China-based e-commerce platforms built multi-billion dollar businesses by exploiting a customs loophole. That loophole – Section 321 ‘de minimis’ thresholds – is now closed, and with it, the current era of ultra-cheap direct-from-China retail.

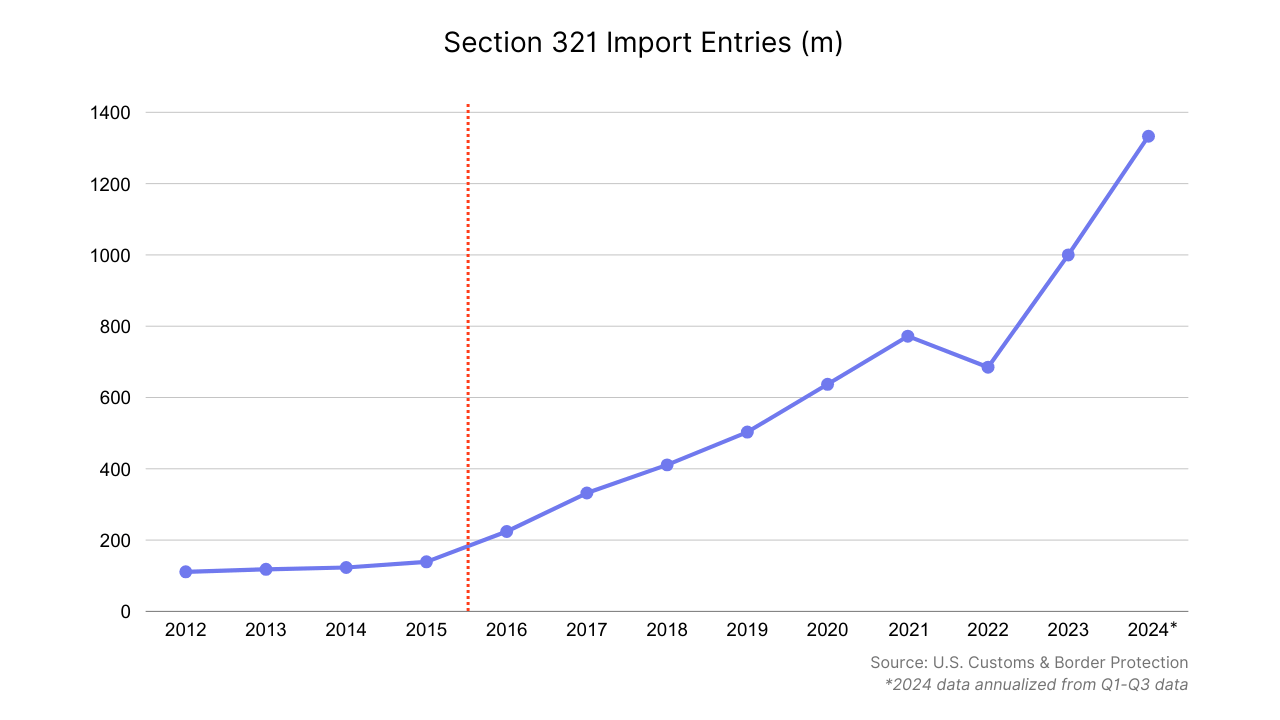

The Trump administration’s decision to suspend de minimis shipments from China marks the end of a remarkable period in U.S. e-commerce. What started as an Obama-era increase of the duty-free threshold from $200 to $800 in 2016 created the foundation for Temu, Shein, and most recently, Amazon Haul.

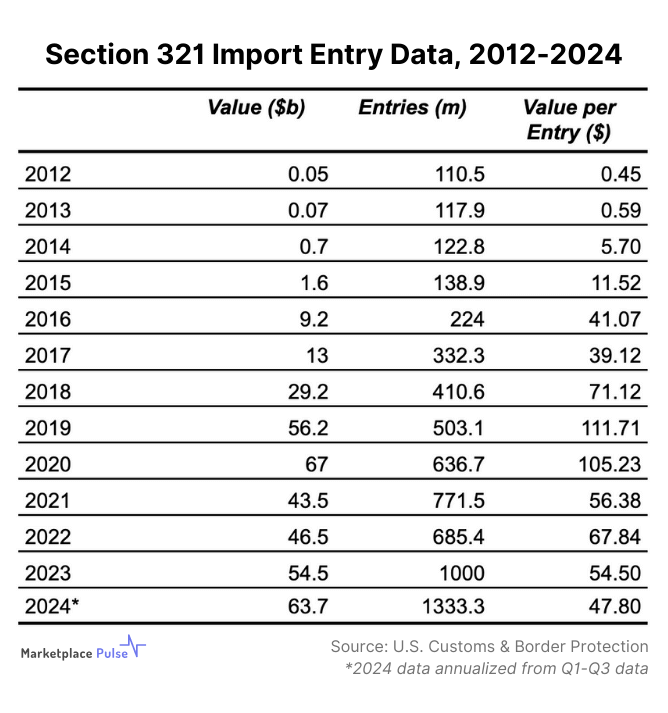

According to U.S. Customs data, de minimis imports exploded from $9.2 billion in 2016 to $54.5 billion in 2023, with Chinese sellers accounting for nearly 60% of all shipments.

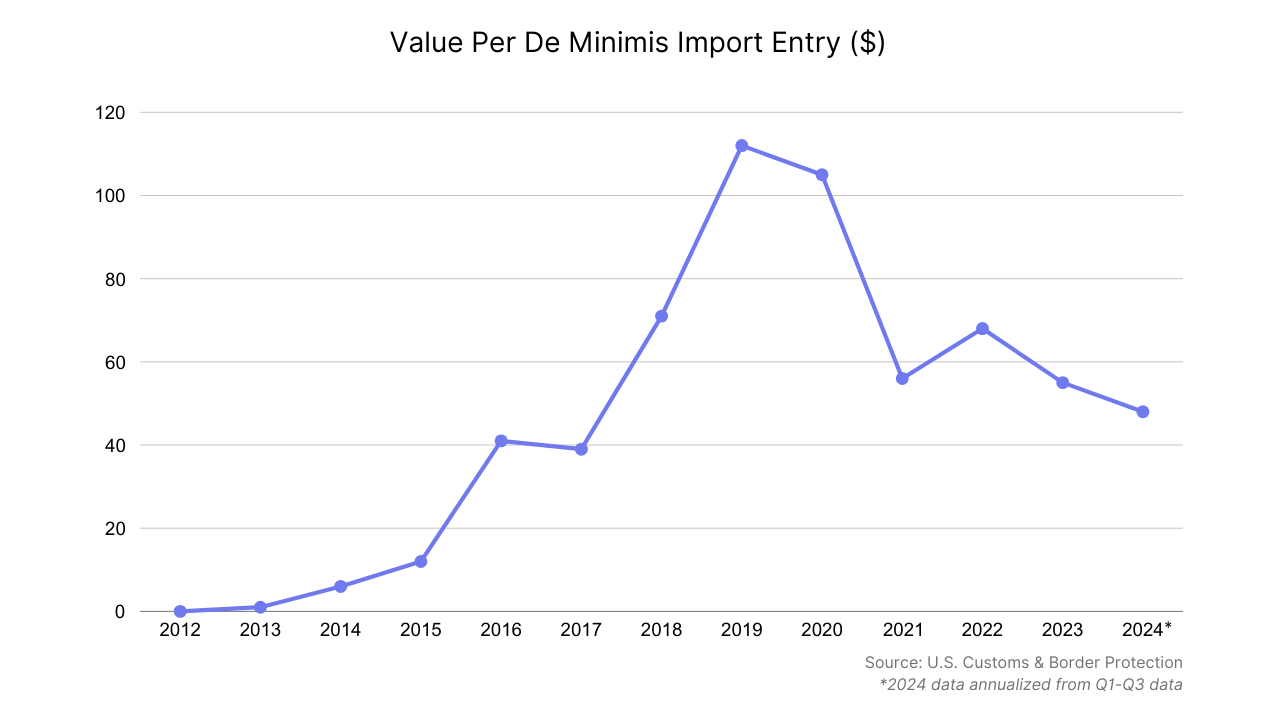

In recent years, the total number of imports under relaxed Section 321 thresholds has grown significantly while the total value of imports remained relatively static. With total entries growing 99% from 2019-2023 (503.1 million to 1 billion) and the value of imports declining 3% (56.2 million to 54.5 million), the average value per shipment dropped dramatically from $111.71 in 2019 to $54.50 in 2023.

The government has only published data through Q3 in 2024, yet the trends have continued. A plunge in average import value indicates Chinese platforms have exploited the de minimis threshold to push increasingly lower-priced goods, forcing U.S. retailers to compete at ever-lower price points or risk losing sales.

The impact on domestic retailers has been substantial. U.S.-based Gap paid $700 million in import taxes in 2022, while direct-from-China competitors paid virtually nothing. This advantage allowed Chinese platforms to consistently undercut U.S. retailers, leading to rapid growth. Temu had set an ambitious $60 billion global sales goal for 2024.

This suspension fundamentally changes the economics. Chinese platforms will now face the same tariffs that have burdened U.S. retailers for years. Plus – despite a last-minute, 30-day delay – de minimis shipments from Canada and Mexico are also set to be suspended, eliminating any hopes of leveraging tariff mitigation strategies through nearby warehousing.

Flexport CEO Ryan Petersen tweeted that 30 of the top 100 American brands on Shopify had been leveraging this strategy by fulfilling orders from just across the Mexican border, so it won’t only be the Chinese that are affected.

Despite ongoing attempts to expand warehousing in the U.S. for larger imports, the options of low-cost Chinese platforms’ smaller direct-to-consumer orders are now limited – either absorb the cost and slash already thin margins or raise prices and risk losing their core value proposition.

Each platform has its own form of significant financial backing – for example, Temu is a relatively small bet for its much larger parent, PDD Holdings. So, absorption of these new costs remains well within their means if they choose to adopt this route.

The changes arrived just as Amazon Haul – the e-commerce giant’s own direct-from-China marketplace – started gaining traction. Amazon positioned Haul as a Temu competitor, complete with similar pricing strategies and reliance on de minimis shipments. The timing couldn’t be worse – Amazon spent months building a loss-leading marketplace that’s now facing the same headwinds that will slow its rivals.

For U.S. sellers, this represents the first significant tailwind in years. The playing field is finally leveling after watching Chinese competitors consistently undercut them through tariff arbitrage. Small and medium-sized U.S. businesses that maintained domestic operations despite margin pressure can now hope to compete more effectively on price.

However, the broader impact may be a fundamental shift in cross-border e-commerce. The de minimis boom created a generation of shoppers accustomed to prices possible only through customs loopholes. As those advantages disappear, the ultra-cheap direct-from-China retail model may prove unsustainable. Platforms will need to evolve beyond pure price competition or risk losing the market share they invested billions in to gain.

The next few quarters will reveal whether Temu, Shein, and others can maintain growth without their core competitive advantage. But one thing is clear – the era of unfettered direct-from-China retail is over.