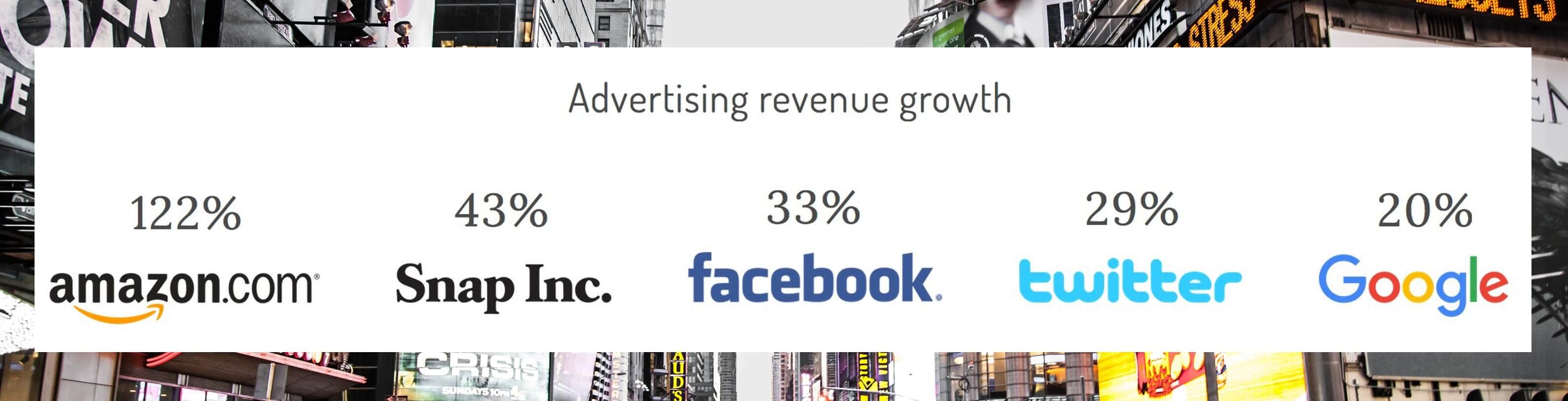

Amazon is the third largest advertising platform, behind Facebook and Google. Facebook and Google together account for more than half of the overall online advertising market in the US, but Amazon advertising is growing six times faster than the incumbents.

| Advertising platform revenue in millions | 2017 Q3 | 2018 Q3 | Growth |

|---|---|---|---|

| $24,065 | $28,954 | 20% | |

| $10,142 | $13,539 | 33% | |

| Amazon | $1,123 | $2,495 | 122% |

| $503 | $650 | 29% | |

| Snapchat | $208 | $298 | 43% |

Amazon is on track to generate $10 billion a year from its advertising platform. The company reported $2.5 billion in sales in its “Other” segment in the third quarter (the segment is assumed to mostly consist of advertising revenue). In the third quarter three years ago it was six times smaller at $407 million, and advertising on Amazon rarely made the news.

Facebook’s advertising revenue rose 33.5% in the third quarter. However, that is a slowdown from the 42.3% growth it posted last quarter and 48.8% growth it posted in the same period last year. Uniquely though Facebook’s advertising is built for mobile - mobile ads accounted for 92% of the ad revenue, up from 88% a year earlier.

Google’s advertising revenue still grew 20% in the third quarter, despite already being the largest advertising platform. Thanks to Google’s dominance in search both on desktop and on mobile it continues to be able to monetize that traffic.

The rest of online advertising in the US is appears on Snapchat, Twitter, Yahoo, and Microsoft properties like Bing and LinkedIn. But all of the rest combined total to less than the duopoly of Facebook and Google.

Amazon advertising is the one to watch because the company is building towards a full-journey, attributable marketing experience. Amazon has historically shared very little data with sellers and brands, but recently it is starting to run experiments with advertising agencies and brands to change that. The consensus among some is that eventually this will lead to a data service provided to brands and agencies.

“Amazon is dealing with the most valuable data asset in the world, even more than Google’s search data.”

– An executive at a top marketing technology and analytics firm

The rise of advertising on Amazon is not surprising given the volume of search traffic available to be monetized. Even without any sophistication by mostly relying on almost trivial keyword-based bidding. But the sophistication is growing and once brands are enabled to utilize Amazon’s data for marketing it will only get more impactful. For example, Amazon is testing a program that lets advertisers retarget shoppers across the web. The capability is available via Amazon’s demand side platform (DSP). Part of that is the ability to bid on shopping intent, one of the first examples of exposing data.

If you want to know what someone will buy, then it helps to know what they already bought in the past. Amazon knows this best. But their ambition is for that knowledge to reach brands and thus power marketing.