Amazon’s introduction of API fees for third-party developers represents another margin squeeze on sellers, this time arriving indirectly through the software tools that have become essential to operate on the platform. Starting January 2026, the fees will force software companies to raise subscription prices or reduce service quality, adding costs to sellers who already pay 50-60% of revenue to Amazon in various fees.

The pattern mirrors how advertising and FBA evolved from optional services to unavoidable requirements. But, as Amazon monetizes every ecosystem layer, it may be testing how much extraction the marketplace can sustain before new commerce models become viable alternatives.

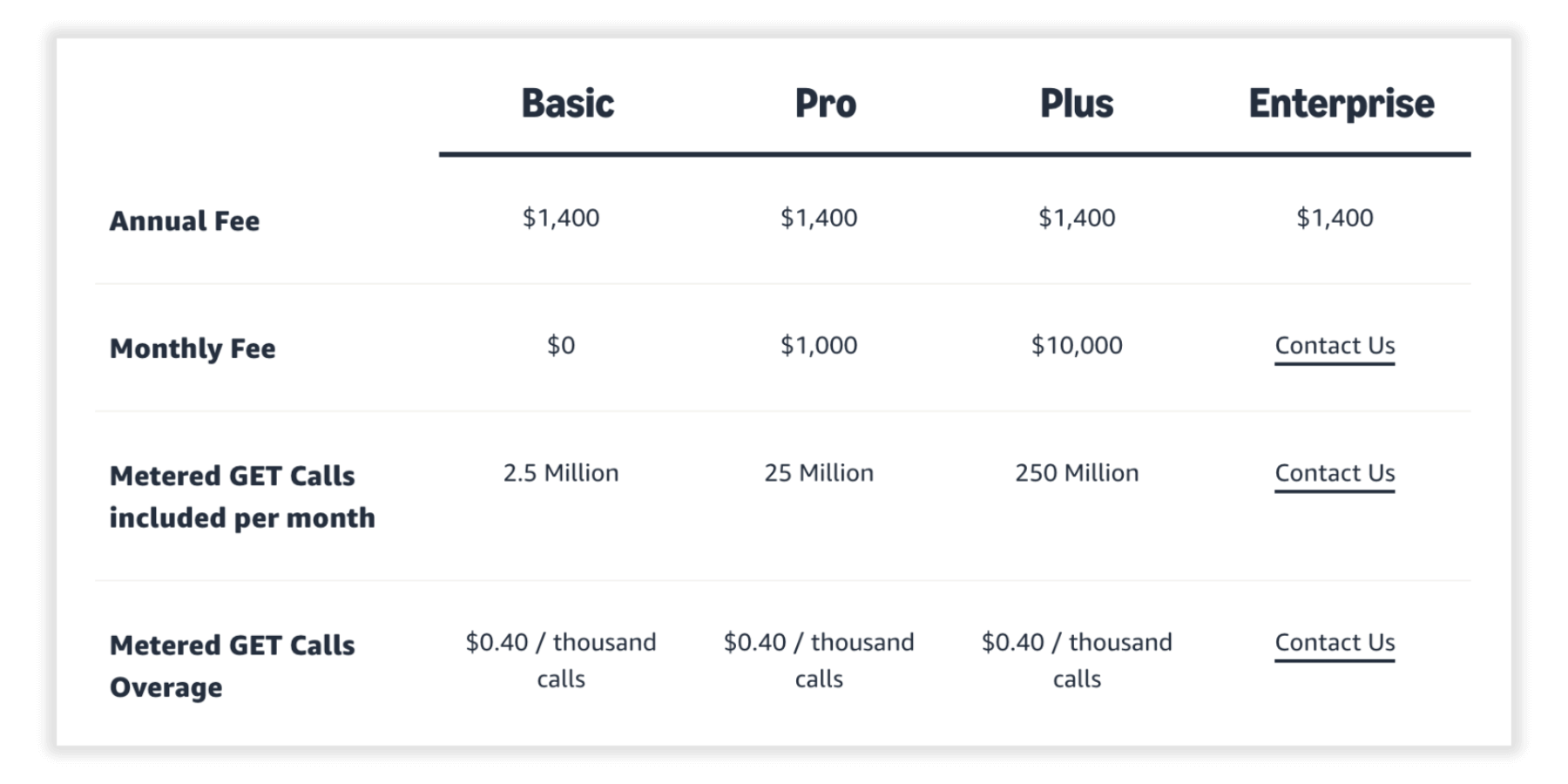

Amazon announced on November 3, 2025, that it will charge third-party developers $1,400 annually, starting January 31, 2026, plus monthly usage fees based on API call volume, effective April 30, 2026. GET calls are API requests that retrieve data from Amazon’s systems. Software tools constantly pull inventory levels, pricing, and order information to keep seller dashboards current. Developers default into a Basic tier including 2.5 million GET calls monthly at no additional charge beyond the annual subscription, with Pro ($1,000/month for 25 million calls), Plus ($10,000/month for 250 million calls), and Enterprise tiers available. Overage charges cost $0.40 per thousand calls above tier limits. The fee structure ends 16 years of free access, dating back to Marketplace Web Services in 2009.

“The API fee structure fundamentally changes the economics of Amazon seller software,” said Yoda Yee, founder and CEO of Threecolts. “At $1,400 annually plus usage fees, a tool with 1,000 customers will pay Amazon roughly $10,000 per month. The $10-$20 monthly subscription tier that many sellers rely on simply can’t absorb these costs. We’re looking at minimum viable price points around $99 per month, or software companies will reduce API call frequency and deliver stale data.”

The fees particularly impact inventory management, repricing, and analytics software that make frequent API calls to maintain current data. Over 100 software companies serve Amazon sellers across product research, pricing, forecasting, advertising, and accounting. Sellers rarely use just one tool – they typically use stacks that handle separate business functions, meaning API fee pass-throughs will compound across multiple subscriptions.

Software aggregators like Threecolts and Carbon6 can distribute costs across their portfolios and offer bundled tools under single subscriptions, providing sellers a path to consolidate expenses. Independent developers and startups face harder choices: significantly increase prices or reduce API call frequency to deliver less timely data.

The API fees follow Amazon’s established playbook of creating ecosystem dependencies, then monetizing them. FBA became required because Prime demands it. Advertising became unavoidable as Amazon allocated search results to sponsored placements. Software tools became essential because Amazon’s APIs create rigid constraints and Seller Central’s functionality gaps forced sellers to third parties. Now Amazon monetizes that software layer. Notably, Amazon’s Ads API remains free – advertising drives revenue, while seller operation tools have become revenue themselves.

The fees also arrive as Amazon faces potential disruption from agentic and conversational commerce models. OpenAI CEO Sam Altman recently articulated a vision where “margins are going to go dramatically down on most goods and services,” proposing ChatGPT take transaction fees on purchases it facilitates – including hotels, restaurants, and potentially physical goods. It’s Jeff Bezos’s “your margin is my opportunity” principle turned against Amazon. As the platform systematically monetizes every layer of its seller ecosystem, it creates the margin structure that makes alternative commerce channels viable – and increasingly attractive to both sellers and shoppers.