Amazon’s same-day and next-day delivery is widening the gap between it and the rest of e-commerce.

“In March, nearly 60% of Prime member orders arrived the same or next day across the top 60 largest U.S. metro areas,” wrote Doug Herrington, CEO of Worldwide Amazon Stores, on Monday. That’s up from “more than half” in the second quarter of 2023 when the company last discussed the topic.

Amazon’s bet is that faster shipping is behavior-changing. It made the bet in 2005, nearly twenty years ago, when it introduced free two-day shipping for Prime members. In parallel, it focused on replacing Google for shopping searches by offering products for every imaginable search phrase. It got there years ago, largely thanks to the marketplace. The next step was making shipping fast enough to alter when and how often shoppers use it.

“As we get items to customers this fast, customers choose Amazon to fulfill their shopping needs more frequently, and we can see the results in various areas,” said Andy Jassy, CEO of Amazon, when discussing first quarter results. “Including how fast our everyday essentials business is growing and the continued increase in Prime member purchase frequency and total spend with us.”

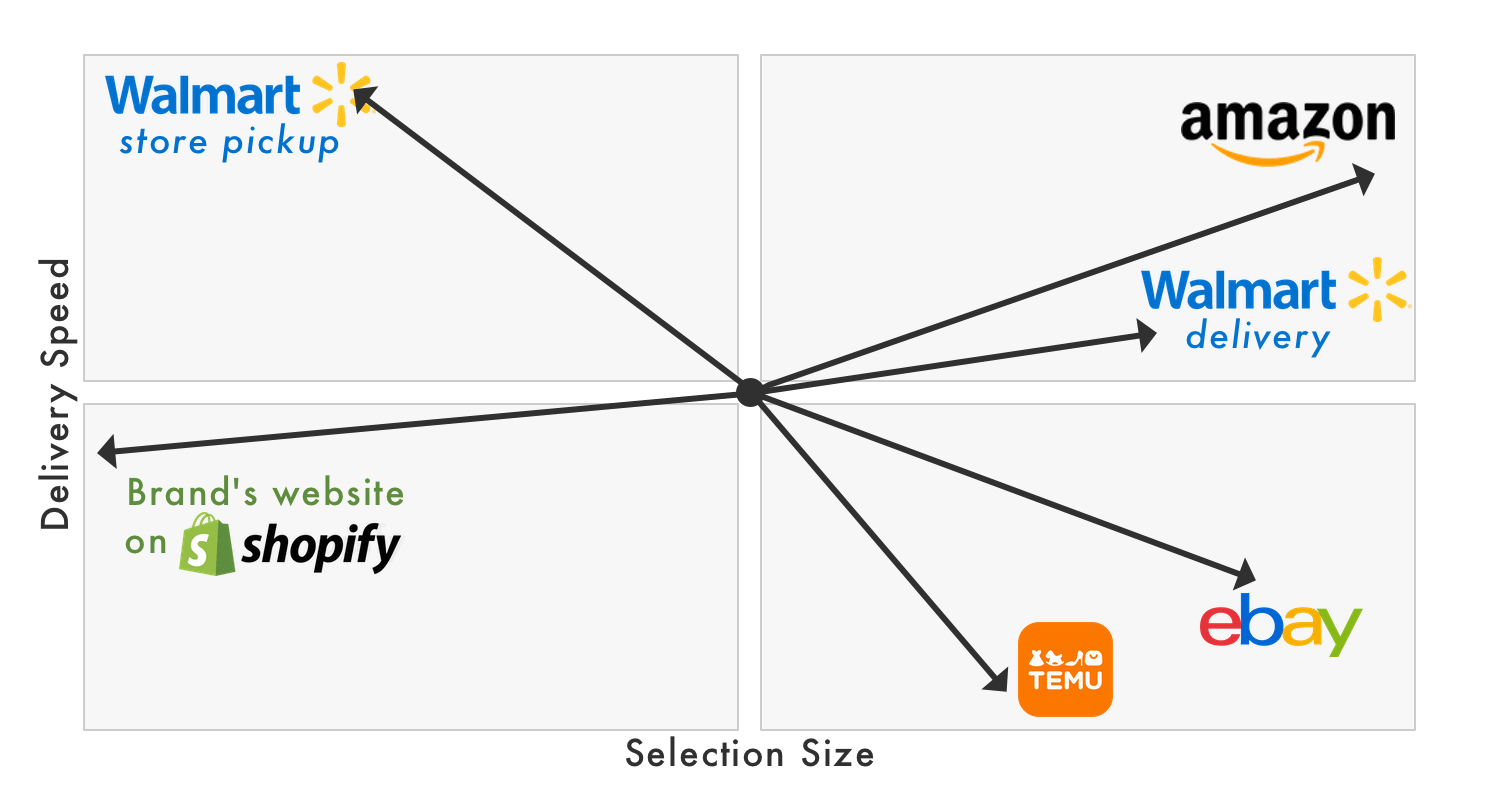

On the surface, every retailer is the same — each sells various physical goods. However, online retailers are not alike when measured against selection size and delivery speed. Amazon — already notorious for its virtually infinite selection — also delivers most of it fast. Fast delivery is not a linear improvement; the difference between two-day and same-day is structural for the retailer and behavior-changing for the shopper.

Buying from Walmart online has two experiences: a fast but limited selection for store pickup or a slower but wide selection for general e-commerce (Walmart fulfills 50% of online orders from one of their stores). eBay has hundreds of millions of listings, but only some come fast, and none consistently. Temu and other direct-from-China services like AliExpress and Shein are growing selection but ship in 5+ days or sometimes weeks. Finally, buying from a brand’s website is advantageous for many reasons. However, they sell only a small selection of items, so they are not comparable to broad e-commerce platforms.

Amazon doesn’t sell goods. It sells goods that ship in one to two days and, for some shoppers, same-day. The logistics are as much part of the product as the products themselves. And Amazon is pushing to separate itself from others by shipping more items faster. Last year, it shipped more than 7 billion items arriving same-day or next-day globally. This year, it shipped more than two billion items in the first quarter already and thus will likely outperform 2023.

There is no clear path for something like Temu to match Amazon’s delivery speed or for Walmart’s store pickup to significantly expand selection. Shoppers might still choose them, or many others, but Amazon’s moat is in remaining the default for most people for most shopping most of the time. Online spending grows or market share shifts when any retailer sells more dollars. When deliveries go from two-day to next-day to same-day, they change how and when e-commerce is useful.