Thrasio’s collapse doesn’t prove that consolidating Amazon brands was a bad idea; it demonstrates that executing the strategy during an unprecedented capital bubble made success nearly impossible. In a new interview, Thrasio co-founder John Hefter offered the first insider account of what went wrong. His revelations confirm what Marketplace Pulse analysis has shown since 2020: the aggregator model itself was sound, but the extreme conditions of 2021 destroyed the economics that made it viable.

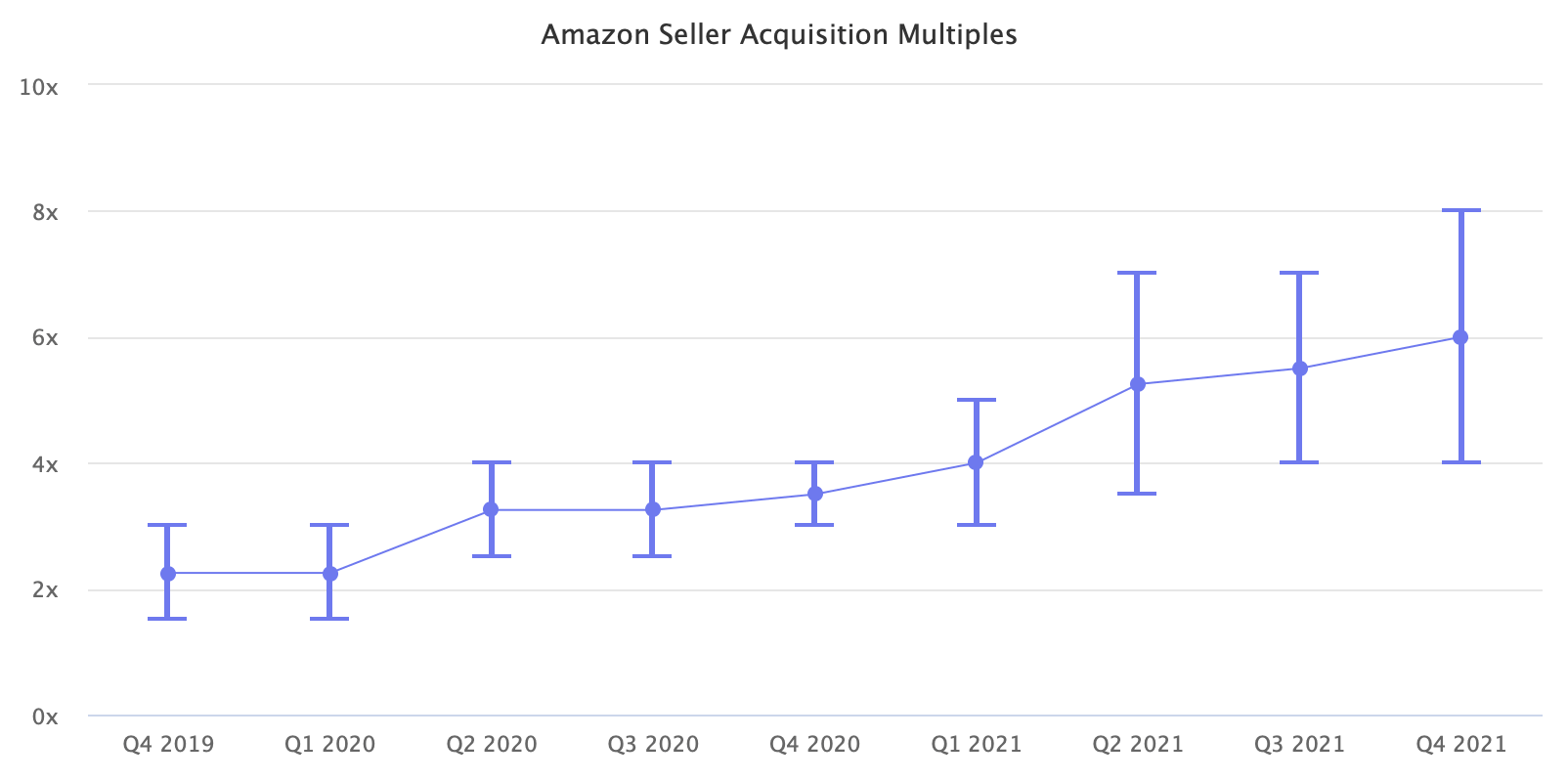

In the interview, Hefter admits Thrasio started acquiring businesses at 2x EBITDA multiples when competition was scarce. By the peak, they were paying 7x for what he calls “Chinese vaporware garbage” just to meet growth targets. The model worked until the bubble made it impossible.

The proof that e-commerce consolidation can work lies elsewhere in the ecosystem. While Thrasio filed for bankruptcy and other aggregators slashed their workforce, software aggregators focused on Amazon seller tools secured nine-figure valuations. Threecolts raised $200 million, and Carbon6 sold for $210 million after aggregating multiple software companies serving Amazon sellers. The model itself works; it simply requires the right asset class and the right market conditions.

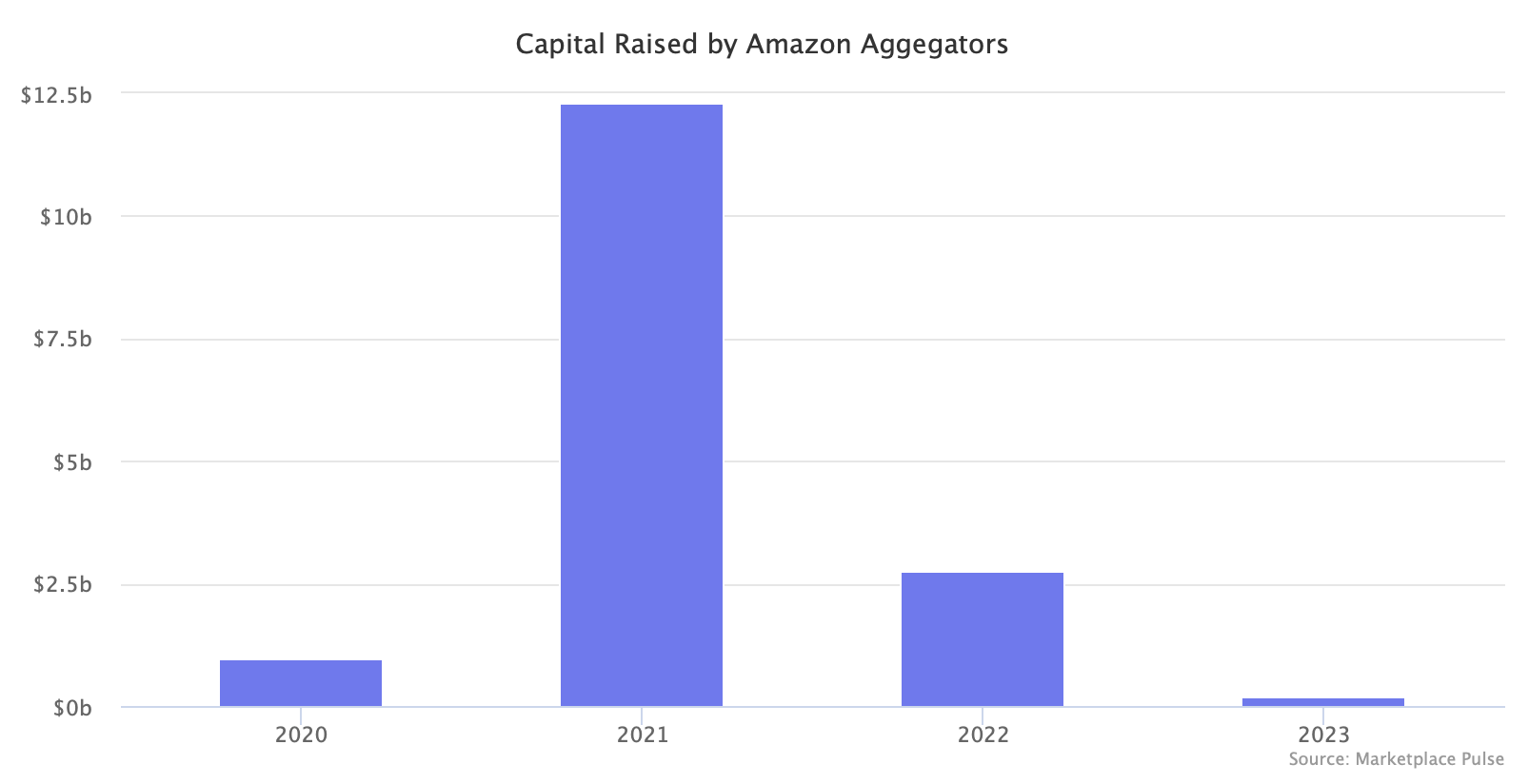

The perfect storm began with free money and ended with impossible valuations. The Amazon Aggregator hype cycle was a result of zero interest rates, an e-commerce growth burst, and an idea that putting a few dozen Amazon brands under one roof would lead to something.

Marketplace Pulse documented this in real-time as aggregators raised $12.3 billion in 2021, 75% as debt. But by 2022, that figure dropped to $2.7 billion as debt covenants locked up previously raised capital. Amazon seller valuations doubled, and Hefter confirms the death spiral: over 100 aggregators competing for assets drove multiples to levels where mistakes became catastrophic. The aggregators destroyed their own model – their capital influx eliminated the favorable economics that made the strategy viable.

Speed compounded the valuation problem in ways unique to physical goods businesses. Hefter describes Thrasio growing from four founders to 1,600 employees across ten global offices in just two and a half years, acquiring 200 brands in the process. Near the peak, they were completing multiple acquisitions per week. The operational challenge aggregators faced was more complex than most anticipated.

While Marketplace Pulse data shows the number of active Amazon sellers has declined, the number of sellers generating over $1 million in annual sales has grown to over 100,000. The paradox meant aggregators were competing against increasingly sophisticated operations – fewer competitors, but higher quality. Many aggregators bought brands they failed to grow, sometimes failing even to maintain existing sales. Marketplace Pulse warned in early 2022 that some aggregators found they were worse at running Amazon seller businesses than the sellers they bought them from.

Hefter’s interview reveals the consequences of that speed: an inventory ordering error that cost hundreds of millions of dollars when a sample exercise was accidentally processed as real orders across nearly the entire portfolio. When you’re managing software, you can roll back a mistake. When you’ve ordered 10,000 pink umbrellas instead of the 50 that actually sell, that inventory sits in warehouses bleeding cash. The model requires operational excellence that’s nearly impossible to achieve at breakneck speed against battle-tested competitors who have spent years mastering Amazon.

Despite the carnage, the reality is that roll-ups work when the economics make sense. Private equity has proven this across industries for decades. Hefter believes the model could work again at 2x multiples with better technology infrastructure, but the bar is now higher. Amazon sellers have become more sophisticated, meaning future success demands platform-specific operational excellence, not just capital and M&A experience.

The lesson isn’t that consolidation fails – it’s that discipline and execution matter more than capital, and sustainable growth beats explosive growth fueled by bubble economics. The acquisition market remains more active than the pre-aggregator era, even if strategic buyers now represent the majority of deals. Those still buying are learning from the expensive lessons Thrasio’s $3 billion funded.