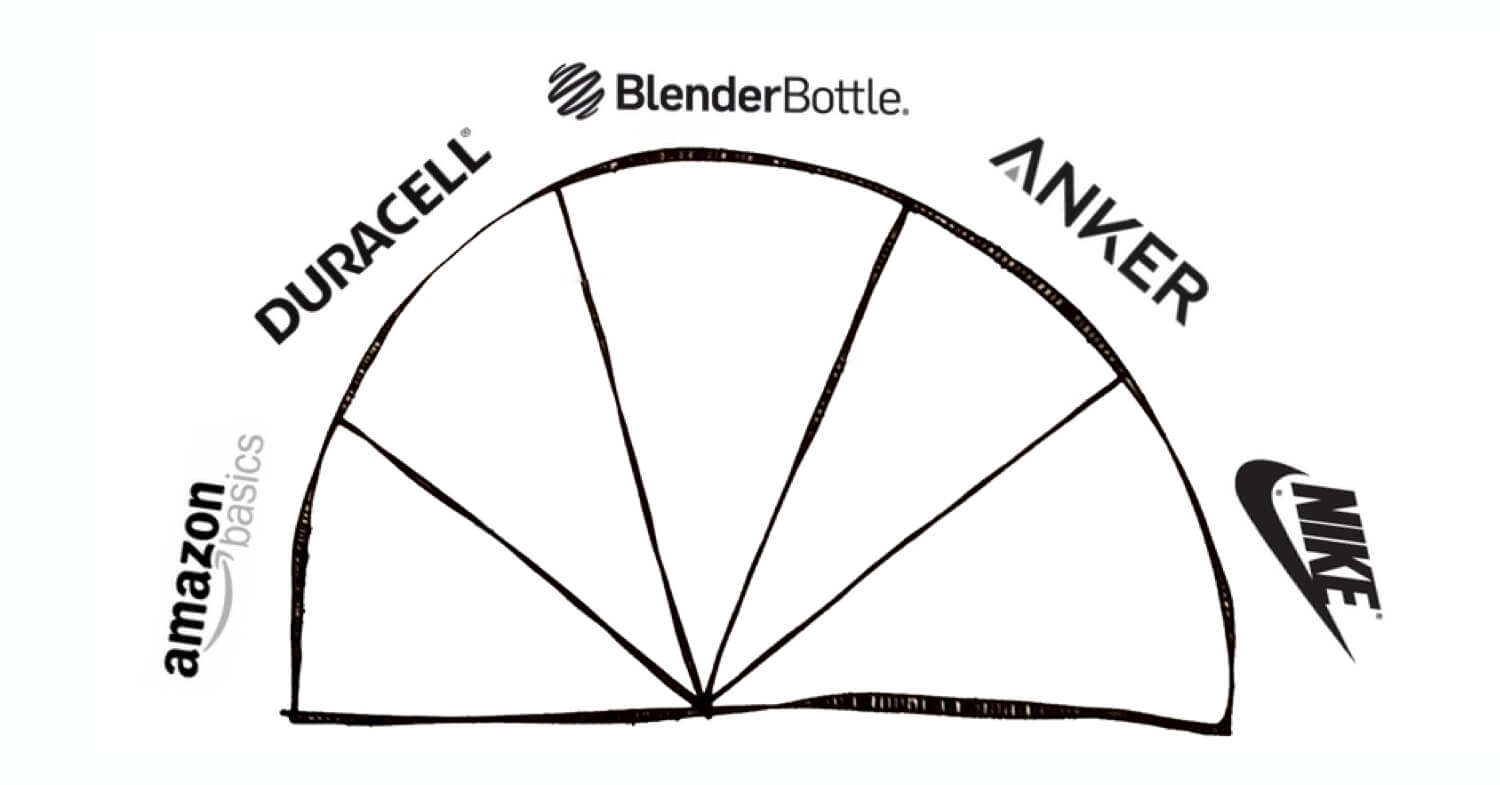

Most brands aspire to be Apple or Nike, but on Amazon, they are closer to AmazonBasics. That is, shoppers buy their products when searching using unbranded search terms. Rather than explicitly looking for the brand, like they do for Apple and Nike.

A brand falls somewhere on the unbranded spectrum by analyzing the most searched terms on Amazon and the products shoppers purchase when searching for them. The test is how often shoppers include the brand name in the search term and how often they buy the brand’s products when searching for unbranded terms.

On one end of the spectrum, there is AmazonBasics. The antithesis of a brand. Shoppers do not search for “amazonbasics yoga mat” or “amazonbasics batteries.” And yet they buy AmazonBasics products when searching for just “yoga mat” and “batteries.” However, some would argue that Amazon puts AmazonBasics unfairly high in search results, driving consumers to pick them.

In the middle, there are brands like BlenderBottle. Its products get bought just as often by shoppers looking for “shaker bottle” as it is by those explicitly looking for “blender bottle.” Then, there are also brands like Anker that capture many unbranded searches and have shoppers looking for the brand.

Apple and Nike are some of the few brands that shoppers seek out explicitly. They search for “nike shoes men” and “airpods pro.” And when they do, they buy the brand. It matters less to those brands that shoppers do not purchase their products when looking for “running shoes” and “wireless headphones.”

Only one in five searches on Amazon include a branded term. Instead, most searches are unbranded, describing the problem and letting the search algorithm pick the best choice. That means consumers are searching for “running shoes women” or “tennis shoes for men” rather than asking, specifically, for Nike, Adidas, or Puma. And when they include a brand name, it is often one of the few that built long-lasting recognition.

Most brands are not Nike, and they cannot act like Nike did when they chose to stop selling on Amazon. And the test for that is the often surprising check for how often shoppers seek out the brand. Despite Nike not being on Amazon, shoppers continue to search for it. Despite many brands being on Amazon, shoppers do not search for them. That is often not an issue because their products are not designed to be recognizable brands. Or more simply, shoppers buy their products despite not remembering to search for them.

Most products sell on Amazon without a moat name brands have built. The unbranded Amazon context allows the proliferation of private label brands. If shoppers are rarely looking for a name brand, then any brand can take their spot. If any brand can take it, a dozen more will try to steal it. Because despite a product being a long-running best-seller, shoppers only buy it because it is the first search result for an unbranded search. Some are trying to become Anker and move up the spectrum, but more is ok without having a moat.

“As buying goes online (regardless of how much the previous points happen at all), buying patterns change. Really, whenever you change the channel, buying patterns change - people do not buy the same in malls as in department stores, nor in department stores as in small shops, and so people do not buy exactly the same things online as they do in supermarkets or malls.”

– Benedict Evans

A dehumidifiers aisle at any major retailer is stocked with Frigidaire, Honeywell, and GE products. Amazon has them too. But it also has brands that most haven’t heard of, and they outsell the former three because - at least on Amazon - few are explicitly searching for those name brands. As Benedict Evans put it, “whenever you change the channel, buying patterns change.” No surprise then that Amazon is mostly unbranded, and it works.