Aggressive China-specific tariffs announced and rapidly escalated by the Trump administration will not reverse the fundamental dynamics that have led Chinese sellers to dominate U.S. e-commerce marketplaces. Despite promises that tariffs will help American businesses, historical evidence shows they simply make products more expensive for American consumers while failing to shift market share to domestic sellers.

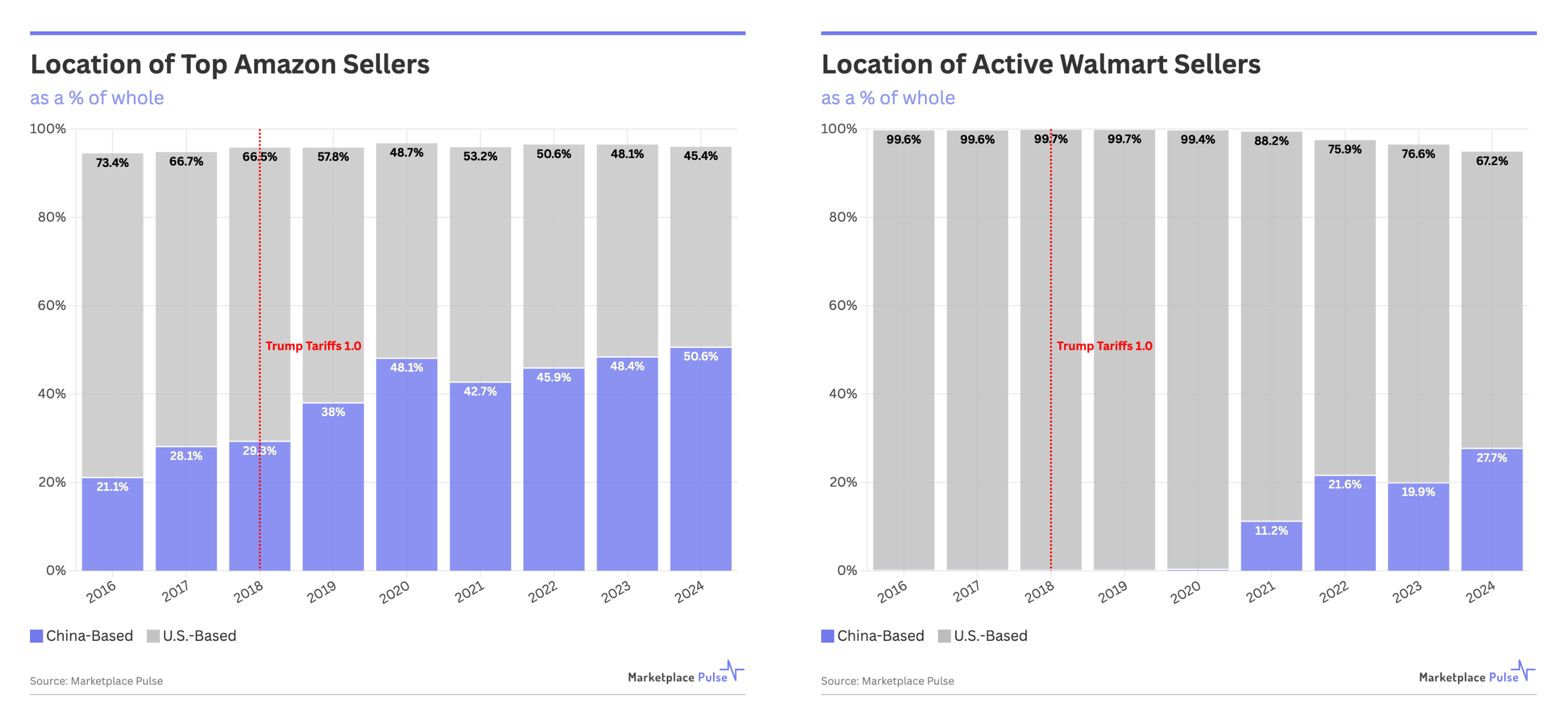

Chinese sellers have steadily increased their presence on major U.S. marketplaces regardless of tariff policies. Today, more than 50% of top sellers on Amazon’s marketplace are based in China, up from less than 40% five years ago. On Walmart’s marketplace, Chinese sellers now represent 28% of all active sellers, up from less than 1% at the start of 2021.

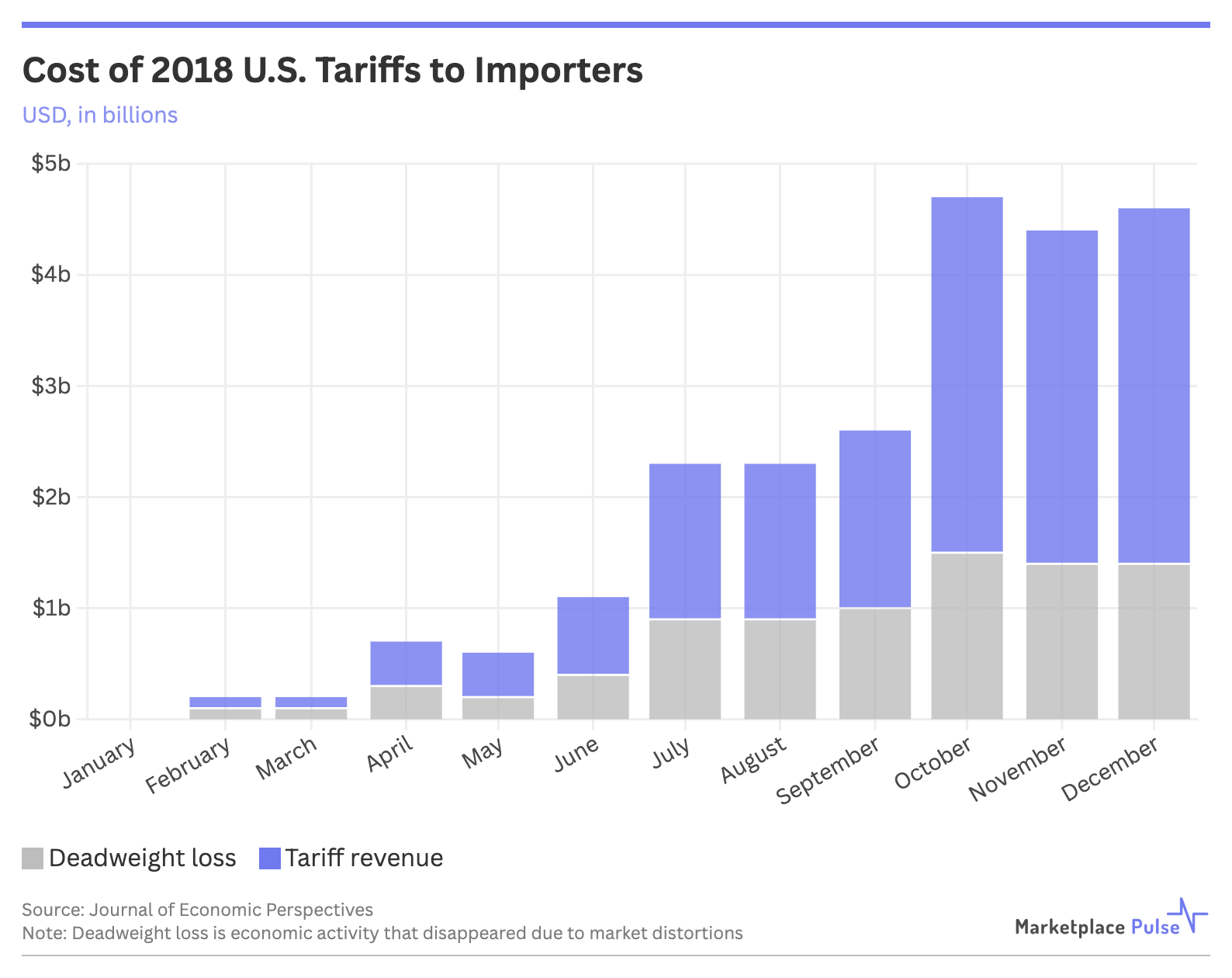

In 2018, the first Trump administration imposed tariffs on $283 billion of imports. A Journal of Economic Perspectives study found these tariffs were “almost completely passed through into U.S. domestic prices,” meaning American consumers and importers, not Chinese exporters, paid the cost. By December 2018, those tariffs cost Americans $3.2 billion per month in additional tax costs and an additional $1.4 billion per month in deadweight welfare losses—economic activity that disappeared due to market distortions.

Rather than bringing manufacturing back to America, the 2018 tariffs simply redirected trade flows. The study found that approximately $165 billion in trade per year was rerouted as companies built complex workarounds, including shipping through third countries, restructuring corporate entities, and adjusting product classifications to avoid tariffs. These supply chains were reconfigured rather than repatriated while the underlying marketplace dynamics continued to evolve in favor of Chinese sellers.

This evolution has been further accelerated by Amazon’s training of shoppers to look past brand names, with e-commerce becoming increasingly “brandless”. This marketplace reality favors sellers with the most efficient supply chains and lowest overhead, areas where Chinese sellers maintain significant advantages regardless of tariff levels.

Chinese sellers have structural advantages that tariffs cannot address. Many are either manufacturers themselves or have a closer proximity to manufacturing than American businesses. They benefit from Chinese government support through export subsidies and tax rebates. And they’ve become increasingly sophisticated in marketplace operations through years of platform experience.

While tariff advocates cite short-term pain for long-term gain, diverting even a small percentage of Chinese manufacturing back to the U.S. would take years. However, the impact on American e-commerce businesses is both immediate and potentially devastating.

Recent analysis from e-commerce software provider Threecolts reveals that small brands and private label businesses are facing a severe cash crunch, with many unable to afford the unexpected tariff costs for inventory already in transit.

Unprecedented tariff rates are forcing domestic e-commerce businesses into impossible choices: scrambling for emergency capital at predatory interest rates, abandoning shipments they can’t afford to clear, or attempting to raise prices in an already price-sensitive market. Without imminent policy changes, many face the threat of bankruptcy. Ironically, these are the very businesses these tariffs were ostensibly designed to protect.

The data points to a familiar outcome: higher prices for American consumers, complex supply chain disruptions, bankruptcies among domestic sellers, and minimal impact on the marketplace dynamics that have led to Chinese seller dominance. Tariffs won’t save the American share of e-commerce and may well accelerate its decline.