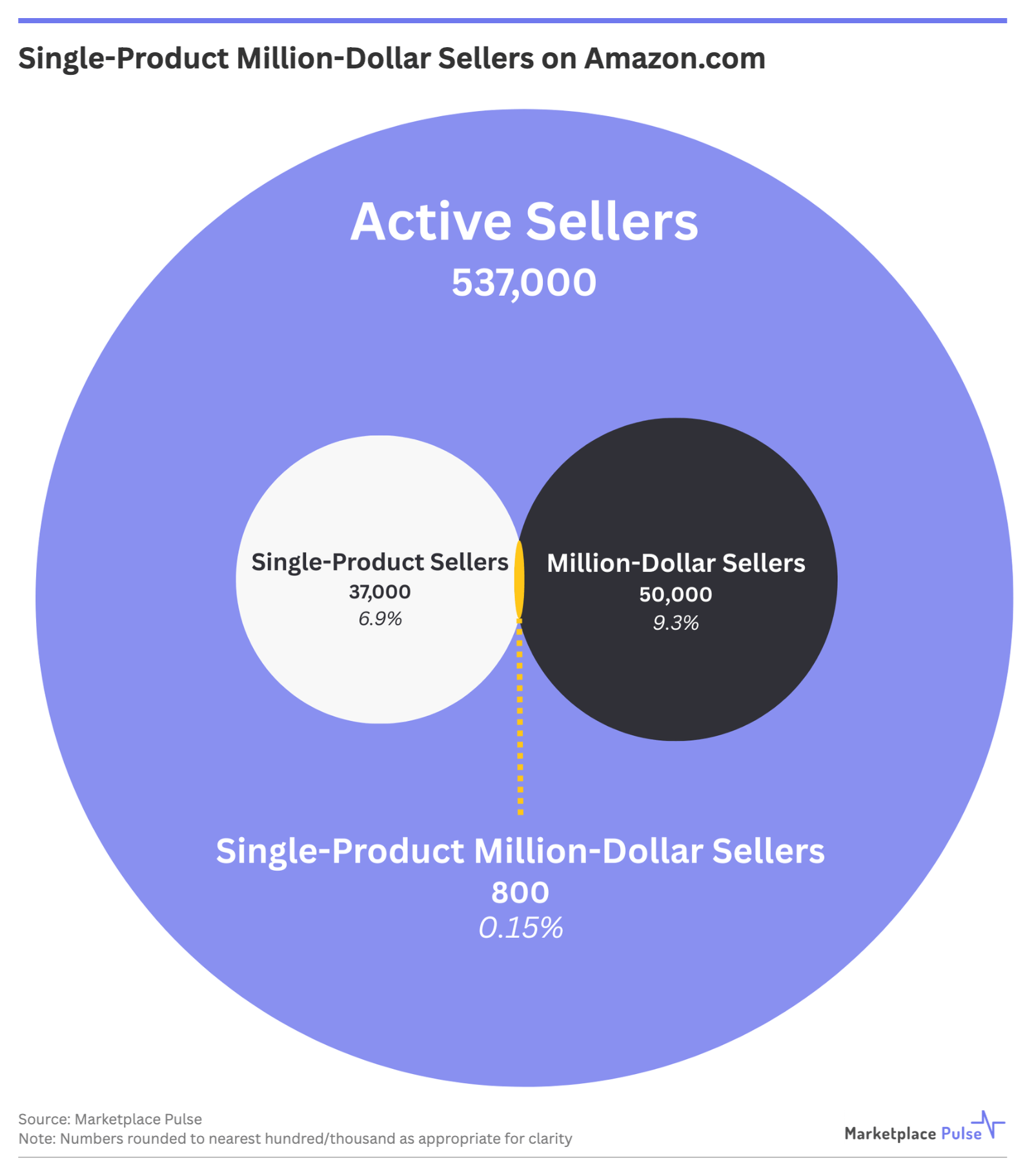

Over 800 Amazon sellers generate more than $1 million annually while listing just one product – a testament to the platform’s unprecedented scale and the precision required to reach such focus. According to Marketplace Pulse research, 19 of these sellers are generating over $10 million with their single SKU.

Amazon’s U.S. marketplace hosts roughly 50,000 million-dollar sellers – the same as all other marketplaces combined – and just 1.6% of these sellers (0.15% of all active sellers in the U.S.) operate with a single product, illustrating how extraordinarily rare this achievement is.

For many sellers, the single-product model represents the lean operational dream: maximum revenue concentration with minimal complexity. Hero Cosmetics exemplified this when it started with one Amazon SKU – the Mighty Patch – that became the platform’s top beauty product, eventually selling for $630 million.

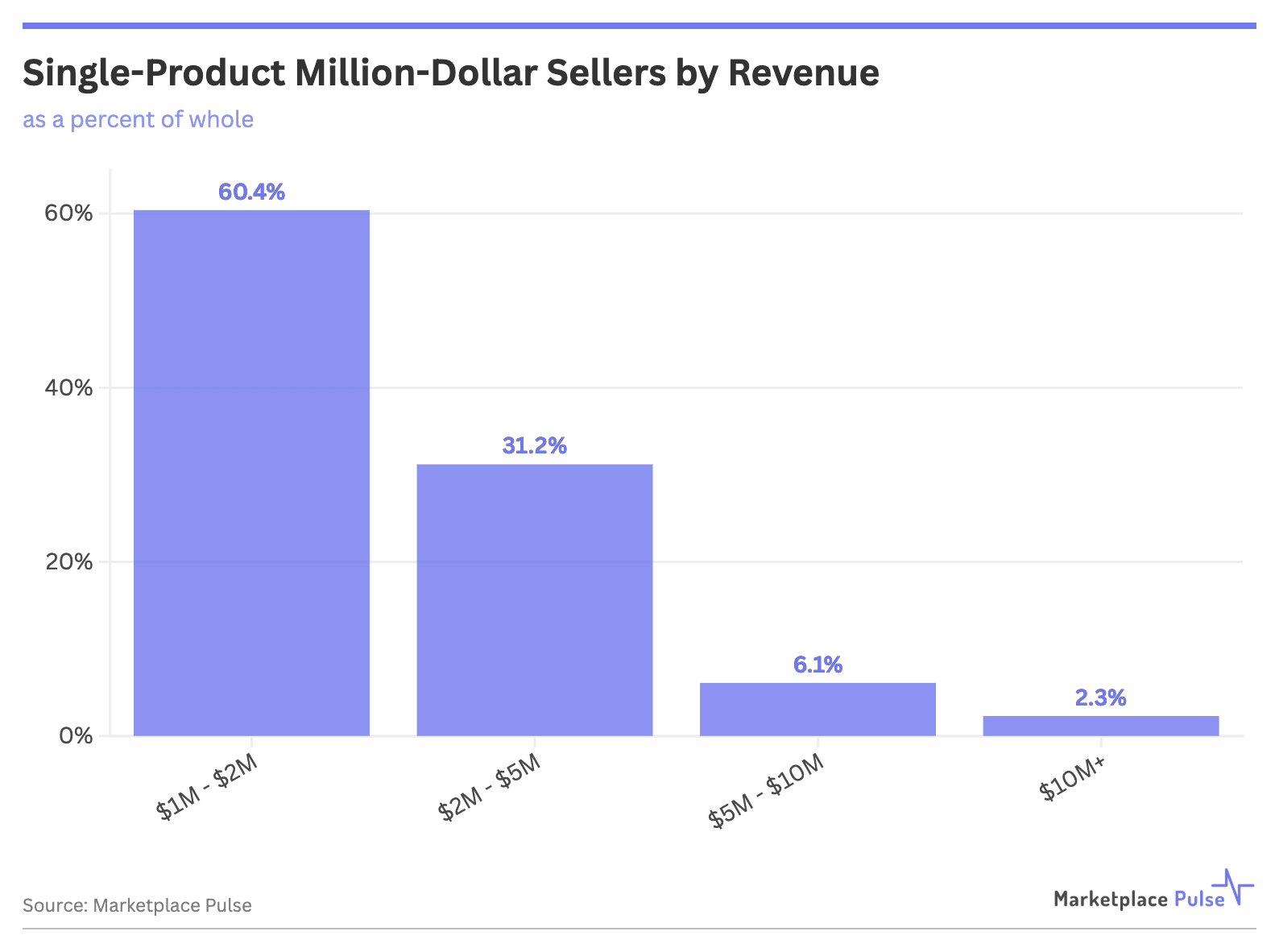

But what these sellers gain in simplification, they lose in diversification. The same focus that creates operational elegance also concentrates all business risk into a single point of failure. Algorithm changes, competitor launches, supply chain disruption, or regulatory shifts can devastate an entire business overnight. This vulnerability explains why nearly 500 of the 800 single-product millionaires fall within the $1-2 million revenue band – the precarious threshold where many businesses either scale past dependence on one product or face extinction.

Cogniscent of this, Hero Cosmetics leveraged single-product success as the foundation for broader diversification. Founder Ju Rhyu described the evolution in a social media post: “1 sku on Amazon. Then a few skus. Then 1 sku at Target. Then a more skus. 1 sku at Ulta. Then a whole shelf”.

Larger Amazon aggregators like Thrasio historically favored high SKU concentration due to operational simplicity when acquiring and integrating new brands. Portfolio diversification happened at the aggregator level rather than within individual brands. However, the Amazon aggregator model has struggled significantly in recent years, in turn creating fewer potential exit opportunities for single-product businesses precisely when their operational risk is highest.

Some single-product sellers are more diversified than they initially seem, though. According to our research, several single-product, million-dollar sellers are simultaneously selling additional product lines directly to Amazon as first-party sellers. This hybrid 1P/3P approach suggests some sellers are finding ways to maintain their marketplace focus while diversifying revenue streams through Amazon’s wholesale channel. It represents a hedging strategy that preserves the operational benefits of a single-product focus while creating additional revenue insurance.

Nearly three-quarters of the single-product million-dollar sellers operate from China and thus maintain structural advantages that recently introduced tariffs cannot address. Proximity to manufacturing, government export subsidies, and years of platform optimization experience all become amplified in single-product businesses where supply chain efficiency and cost structure optimization matter most.

Amazon’s scale enables the impossible: individual products generating revenue that would have required entire product lines in traditional retail. According to Similar Web data, Amazon.com now receives 2.8 billion monthly visits, creating discovery opportunities that simply don’t exist elsewhere.

The 800+ single-product millionaires prove that in an era of infinite selection and countless competitors, extreme focus can still triumph. They represent the ultimate expression of Amazon’s promise: that the right product, optimized correctly, can reach unprecedented scale.