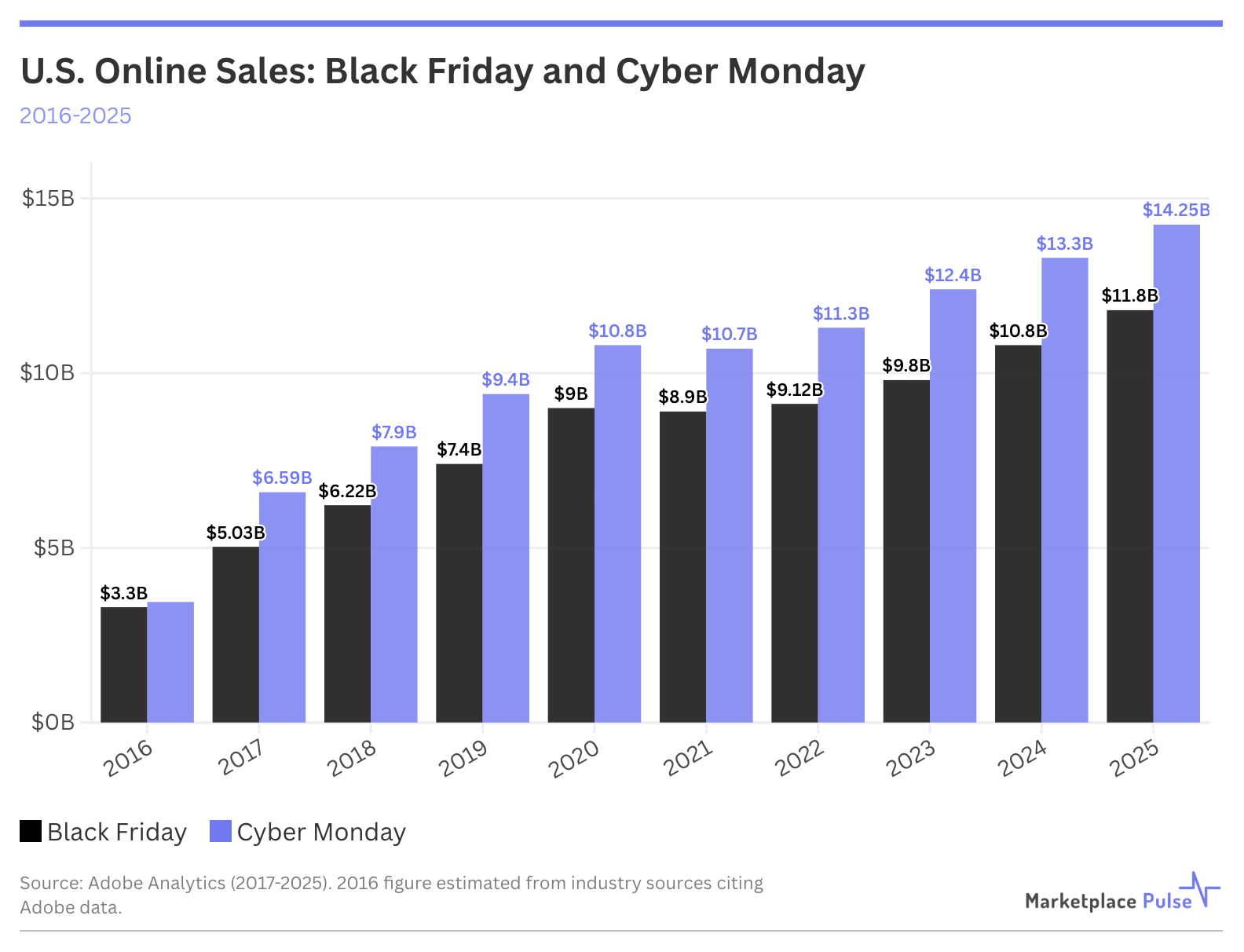

Widespread predictions of disrupted U.S. holiday sales due to escalating tariffs proved unfounded. According to Adobe Analytics, online spending on Cyber Monday hit $14.25 billion, up 7.1% year over year, while Black Friday reached $11.8 billion, up 9.1%. Adobe projects the full 2025 holiday season to reach $253.4 billion, up 5.3%. Despite unprecedented tariff levels – customs revenue surged nearly $120 billion in fiscal year 2025 – consumer spending patterns remained remarkably consistent. While “massive customs fraud” may have partially mitigated tariff impacts, the stability reveals something more fundamental: e-commerce has matured beyond external shocks.

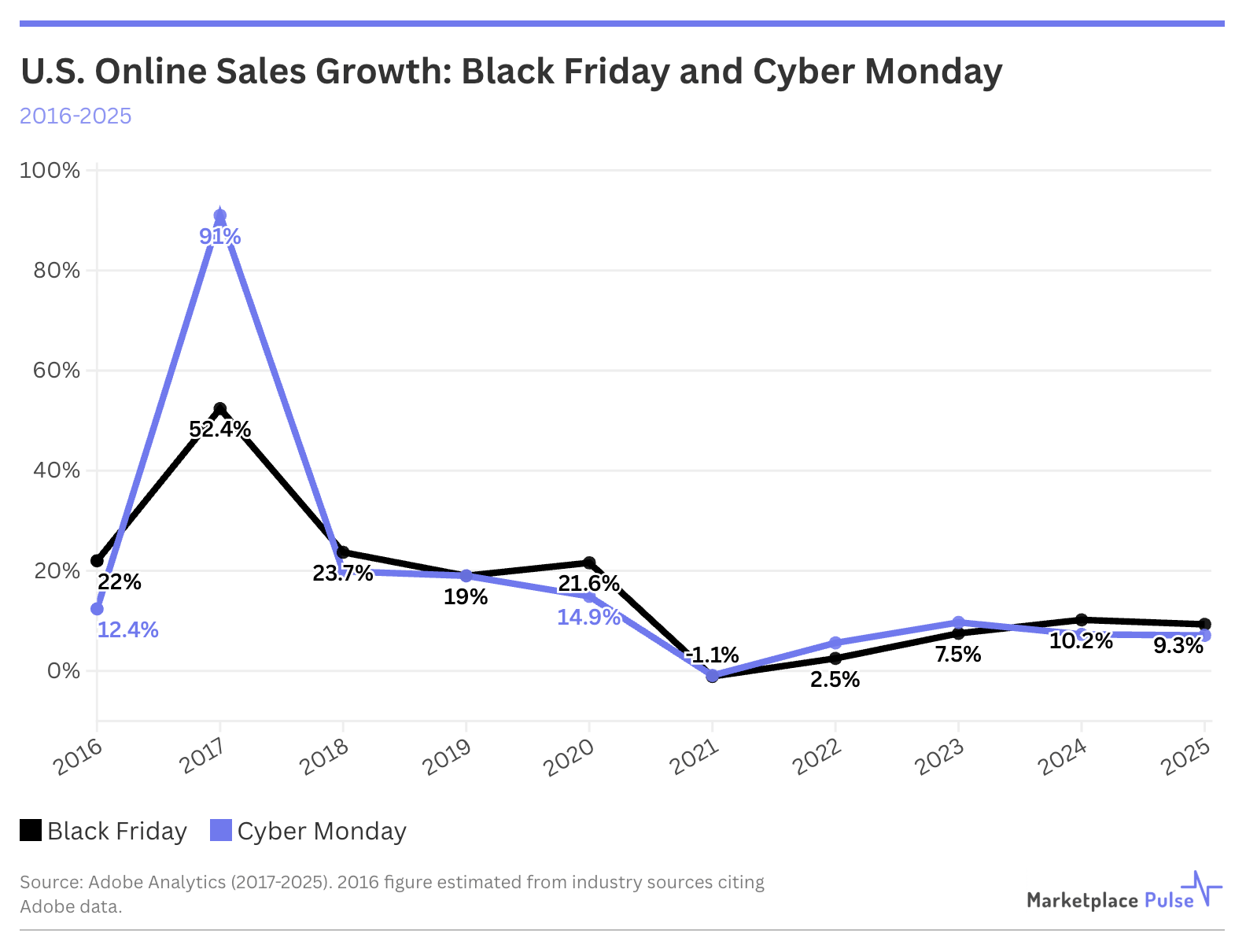

The past decade tells a story of three dramatic inflections followed by sustained normalization. In 2017, Black Friday online sales surged 50.6% to $5.03 billion, while Cyber Monday sales jumped 91% to $6.59 billion, marking the mobile commerce breakthrough that fundamentally reshaped shopping behavior. The 2020 pandemic drove Black Friday to $9.0 billion (+21.6%) and Cyber Monday to $10.8 billion (+14.9%), compressing years of projected digital adoption into months. Then came 2021’s supply chain crisis, producing the only year-over-year declines in the entire dataset: Black Friday fell 1.1% and Cyber Monday dropped 0.9%.

What followed was the establishment of a new baseline. From 2022 through 2025, annual growth has consistently tracked between 5-10%, a dramatic deceleration from the 15-20%+ rates that defined 2017-2020 but a sustainable pattern that persisted through inflation, tariff escalation, and continued supply chain adjustments. The 2025 holiday season confirms this represents structural maturity, not a temporary plateau.

The data reveals what this equilibrium looks like in practice. Black Friday growth outpaced Cyber Monday for the second consecutive year, as the traditionally in-store event continues absorbing online spending. The promotional calendar keeps fragmenting, with retailers launching “Fake Friday” deals the week before Thanksgiving and promotional activity now spanning the entire month. Mobile hit 61.6% of transactions on Thanksgiving and 57.5% on Cyber Monday, completing the channel shift that began in 2017. Most significantly, e-commerce has returned to its COVID peak penetration of 16.3% of retail via genuine, choice-based adoption rather than crisis-driven necessity.

Unlike previous years, where singular catalysts drove change (mobile breakthroughs, pandemic lockdowns, supply chain collapses), 2025 operated without a defining disruptor. Tariffs created seller-side chaos but failed to alter consumer behavior. Inflation persisted but didn’t suppress spending. The promotional calendar continued fragmenting, yet total volume grew predictably. This absence of drama is itself the story.

E-commerce has reached equilibrium. Barring another global shutdown, 5-8% annual growth represents the new normal: sustainable expansion driven by incremental mobile adoption and gradual retail channel shift rather than structural transformation. For years, the industry misread each spike and crash as the new normal. The 2017 mobile breakthrough, 2020 pandemic surge, 2021 supply chain crisis, and 2025 tariff escalation all seemed like defining moments, but have increasingly become external shocks that produce noise rather than structural shifts. The decade of volatility is over. This is what sustainable e-commerce growth looks like.