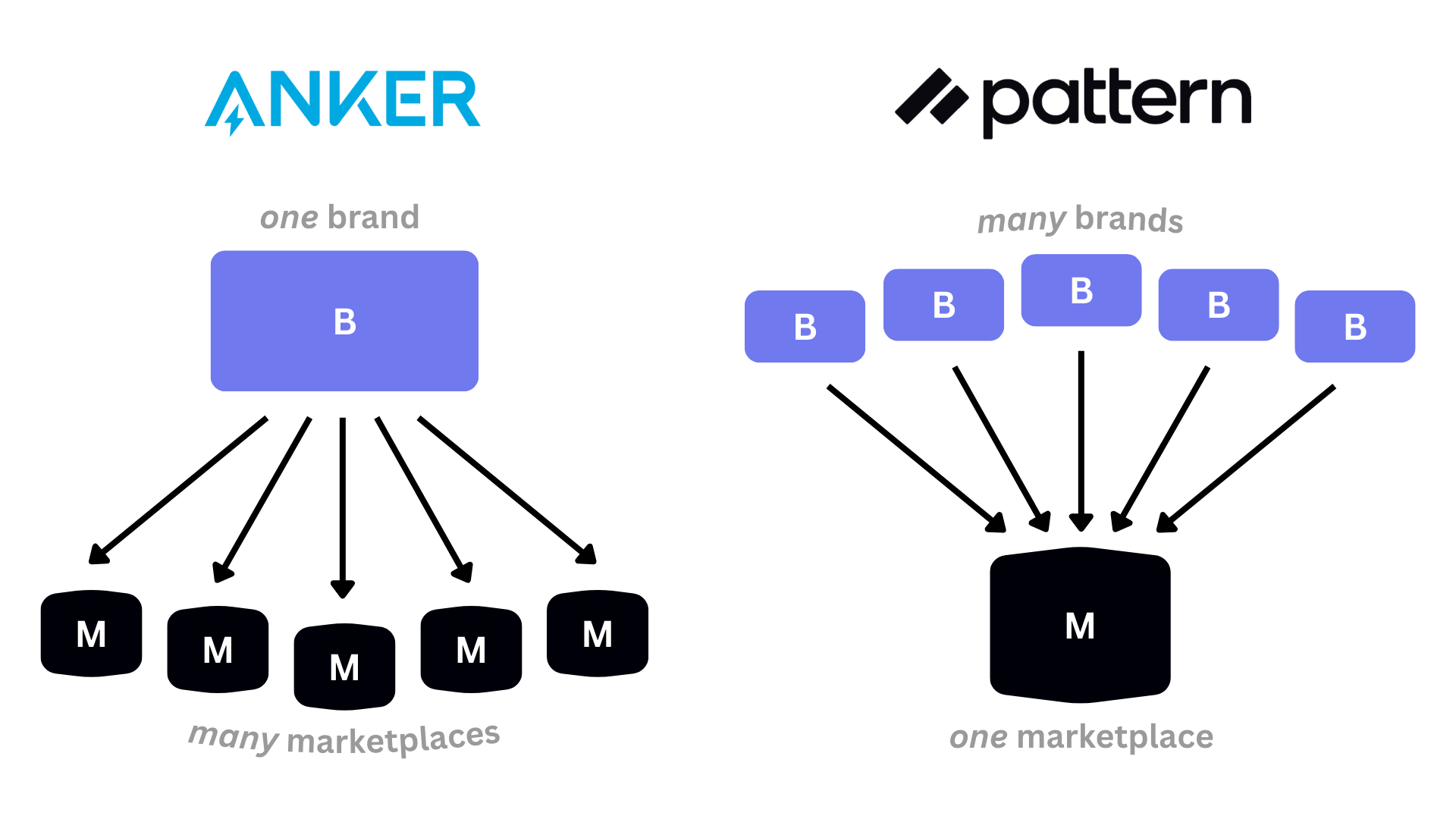

Pattern’s IPO filing this month presents a fascinating counterpoint to the Anker playbook for Amazon-native success. While both companies achieved billion-dollar scale starting from Amazon, they chose radically different strategies. Anker built brand equity and diversified beyond marketplaces, while Pattern perfected the reseller model through exclusive partnerships and technology infrastructure. Pattern’s public debut will test whether sophisticated reselling can command the public market valuations traditionally reserved for brand builders.

Anker’s evolution represents the textbook Amazon-native trajectory: use the marketplace as a proving ground, invest in genuine product innovation, build consumer brand recognition, then diversify across channels. By 2021, Amazon represented just 54% of Anker’s $1.89 billion in sales, with brick-and-mortar stores accounting for 36% and other channels filling the remainder. The company previously reported it employs over 1,600 people in R&D alone – nearly half its workforce – creating defensible products rather than optimizing existing ones. Anker succeeded by building something consumers recognize and trust, whether they encounter it on Amazon or in Best Buy.

Pattern took the opposite approach. Instead of building consumer-facing brands, the company built infrastructure for other people’s brands. Rather than diversifying away from Amazon, Pattern doubled down with 94% of its entire $1.8 billion revenue coming from the Amazon ecosystem, with the vast majority (88% of total revenue) concentrated specifically on Amazon.com.

The company shared it has 400 software engineers on payroll – they aren’t designing consumer electronics; they’re optimizing the machinery of reselling. Pattern’s bet is that becoming the best possible intermediary – with exclusive brand partnerships, proprietary data analytics, and sophisticated logistics – can be equally as valuable as building brands itself.

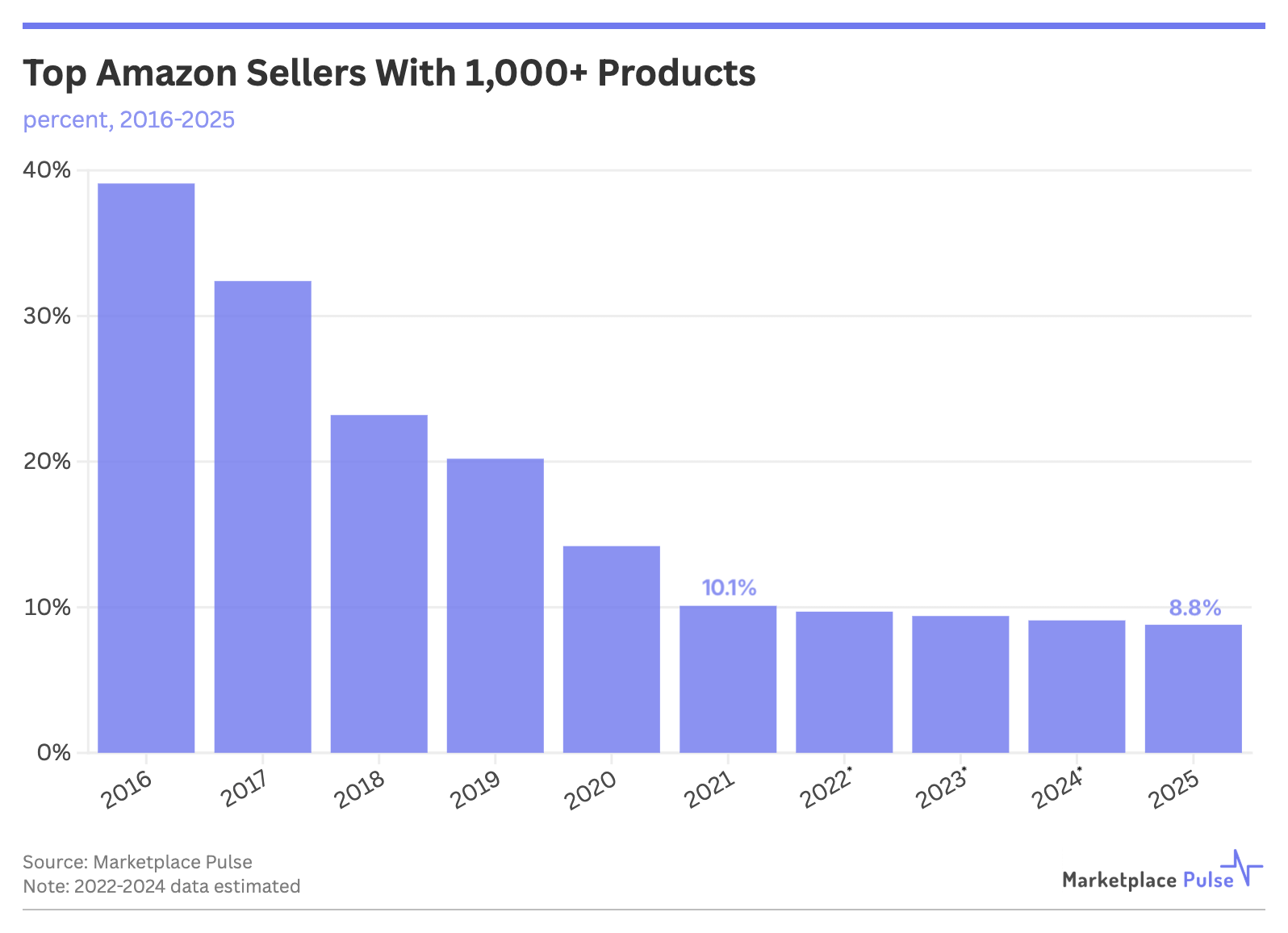

The data suggests Pattern identified a now-stable niche. Marketplace Pulse analysis in 2021 revealed that Amazon resellers were disappearing, with sellers listing 1,000 or more products accounting for just 10% of the top sellers, down from a peak of 40% in 2016. That number has stabilized and now sits at 8.8% of top Amazon sellers.

Rather than disappearing, sophisticated resellers like Pattern – which itself has over 10,000 products listed – have found their footing by evolving beyond simple arbitrage. Pattern’s model depends on exclusive partnerships with brands like Nestlé, Panasonic, and Skechers, acting more like an outsourced e-commerce department than a traditional reseller competing on price.

This evolution mirrors the “agency-reseller” model that emerged as traditional reselling became untenable. Pattern offers brands something they can’t easily build themselves: sophisticated marketplace optimization, global logistics, advertising management, and data analytics across platforms. Nearly half of Pattern’s revenue comes from brand partners who have been with the company for five years or longer, suggesting that these relationships have staying power. Rather than racing to the bottom on price, Pattern creates value through operational excellence.

Both models face distinct risks. Anker’s brand-building approach requires a massive investment in R&D and takes years to establish a market position, but creates transferable equity that works across any sales channel. Pattern’s infrastructure approach scales faster with lower upfront investment, but it creates platform dependence and vulnerability to changes in partnerships. If Amazon alters its policies or key brand partners develop internal capabilities, Pattern’s moats evaporate quickly.

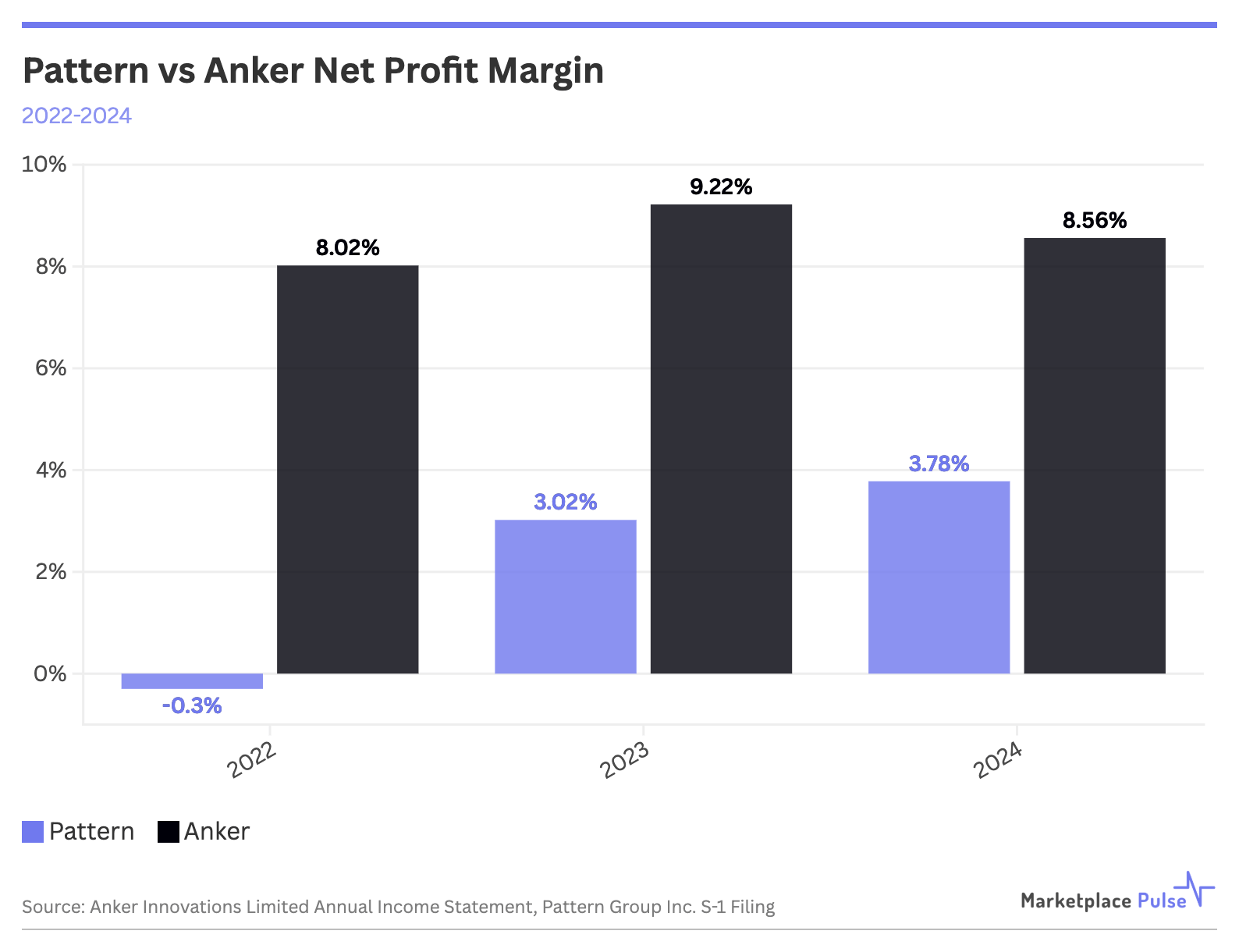

Pattern’s IPO ultimately tests a fundamental question about marketplace businesses: Can sophisticated reselling generate returns comparable to those of brand building? The company’s $68 million net income on $1.8 billion revenue produces thin, albeit growing, margins that depend entirely on operational efficiency. Anker’s approach generates better margins through product differentiation, but it requires breakthrough innovation to maintain its competitive position.

The market appears large enough for both strategies. Pattern’s focus on health and wellness products (63% of inventory purchases) potentially exploits regulatory and trust advantages that increasingly dominant Chinese competitors struggle to match. At the same time, Anker’s electronics expertise creates global scale in categories where innovation drives recognition. Neither company needs to eliminate the other to succeed.

Pattern’s public debut will reveal whether investors value infrastructure-as-a-service over brand equity. If successful, it validates that Amazon-native companies don’t need to follow Anker’s diversification playbook. Instead, they can build deeper into marketplace optimization and win through operational excellence rather than consumer recognition. Two billion-dollar companies, two entirely different theories of how to extract value from Amazon’s ecosystem.