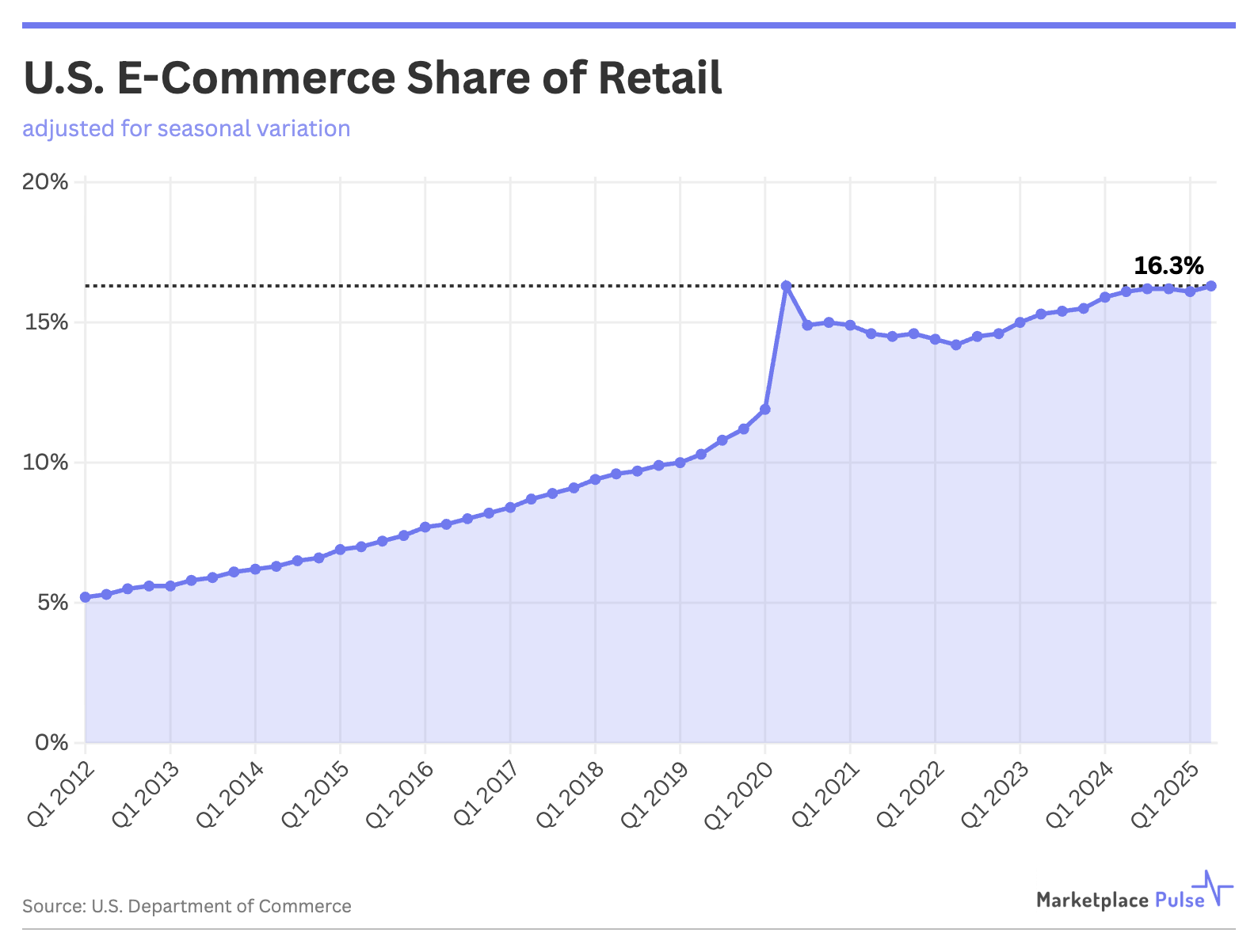

Five years after COVID-19 shocked the world into digital shopping, U.S. e-commerce has finally crawled back to the summit it briefly scaled in the spring of 2020. According to the Census Bureau’s latest quarterly report, e-commerce now represents 16.3% of total retail sales – the exact same peak it hit during the lockdown chaos of Q2 2020.

This milestone is both anticlimactic and profound. The return to the peak has been slow and steady, but the trajectory reveals how wrong even some of the industry’s biggest titans were about the future of digital commerce.

Industry giants bet the house on perpetual acceleration. Shopify doubled its workforce while Amazon added 427,300 employees in just 10 months, only for both to conduct massive layoffs with Shopify CEO Tobias Lütke admitting: “It’s now clear that bet didn’t pay off.” Neither company predicted it would take five years to return to the same penetration level.

The industry’s fundamental miscalculation was treating crisis-driven adoption as a permanent change in behavior. Covid didn’t accelerate e-commerce – what looked like a permanent step-change was a temporary disruption. The forced migration of 2020 created an illusion of accelerated consumer evolution that was unsustainable.

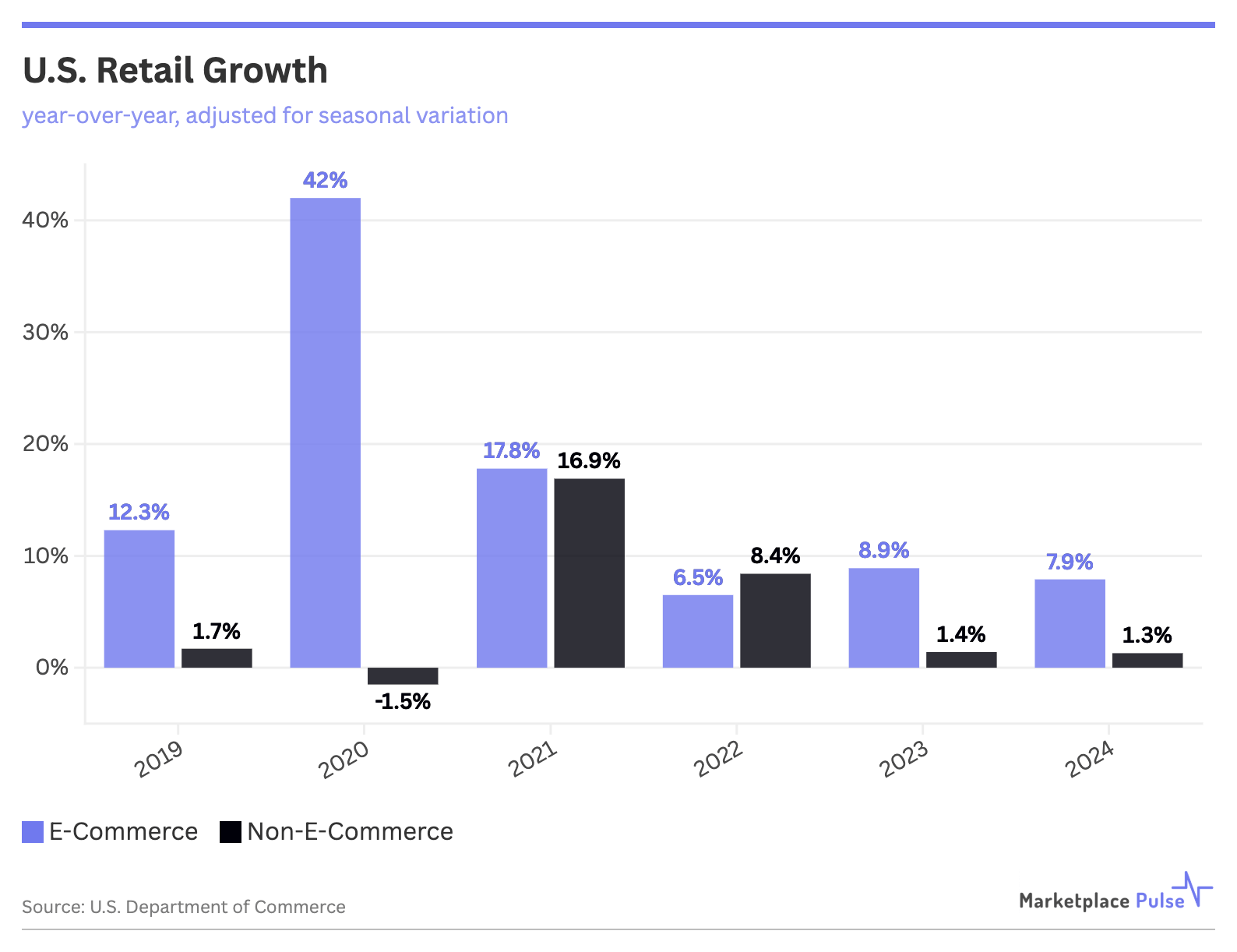

After e-commerce’s meteoric 42% growth in 2020, it crashed to just 6.5% in 2022 while non-e-commerce surged 16.9% in 2021 as consumers returned to stores. Yet the methodical quarter-by-quarter climb of e-commerce’s retail share from 14.2% in Q2 2022 to today’s 16.3% demonstrates something fundamentally different: genuine, sustainable adoption built on choice rather than necessity.

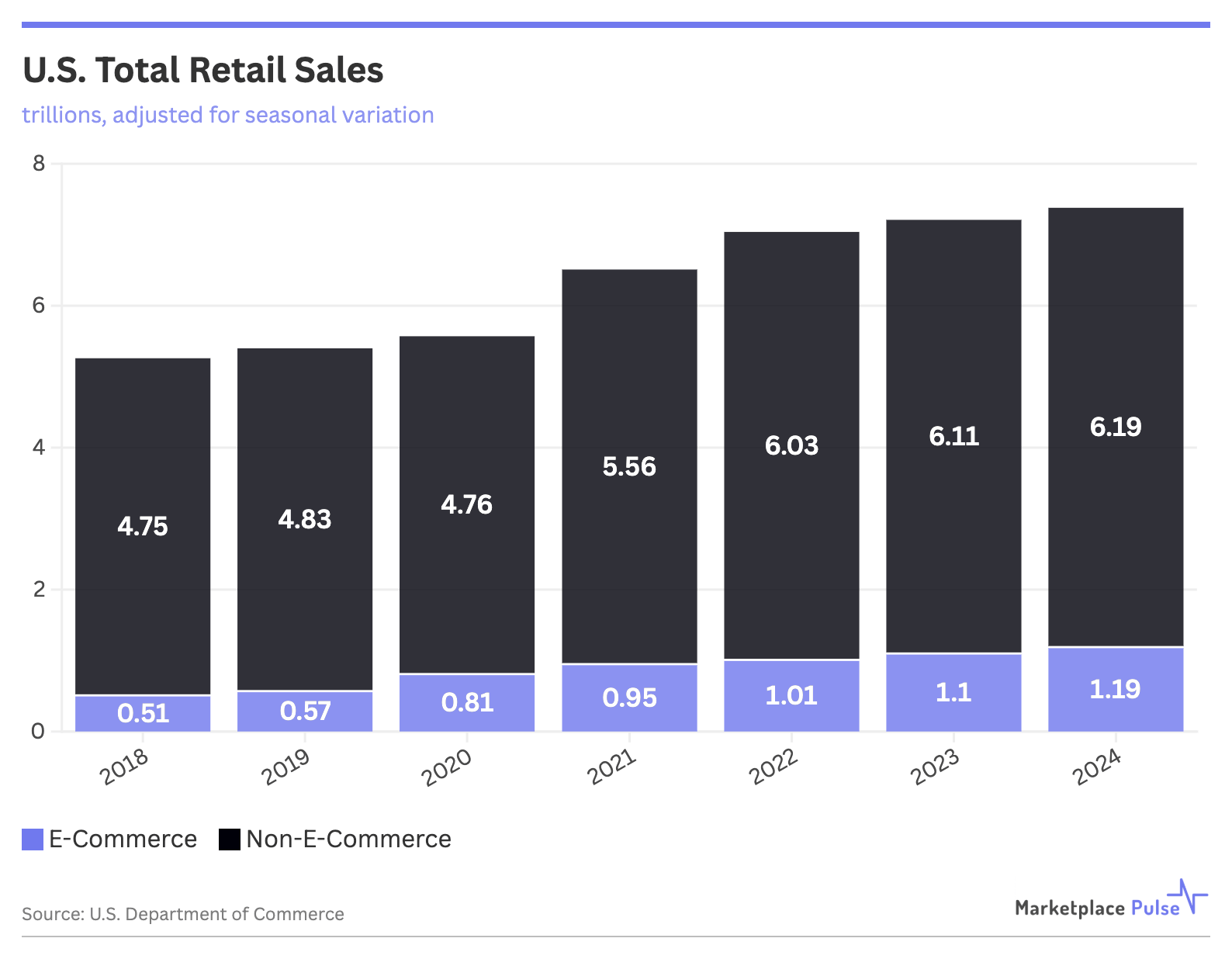

Crucially, this wasn’t a zero-sum battle. Total retail expanded from $5.25 trillion in 2018 to $7.38 trillion in 2024 – a 40% increase in just six years. Both slices of the pie grew dramatically, with e-commerce capturing its share through genuine market expansion rather than cannibalizing physical retail.

Online retail’s COVID-driven boost wasn’t a step-change; it was borrowed growth that has now reverted to the mean. Historical data shows e-commerce was gaining roughly one percentage point of retail share annually before the pandemic, driven by consistently outpacing total retail growth. The five-year detour through crisis and correction has essentially returned the industry to its natural growth path.

Ever-increasing digital native adoption, expanding AI-driven personalization, and relentless improvements in consumer convenience will drive continued steady growth. But offline retail won’t face obscurity – it continues growing in absolute terms and serves irreplaceable functions. The recent decisions by both Amazon and Warby Parker to discontinue their ‘try at home before you buy’ services underscore the persistent limitations of digital-only commerce.

At 16.3% of a massive retail market, e-commerce has significant room for continued expansion. But the lesson of the past five years is clear: sustainable growth looks nothing like the explosive, crisis-driven adoption of 2020.