Amazon will lower the transaction fee it charges sellers from 17% to just 5% for under-$15 apparel items as it faces Shein’s competition.

Amazon is the largest clothing retailer in the U.S., including online and offline retail. But it charges sellers a 17% fee plus additional fees for fulfillment and advertising, making it one of the most expensive Amazon categories to sell in. Amazon increased the fee to 17% from 15% five years ago, in April 2018.

Shein is an order of magnitude smaller than Amazon - its GMV this year, more than $40 billion, is less than 10% of Amazon’s. But most of that $40 billion is in clothing, which Shein is best known for and strongest in. Its supply chain, tuned to introduce thousands of new designs daily while dynamically adjusting which products get manufactured, is uniquely fit for clothing. It is the biggest online-native clothing retailer.

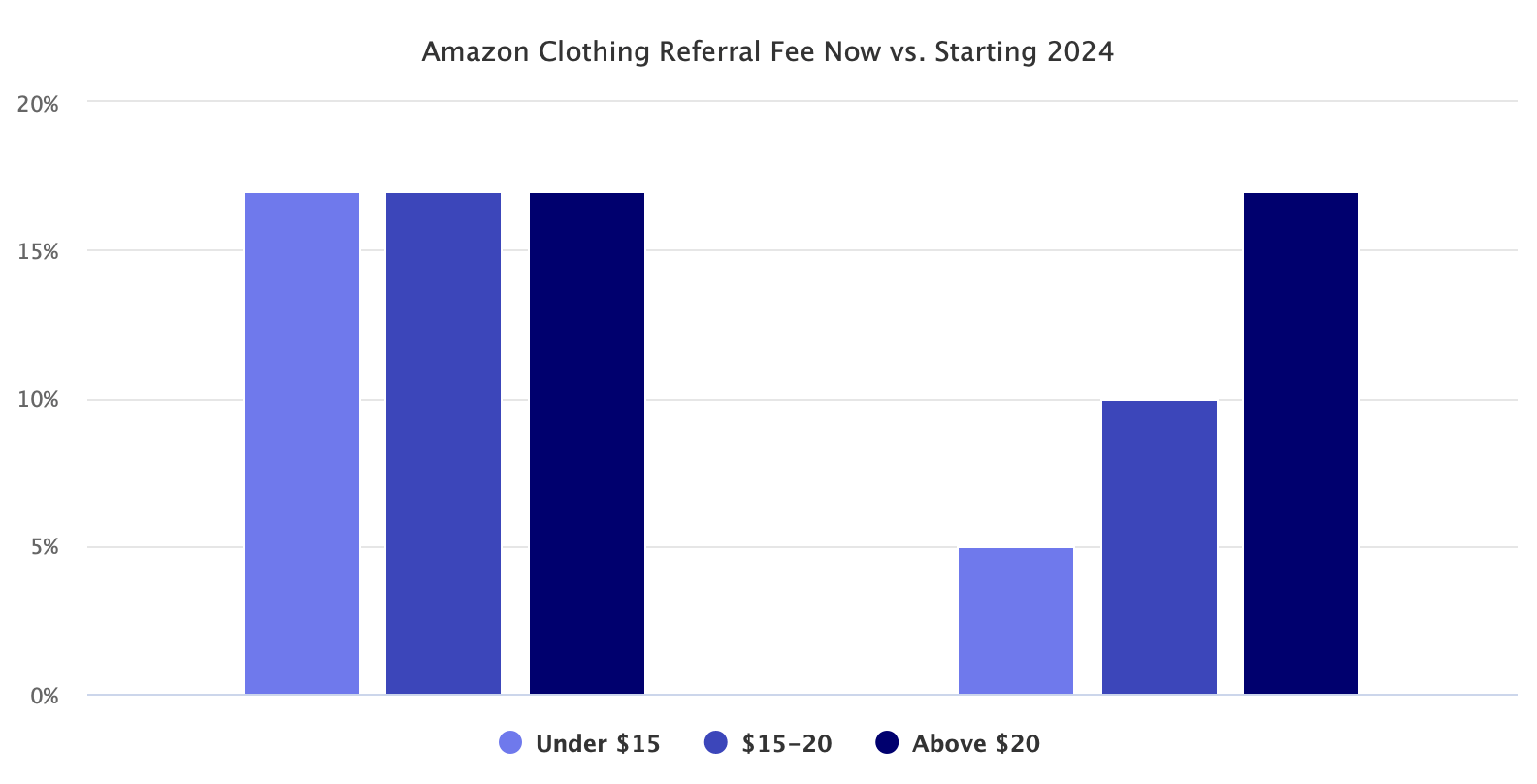

Amazon is reacting to Shein by lowering referral fees from 17% to 5% for clothing items priced under $15. For products priced between $15 and $20, it will decrease referral fees from 17% to 10%. Lower fees will allow sellers to lower prices by a few dollars and maintain the same margin. More expensive items remain at 17%.

Shein can’t match Amazon’s one-day or two-day delivery, but it can offer bargain prices while taking a week to deliver. Amazon sells products and fast shipping; Shein sells products and slow shipping. The two are inseparable - the logistics are as much part of the product as the products themselves. However, Amazon’s high fees made the price difference even greater.

Amazon will remain more expensive than Shein even after the fee reduction because the biggest cost is fulfillment. Items stored in domestic Amazon warehouses will always be more costly than Shein’s direct shipments to consumers from China, which also skip inspection and taxation by U.S. Customs.

Shein is not a direct competitor to Amazon in general, but in clothing, it absolutely is. Shein has expanded to more categories, started manufacturing outside China, built domestic warehouses, and launched a marketplace to attract sellers. But its core remains clothing shipped from China. Yet Shein’s critical innovation was dressing the supply chain advantage in an experience that delights. Shein looks and feels like a brand store rather than a random selection of products.

Amazon rarely changes referral fees, and reducing the fee by 70% for items in Shein’s key price segment is unquestionably a response to Shein. But even if fees were to go to zero, Amazon would still have no answer for Shein. For instance, Amazon doesn’t have the tens of millions of followers Shein has on Instagram nor the billions of views Shein hauls have on TikTok. Perhaps Amazon doesn’t need to answer, but the seller fee is not it. Focusing on fees is missing the forest for the trees.