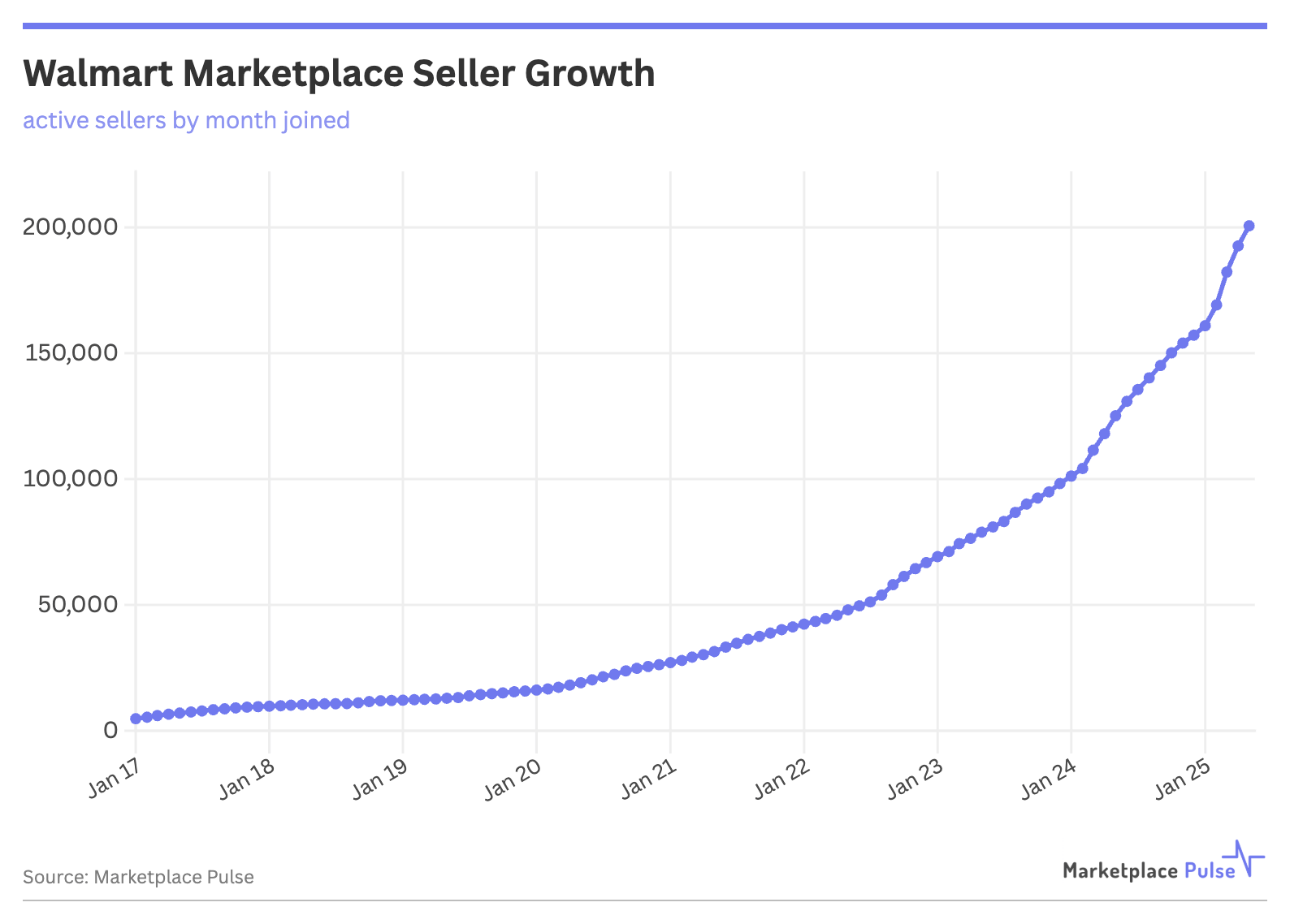

Walmart’s marketplace has crossed 200,000 active sellers for the first time, driven by the fastest seller acquisition rate in the platform’s history.

According to Marketplace Pulse data, 44,000 sellers were added in just five months compared to 59,000 for all of 2024, putting Walmart on track for its highest marketplace growth year yet.

The acceleration represents a 30% increase in seller count during the first five months of 2025 alone. At this pace, Walmart could add over 100,000 sellers this year – nearly doubling the growth seen in 2024 when the platform expanded by 60% to reach almost 160,000 sellers.

This growth coincides with Walmart’s continued marketing push to reposition itself as a modern e-commerce destination. The retailer’s new “Who Knew?” campaign specifically highlights “an expanded marketplace with more than half a billion items available online and in-app” – directly acknowledging that marketplace sellers, not Walmart’s own inventory, drive the vast majority of its product selection.

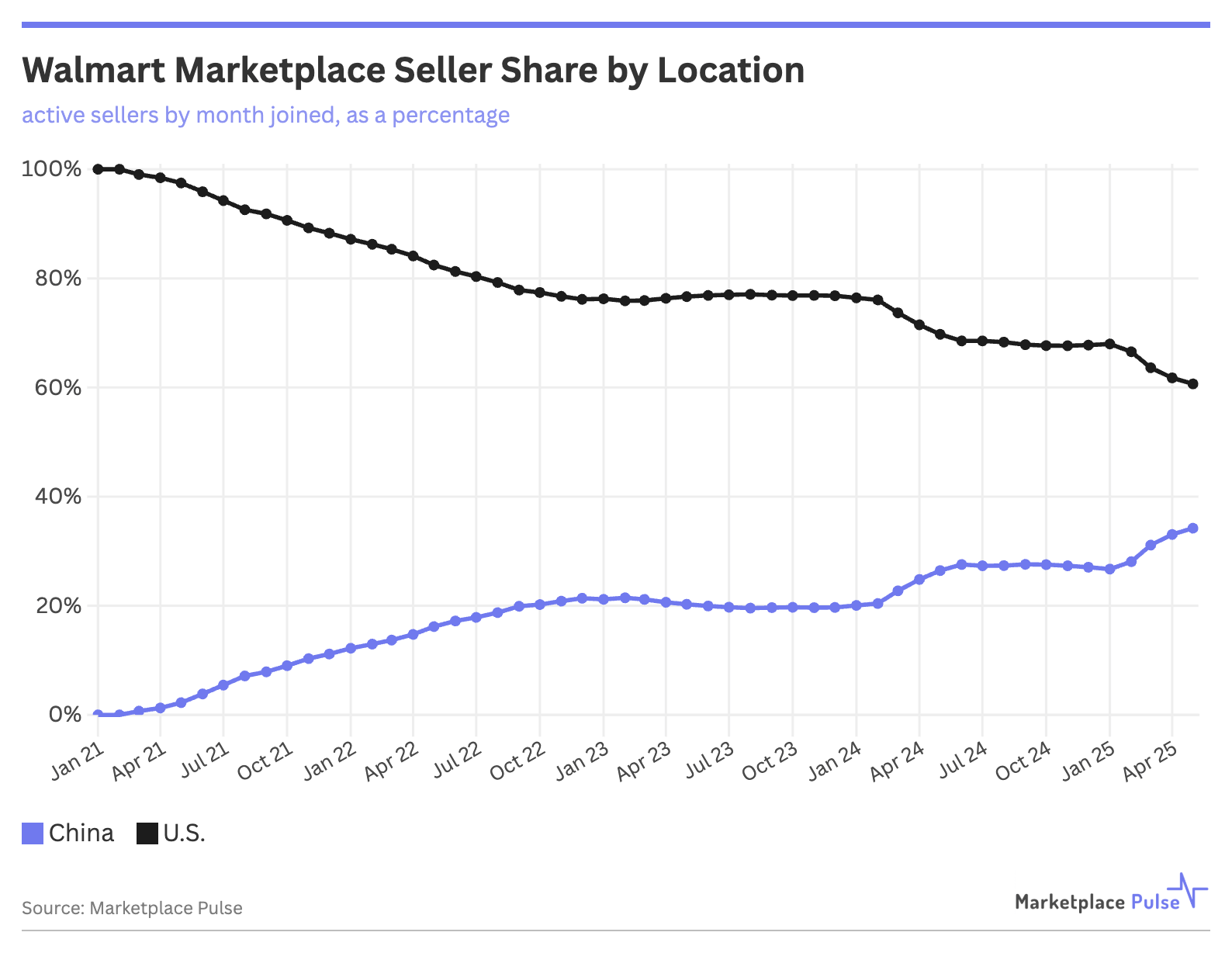

The rapid expansion marks a dramatic evolution for America’s largest traditional retailer. Walmart only opened its marketplace to international sellers in March 2021, yet foreign sellers now represent a significant portion of new additions. Nearly 60% of sellers joining in 2025 are from China, pushing total Chinese representation to 34% of all active sellers.

This shift creates an interesting paradox for Walmart. CEO Doug McMillon has emphasized that “two-thirds of what we sell in the U.S. has been made or grown in the U.S.” – a core part of Walmart’s traditional American retail identity. While that may be true for physical stores, Walmart.com increasingly resembles other major marketplaces where international sellers dominate.

The transformation has happened with remarkable speed. In just four years since allowing international sellers, Chinese merchants have grown from zero to representing over one-third of the platform. This timeline is far more compressed than Amazon’s gradual shift toward international sellers, which occurred over nearly a decade.

For Walmart, the seller growth brings both opportunities and challenges. Greater product selection strengthens its position against Amazon, but maintaining quality and brand consistency becomes more complex as the platform scales. Unlike Amazon, which built its marketplace over an extended period, Walmart is experiencing explosive growth that tests its infrastructure and vetting processes.

The marketplace expansion reflects Walmart’s broader strategy to blend online and offline retail. With over 420 million products now available on Walmart.com – 95% from marketplace sellers – the company is leveraging its 4,600 U.S. stores for fulfillment while rapidly expanding selection through third-party merchants.

As Walmart crosses this 200,000-seller milestone, the platform finds itself balancing rapid growth with its traditional American retail identity. The question isn’t whether Walmart can continue adding sellers – the current trajectory suggests it can easily do so – but whether it can maintain the brand consistency and operational excellence that differentiated it from competitors as it scales toward Amazon-like marketplace dynamics.